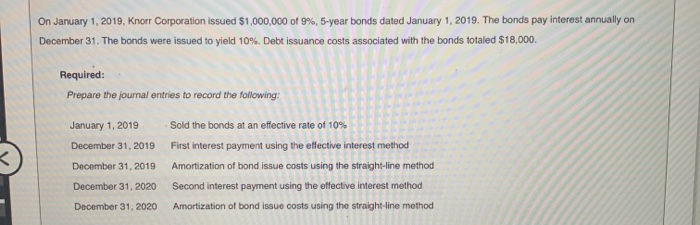

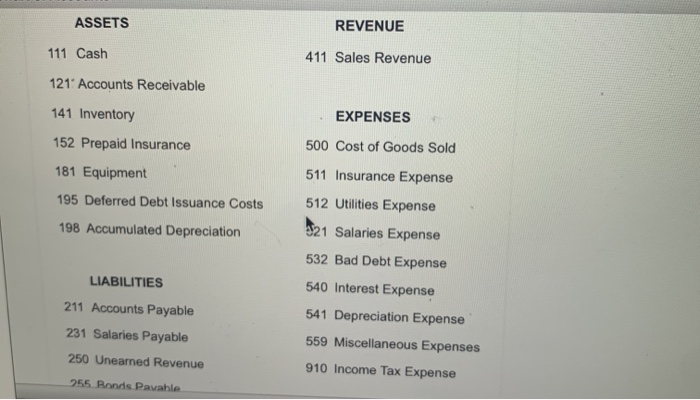

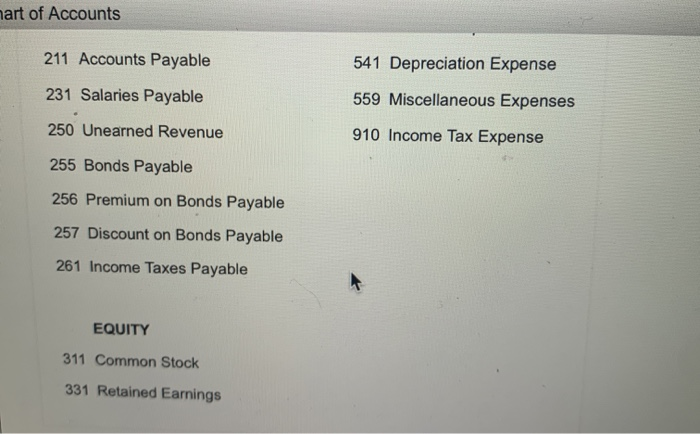

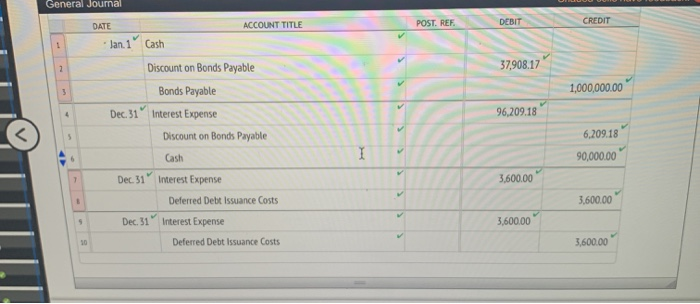

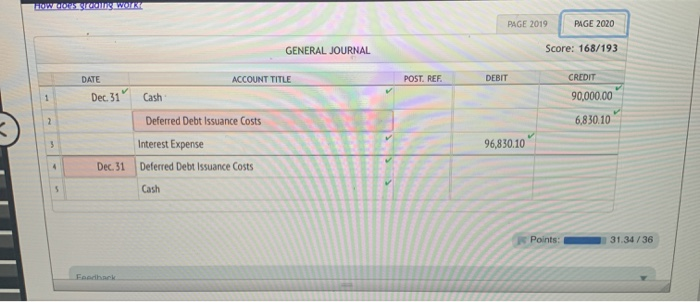

On January 1, 2019, Knorr Corporation issued $1,000,000 of 9%, 5-year bonds dated January 1, 2019. The bonds pay interest annually on December 31. The bonds were issued to yield 10%. Debt issuance costs associated with the bonds totaled $18,000. Required: Prepare the journal entries to record the following: January 1, 2019 December 31, 2019 December 31, 2019 Sold the bonds at an effective rate of 10% First interest payment using the effective interest method Amortization of bond issue costs using the straight-line method Second interest payment using the effective interest method Amortization of bond issue costs using the straight-line method December 31, 2020 December 31, 2020 ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 511 Insurance Expense 181 Equipment 195 Deferred Debt Issuance Costs 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 559 Miscellaneous Expenses 910 Income Tax Expense 255 Bonds Pavable nart of Accounts 211 Accounts Payable 541 Depreciation Expense 231 Salaries Payable 559 Miscellaneous Expenses 250 Unearned Revenue 910 Income Tax Expense 255 Bonds Payable 256 Premium on Bonds Payable 257 Discount on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings General Journal POST. REF DEBIT CREDIT 1 2 37,908.17 3 1,000,000.00 96.209.18 DATE ACCOUNT TITLE - Jan. 1 Cash Discount on Bonds Payable Bonds Payable Dec. 31 Interest Expense Discount on Bonds Payable Cash Dec. 31 Interest Expense Deferred Debt Issuance Costs Dec. 31 Interest Expense Deferred Debt Issuance Costs 6,209.18 I 90,000.00 7 3,600.00 3.600.00 5 3,600.00 3,600.00 EUWE WO PAGE 2019 PAGE 2020 GENERAL JOURNAL Score: 168/193 DATE ACCOUNT TITLE POST. REF DEBIT CREDIT 90,000.00 1 Dec 31" Cash 2 6,830.10 3 Deferred Debt Issuance Costs Interest Expense Deferred Debt Issuance Costs 96,830.10 4 Dec. 31 Cash Points: 31.34/36 Eredek