Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Gates Corporation issued $100,000 of 5-year bonds due December 31, 2023, for $103,604.79 minus debt issuance costs of $3,000. The

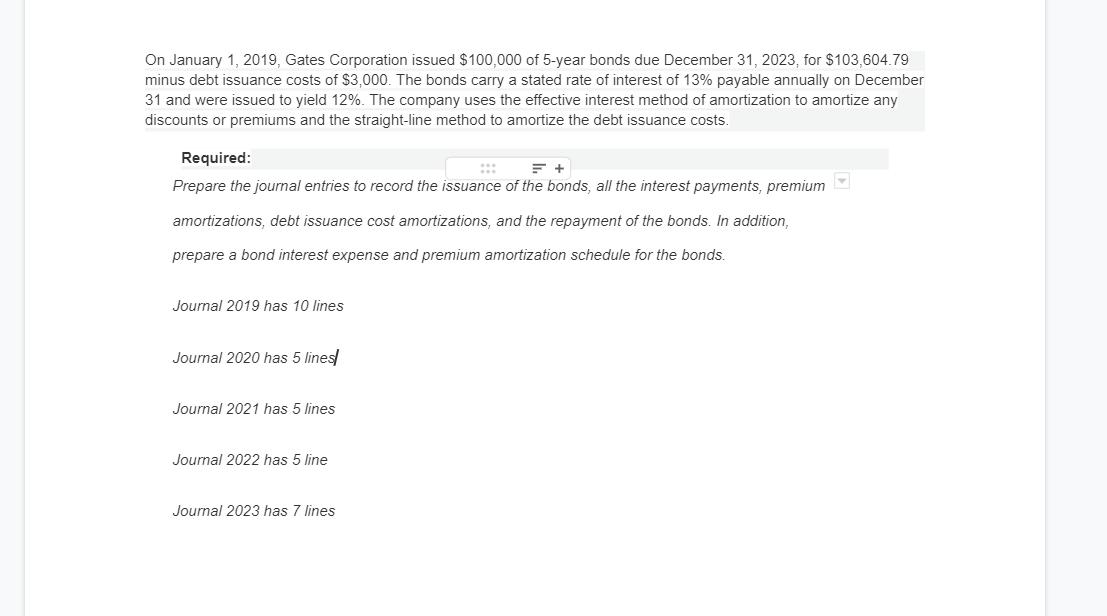

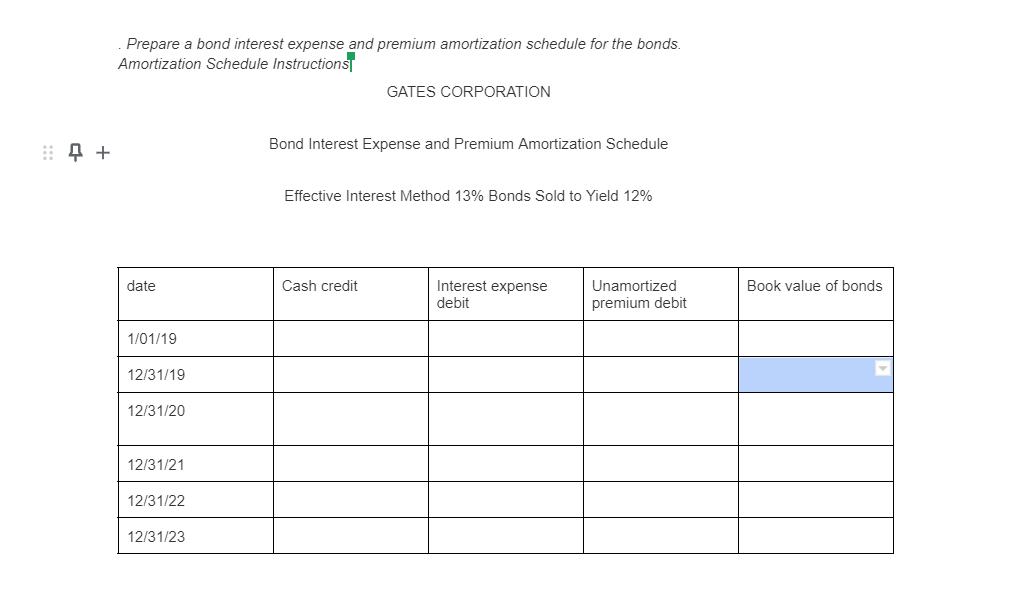

On January 1, 2019, Gates Corporation issued $100,000 of 5-year bonds due December 31, 2023, for $103,604.79 minus debt issuance costs of $3,000. The bonds carry a stated rate of interest of 13% payable annually on December 31 and were issued to yield 12%. The company uses the effective interest method of amortization to amortize any discounts or premiums and the straight-line method to amortize the debt issuance costs. Required: F + Prepare the journal entries to record the issuance of the bonds, all the interest payments, premium amortizations, debt issuance cost amortizations, and the repayment of the bonds. In addition, prepare a bond interest expense and premium amortization schedule for the bonds. Journal 2019 has 10 lines Journal 2020 has 5 lines Journal 2021 has 5 lines Journal 2022 has 5 line Journal 2023 has 7 lines 4 + Prepare a bond interest expense and premium amortization schedule for the bonds. Amortization Schedule Instructions date 1/01/19 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 GATES CORPORATION Bond Interest Expense and Premium Amortization Schedule Effective Interest Method 13% Bonds Sold to Yield 12% Cash credit Interest expense debit Unamortized premium debit Book value of bonds

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Date 1119 Journal Entries Particulars Cash All To Premium on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started