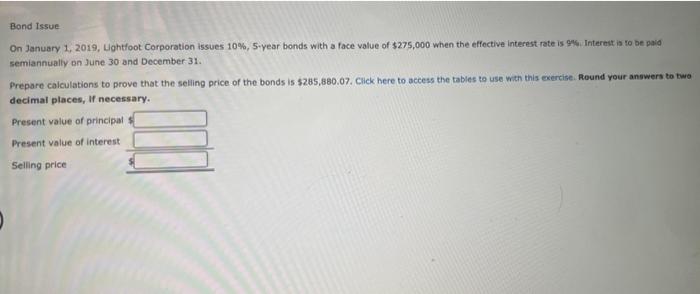

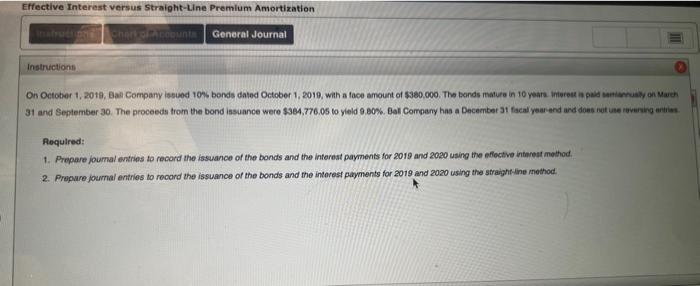

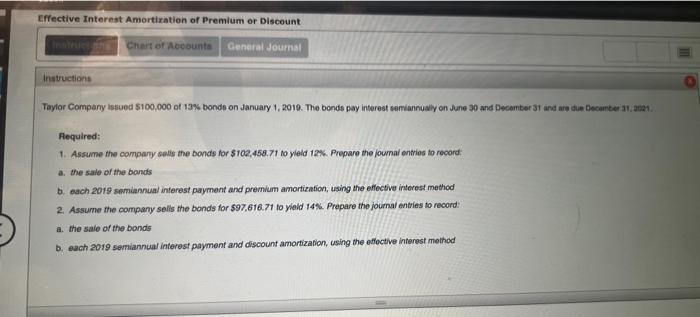

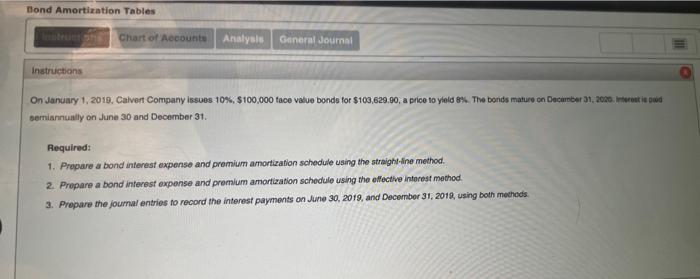

On January 1, 2019, Lohtfoot Corporation issues 10%,5-year bonds with a face value of $275,000 when the effective interest rate is 94 . Interest is to be paid semiannually on June 30 and December 31. Prepare calculations to prove that the selling price of the bonds is $285,880.07. Click here to access the tables to use with this exercise. Round your answers to two decimal places, If necessary. Present value of principal Present value of interest Selling price 31 and September 30. The proceeds from the bond issuance were $384,776.05 to yield 9.80%. BeI Compeny has a December 31 facal year and and does net une rayarka aritias. Requlred: 1. Prepare joumal watrins to record the issuance of the bonds and the interest payments for 2019 and 2020 using the efloctive intarest method. 2. Prepure joumal entries to rocord the issuance of the bonds and the intorest payments for 2019 and 2020 using the straight-ine method. Taylor Company issued $100,000 of 13% bonde on January 1, 2019. The bonde pay interest cemiannualy on June 30 and Decenter 31 and are due Decamber 31, ace1. Aequired: 1. Assume the company selts the bonds for $102,458.71 to yleld 12%. Propare the joumal entrios to record: a. the sate of the bonds b. each 2019 semiannual interest payment and premum amortization, using the effective interest method 2. Assume the company sells the bonds for $97,616.71 to yieid 14%. Prepare the joumal entries to record: a. the saie of the bonds b. each 2019 semiannuat interest payment and discount amortization, using the effoctive interest method On January 1, 2019, Calvent Company issues 108 , $100,000 tace value bonds for $103,629.90, a price to yeld 8%. The bonds mature cn Decimber 31, 2036. hiterest ie diwd semiannualy on June 30 and December 31. Requiredi 1. Propare a bond interest expense and premium amortization schedule using the straghi-line method. 2. Prepare a bond interest expense and premium amortization schodule using the olfective inforest method. 3. Prepare the joumal entries to record the interest payments on June 30,2019 , and Decembor 31, 2018, using both mothods