Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Carius Corporation (lessee) entered into a lease agreement for a warehouse facility with Patel Storage, Inc. (lessor). The lease agreement

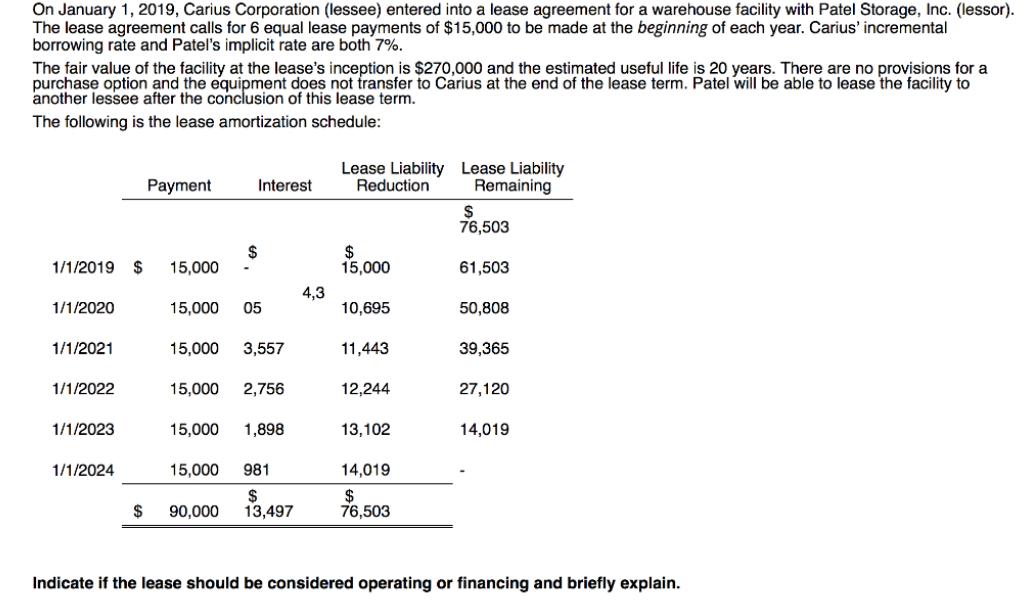

On January 1, 2019, Carius Corporation (lessee) entered into a lease agreement for a warehouse facility with Patel Storage, Inc. (lessor). The lease agreement calls for 6 equal lease payments of $15,000 to be made at the beginning of each year. Carius' incremental borrowing rate and Patel's implicit rate are both 7%. The fair value of the facility at the lease's inception is $270,000 and the estimated useful life is 20 years. There are no provisions for a purchase option and the equipment does not transfer to Carius at the end of the lease term. Patel will be able to lease the facility to another lessee after the conclusion of this lease term. The following is the lease amortization schedule: Lease Liability Lease Liability Reduction Payment Interest Remaining $ 76,503 2$ 15,000 $ 15,000 1/1/2019 $ 61,503 4,3 1/1/2020 15,000 05 10,695 50,808 1/1/2021 15,000 3,557 11,443 39,365 1/1/2022 15,000 2,756 12,244 27,120 1/1/2023 15,000 1,898 13,102 14,019 1/1/2024 15,000 981 14,019 $ 13,497 90,000 76,503 $ Indicate if the lease should be considered operating or financing and briefly explain.

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Type of tests for identifying type of Lease Lease is considerd as capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started