Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019 PEN PENNY received a Utility Bill from BPL for $10,000, the bill was due on February 28, 2019. (a) Show

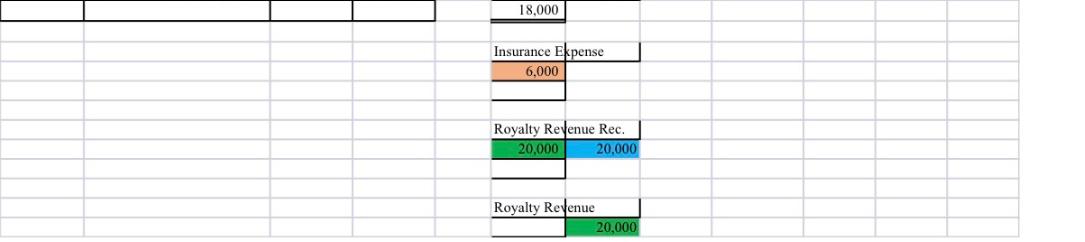

On January 1, 2019 PEN PENNY received a Utility Bill from BPL for $10,000, the bill was due on February 28, 2019. (a) Show the entries on January 1, 2019 and February 28, 2019. 2. On March 1, 2019 PEN PENNY company borrowed $400,000 from the Royal Bank of Canada and issued a notes payable to pay interest at the rate of 6% at the end of each quarter. a. Show the entry to record the amount borrowed, and the interest expense for March 31st. 3. On August 1, 2019 PEN PENNY company received rent of $30,000 from a tenant for three months rent. a. Show the entries on August 1, 2019 and August 31, 2019 4. On July 1, 2019 PEN PENNY Company Paid its insurance for two years $24,000. a. Show the entries on July 1, 2019 and December 31, 2019 5. On October 1, 2019 PEN PENNY earned royalty of $20,000 but did not receive the amount until February 3, 2020. a. Show the entries on October 1, 2019 and February 3, 2020. General Journal Date Particulars Debit Credit 1-Jan-19 Electricity Expense 10,000 Electricity Expense 10,000 BPL Accounts Payable 10,000 28-Feb-19 BPL Accounts Payable 10,000 Cash 10,000 BPL Accounts Payable 10,000 10,000 1-Mar-19 Cash 400,000 Cash RBC-Note Payable 400,000 400,000 10000 30000 2000 20,000 24,000 31-Mar-19 Interest Expense 2,000 Cash/ Interest Payable 2,000 RBC-Note Payable 1-Aug-19 Cash 30,000 400,000 P R T Unearned Rent Revenue 30,000 400,000 0.06 0.0833333 2000 6% 1/12 31-Aug-19 Unearned Rent Revenue 10,000 Interest Expense Rent Revenue 10,000 2,000 1-Jul-19 Prepaid Insurance 24,000 Cash 24,000 Unearned Rent Revenue 10,000 31-Dec-19 Insurance Expense 6,000 30,000 20,000 Prepaid Insurance 6,000 Rent Revenue 1-Oct-19 Royalty Revenue Rec. 20,000 10,000 Royalty Revenue 20,000 3-Feb-20 Cash 20,000 Prepaid Insurance Royalty Revenue Rec. 20,000 24,000 6,000 18,000 Insurance Expense 6,000 Royalty Revenue Rec. 20,000 Royalty Revenue 20,000 20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started