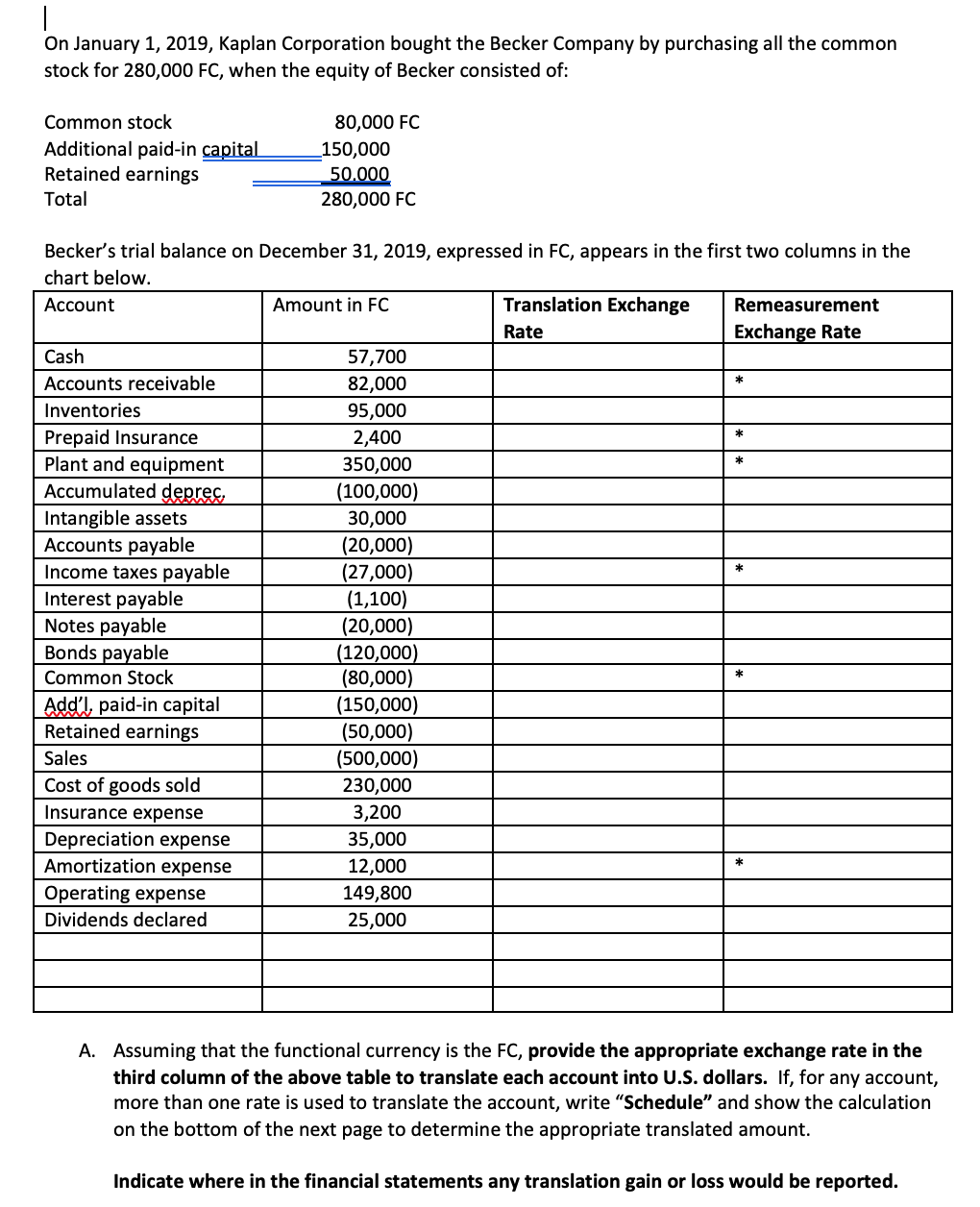

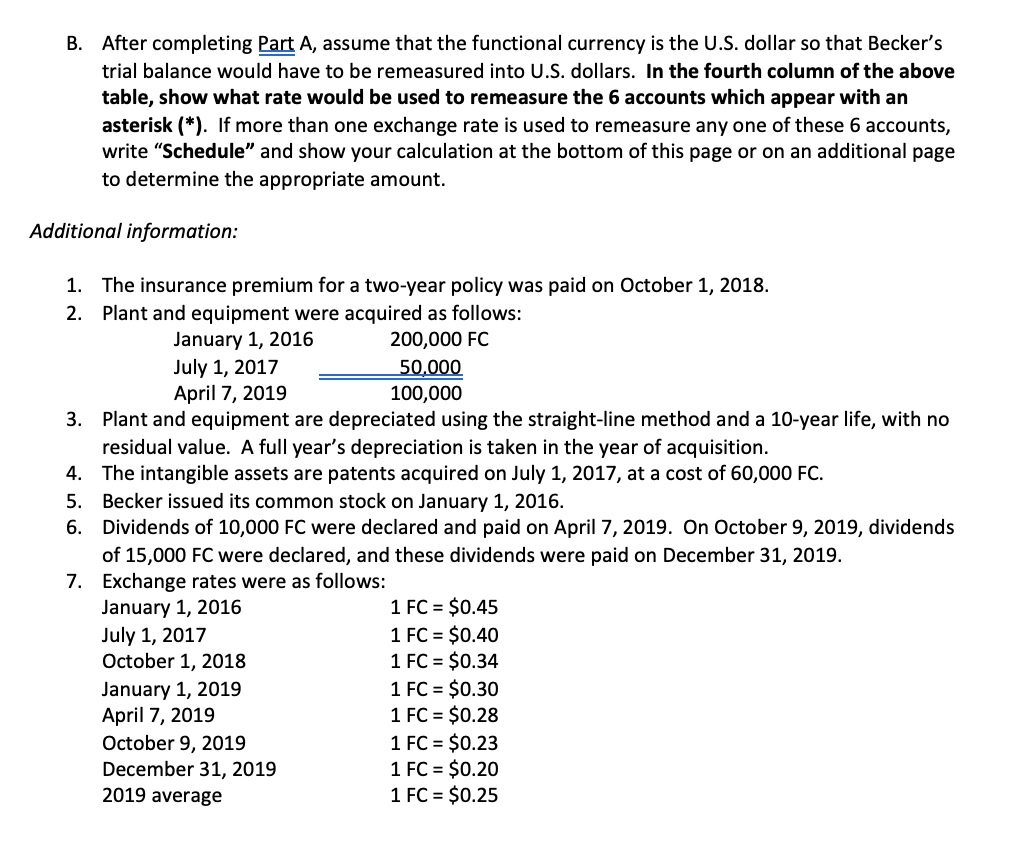

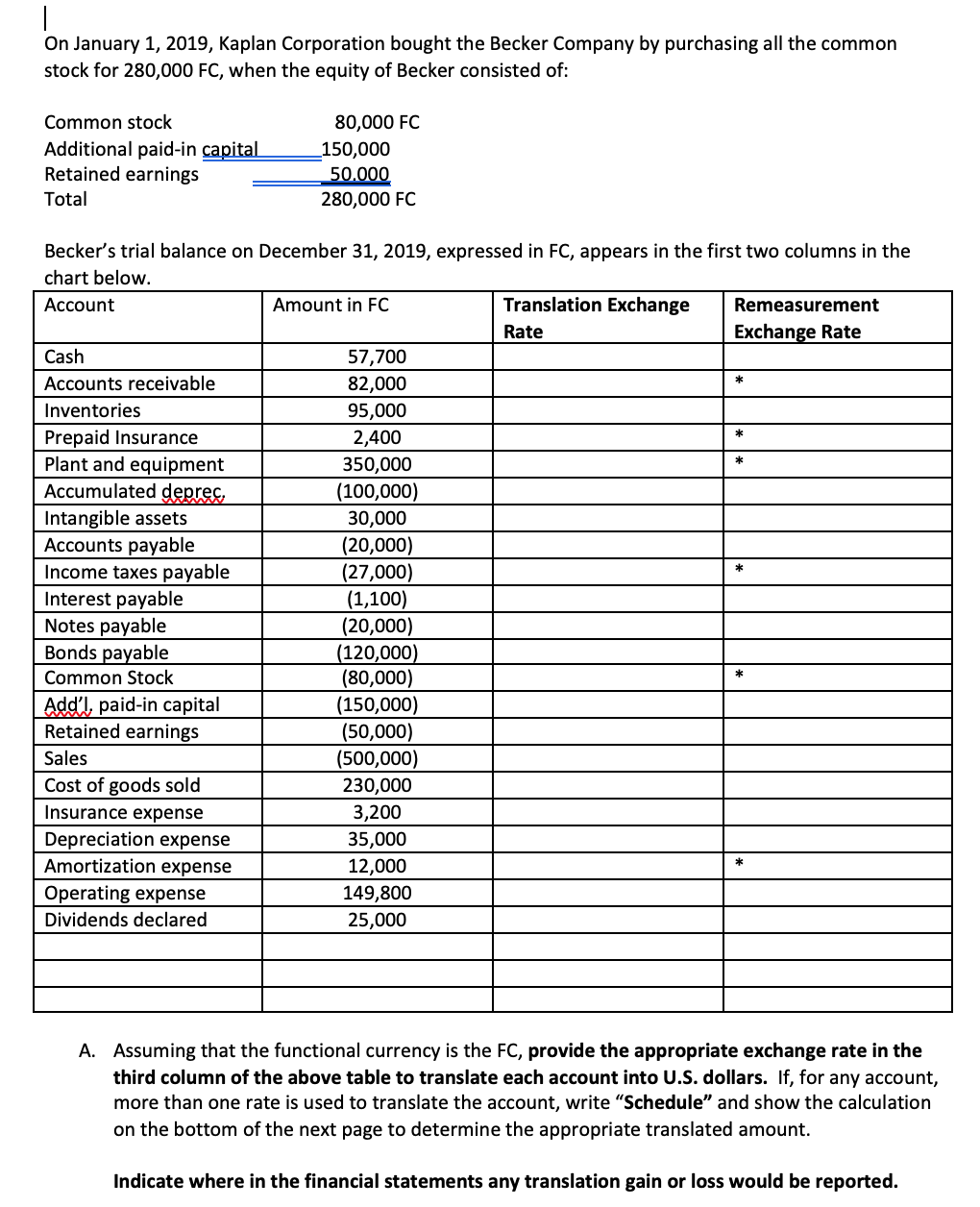

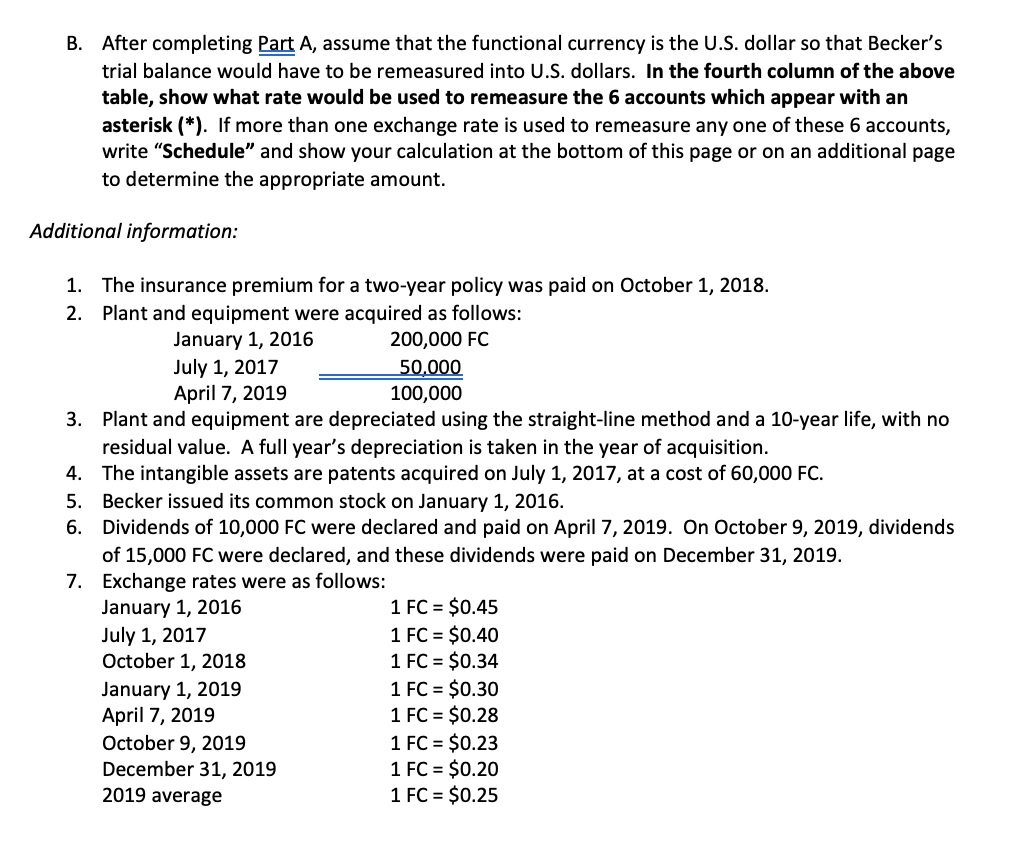

On January 1, 2019, Kaplan Corporation bought the Becker Company by purchasing all the common stock for 280,000 FC, when the equity of Becker consisted of: Common stock Additional paid-in capital Retained earnings Total 80,000 FC 150,000 50.000 280,000 FC * * * * Becker's trial balance on December 31, 2019, expressed in FC, appears in the first two columns in the chart below. Account Amount in FC Translation Exchange Remeasurement Rate Exchange Rate Cash 57,700 Accounts receivable 82,000 Inventories 95,000 Prepaid Insurance 2,400 Plant and equipment 350,000 Accumulated deprec. (100,000) Intangible assets 30,000 Accounts payable (20,000) Income taxes payable (27,000) Interest payable (1,100) Notes payable (20,000) Bonds payable (120,000) Common Stock (80,000) Add'l, paid-in capital (150,000) Retained earnings (50,000) Sales (500,000) Cost of goods sold 230,000 Insurance expense 3,200 Depreciation expense 35,000 Amortization expense 12,000 Operating expense 149,800 Dividends declared 25,000 A. Assuming that the functional currency is the FC, provide the appropriate exchange rate in the third column of the above table to translate each account into U.S. dollars. If, for any account, more than one rate is used to translate the account, write Schedule and show the calculation on the bottom of the