Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Bog, Cog, and Fog had capital balances of $60,000, $100,000, and $20,000 respectively in their partnership. In 2019 the partnership

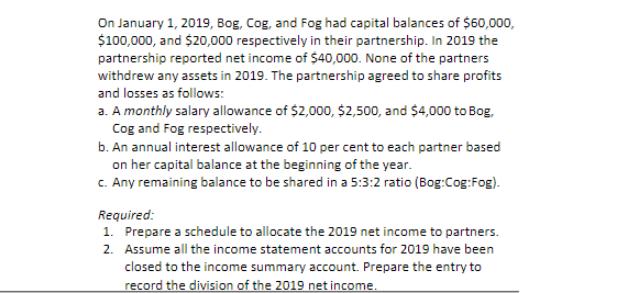

On January 1, 2019, Bog, Cog, and Fog had capital balances of $60,000, $100,000, and $20,000 respectively in their partnership. In 2019 the partnership reported net income of $40,000. None of the partners withdrew any assets in 2019. The partnership agreed to share profits and losses as follows: a. A monthly salary allowance of $2,000, $2,500, and $4,000 to Bog, Cog and Fog respectively. b. An annual interest allowance of 10 per cent to each partner based on her capital balance at the beginning of the year. c. Any remaining balance to be shared in a 5:3:2 ratio (Bog:Cog:Fog). Required: 1. Prepare a schedule to allocate the 2019 net income to partners. 2. Assume all the income statement accounts for 2019 have been closed to the income summary account. Prepare the entry to record the division of the 2019 net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started