Answered step by step

Verified Expert Solution

Question

1 Approved Answer

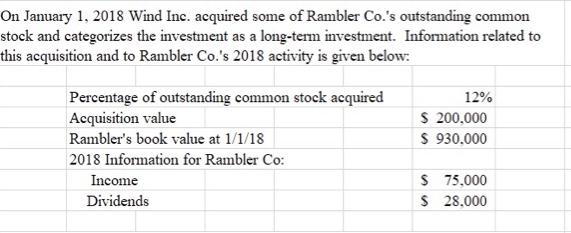

On January 1, 2018 Wind Inc. acquired some of Rambler Co. s outstanding common stock and categorizes the investment as a long-term investment. Information

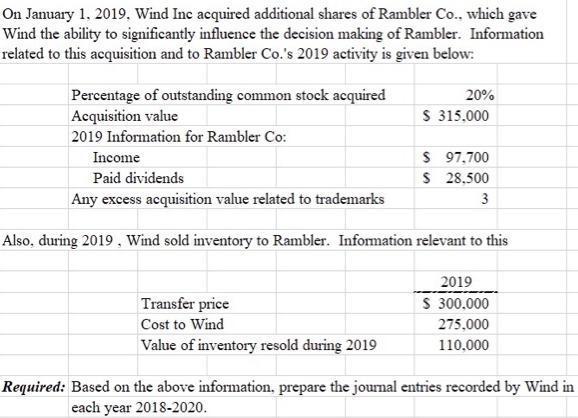

On January 1, 2018 Wind Inc. acquired some of Rambler Co. s outstanding common stock and categorizes the investment as a long-term investment. Information related to this acquisition and to Rambler Co. s 2018 activity is given below: Percentage of outstanding common stock acquired Acquisition value Rambler s book value at 1/1/18 2018 Information for Rambler Co: Income Dividends 12% $ 200,000 $ 930.000 $ 75,000 $ 28,000 On January 1, 2019, Wind Inc acquired additional shares of Rambler Co.. which gave Wind the ability to significantly influence the decision making of Rambler. Information related to this acquisition and to Rambler Co. s 2019 activity is given below: Percentage of outstanding common stock acquired Acquisition value 2019 Information for Rambler Co: 20% $ 315.000 Income Paid dividends Any excess acquisition value related to trademarks Also, during 2019, Wind sold inventory to Rambler. Information relevant to this Transfer price Cost to Wind Value of inventory resold during 2019 $ 97,700 $ 28.500 3 2019 $ 300,000 275,000 110,000 Required: Based on the above information, prepare the journal entries recorded by Wind in each year 2018-2020.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ramblers Book Value as on 01012018 930000 Share acquired in book value 111600 Acquisition V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started