Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Navy Marine Supplies purchased a Government of Canada bond at par for $30,000. The bond has an interest rate of 15%

On January 1, 2019, Navy Marine Supplies purchased a Government of Canada bond at par for $30,000. The bond has an interest rate of 15% and matures in three years. By December 31, 2019, market interest rates had increased such that the fair value of the bond decreased to $29,700. The fair value of the bond decreased further to $29,300 on December 31, 2020 (two years after purchase).

Requirement:

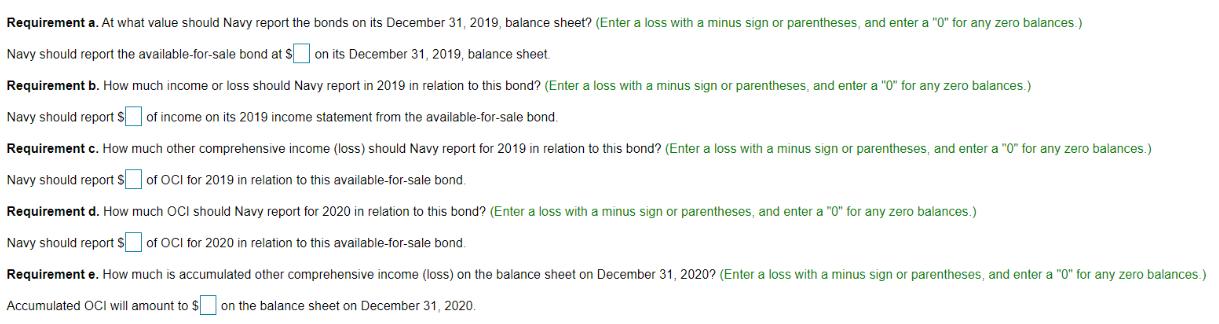

Requirement a. At what value should Navy report the bonds on its December 31, 2019, balance sheet? (Enter a loss with a minus sign or parentheses, and enter a "0" for any zero balances.) Navy should report the available-for-sale bond at S on its December 31, 2019, balance sheet Requirement b. How much income or loss should Navy report in 2019 in relation to this bond? (Enter a loss with a minus sign or parentheses, and enter a "0" for any zero balances.) Navy should reports of income on its 2019 income statement from the available-for-sale bond. Requirement c. How much other comprehensive income (loss) should Navy report for 2019 in relation to this bond? (Enter a loss with a minus sign or parentheses, and enter a "0" for any zero balances.) Navy should report $ of OCI for 2019 in relation to this available-for-sale bond. much OCI should Navy report for 2020 in relation to this bond? (Enter a loss with a minus sign or parentheses, and enter a "0" for any zero balances.) Requirement d. How Navy should report $ of OCI for 2020 in relation to this available-for-sale bond. Requirement e. How much is accumulated other comprehensive income (loss) on the balance sheet on December 31, 2020? (Enter a loss with a minus sign or parentheses, and enter a "0" for any zero balances.) Accumulated OCI will amount to $ on the balance sheet on December 31, 2020.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Before we get know that available for sale investments are get into this question we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started