next page to determine the appropriate translated amount. Indicate where in the financial statements any translation gain or loss would be reported. B. After completing Part A, assume that the functional currency is the U.S. dollar so that Becker's trial balance would have to be remeasured into U.S. dollars. In the fourth column of the above table, show what rate would be used to remeasure the 6 accounts which appear with an asterisk (*). If more than one exchange rate is used to remeasure any one of these 6 accounts, write "Schedule" and show your calculation at the bottom of this page or on an additional page to determine the appropriate amount. Additional information: 1. The insurance premium for a two-year policy was paid on October 1, 2018. 2. Plant and equipment were acquired as follows: January 1, 2016 200,000 FC July 1, 2017 50.000 April 7, 2019 100,000 3. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full year's depreciation is taken in the year of acquisition. 4. The intangible assets are patents acquired on July 1, 2017, at a cost of 60,000 FC. 5. Becker issued its common stock on January 1, 2016. 6. Dividends of 10,000 FC were declared and paid on April 7, 2019. On October 9, 2019, dividends of 15,000 FC were declared, and these dividends were paid on December 31, 2019. 7. Exchange rates were as follows: January 1, 2016 1 FC = $0.45 July 1, 2017 1 FC = $0.40 October 1, 2018 1 FC = $0.34 January 1, 2019 1 FC = $0.30 April 7, 2019 1 FC = $0.28 October 9, 2019 1 FC = $0.23 December 31, 2019 1 FC = $0.20 1 FC = $0.25 2019 average On January 1, 2019, Kaplan Corporation bought the Becker Company by purchasing all the common stock for 280,000 FC, when the equity of Becker consisted of: Common stock Additional paid-in capital Retained earnings Total 80,000 FC 150,000 50.000 280,000 FC * * * * Becker's trial balance on December 31, 2019, expressed in FC, appears in the first two columns in the chart below. Account Amount in FC Translation Exchange Remeasurement Rate Exchange Rate Cash 57,700 Accounts receivable 82,000 Inventories 95,000 Prepaid Insurance 2,400 Plant and equipment 350,000 Accumulated deprec. (100,000) Intangible assets 30,000 Accounts payable (20,000) Income taxes payable (27,000) Interest payable (1,100) Notes payable (20,000) Bonds payable (120,000) Common Stock (80,000) Add'l, paid-in capital (150,000) Retained earnings (50,000) Sales (500,000) Cost of goods sold 230,000 Insurance expense 3,200 Depreciation expense 35,000 Amortization expense 12,000 Operating expense 149,800 Dividends declared 25,000 A. Assuming that the functional currency is the FC, provide the appropriate exchange rate in the third column of the above table to translate each account into U.S. dollars. If, for any account, more than one rate is used to translate the account, write Schedule and show the calculation on the bottom of the next page to determine the appropriate translated amount. Indicate where in the financial