Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Panic Inc. (Panic) acquired 70% of Stress Ltd. (Stress) for $560,000 when Stress's common stock was $300,000 and its Retained

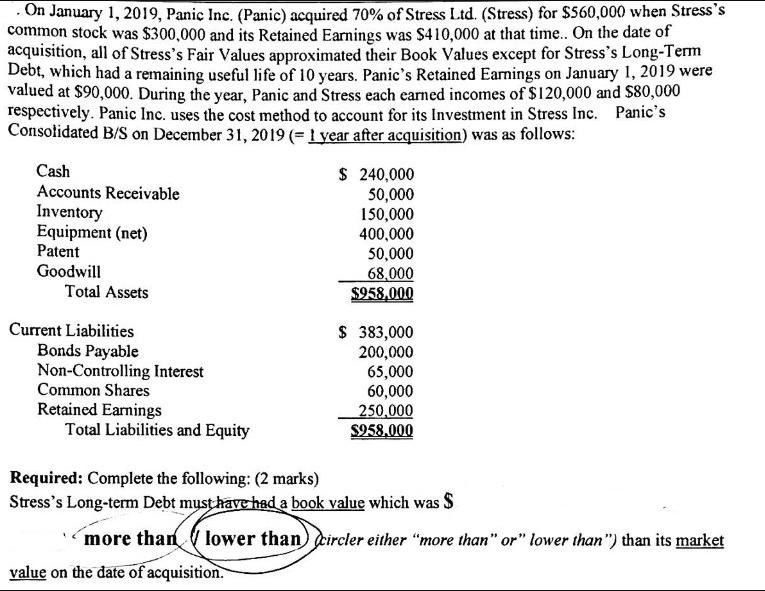

On January 1, 2019, Panic Inc. (Panic) acquired 70% of Stress Ltd. (Stress) for $560,000 when Stress's common stock was $300,000 and its Retained Earnings was $410,000 at that time.. On the date of acquisition, all of Stress's Fair Values approximated their Book Values except for Stress's Long-Term Debt, which had a remaining useful life of 10 years. Panic's Retained Earnings on January 1, 2019 were valued at $90,000. During the year, Panic and Stress each earned incomes of $120,000 and $80,000 respectively. Panic Inc. uses the cost method to account for its Investment in Stress Inc. Panic's Consolidated B/S on December 31, 2019 (= 1 year after acquisition) was as follows: Cash Accounts Receivable Inventory Equipment (net) Patent Goodwill Total Assets Current Liabilities Bonds Payable Non-Controlling Interest Common Shares Retained Earnings Total Liabilities and Equity $ 240,000 50,000 150,000 400,000 50,000 68,000 $958,000 $ 383,000 200,000 value on the date of acquisition. 65,000 60,000 250,000 $958.000 Required: Complete the following: (2 marks) Stress's Long-term Debt must have had a book value which was more than lower than circler either "more than" or" lower than") than its market

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

We are given that on the date of acquisition January 1 2019 Panic Inc acquired 70 of Stress Ltd Stress for 560000 Additionally all of Stresss Fair Val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started