statements any translation gain or loss would be reported. B. After completing Part A, assume that the functional currency is the U.S. dollar so that Becker's trial balance would have to be remeasured into U.S. dollars. In the fourth column of the above table, show what rate would be used to remeasure the 6 accounts which appear with an asterisk (*). If more than one exchange rate is used to remeasure any one of these 6 accounts, write "Schedule" and show your calculation at the bottom of this page or on an additional page to determine the appropriate amount. Additional information: 1. The insurance premium for a two-year policy was paid on October 1, 2018. 2. Plant and equipment were acquired as follows: January 1, 2016 200,000 FC July 1, 2017 50.000 April 7, 2019 100,000 3. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full year's depreciation is taken in the year of acquisition. 4. The intangible assets are patents acquired on July 1, 2017, at a cost of 60,000 FC. 5. Becker issued its common stock on January 1, 2016. 6. Dividends of 10,000 FC were declared and paid on April 7, 2019. On October 9, 2019, dividends of 15,000 FC were declared, and these dividends were paid on December 31, 2019. 7. Exchange rates were as follows: January 1, 2016 1 FC = $0.45 July 1, 2017 1 FC = $0.40 October 1, 2018 1 FC = $0.34 January 1, 2019 1 FC = $0.30 April 7, 2019 1 FC = $0.28 October 9, 2019 1 FC = $0.23 December 31, 2019 1 FC = $0.20 1 FC = $0.25 2019 average