Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Planet Corporation, a U.S. company, acquired 100% of Star Corporation, a Bulgarian company, paying an excess of 90,000 Bulgarian Lev

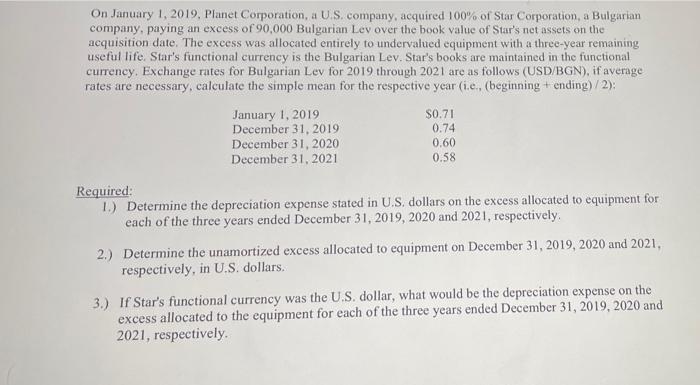

On January 1, 2019, Planet Corporation, a U.S. company, acquired 100% of Star Corporation, a Bulgarian company, paying an excess of 90,000 Bulgarian Lev over the book value of Star's net assets on the acquisition date. The excess was allocated entirely to undervalued equipment with a three-year remaining useful life. Star's functional currency is the Bulgarian Lev. Star's books are maintained in the functional currency. Exchange rates for Bulgarian Lev for 2019 through 2021 are as follows (USD/BGN), if average rates are necessary, calculate the simple mean for the respective year (i.e., (beginning + ending)/2): January 1, 2019 December 31, 2019 December 31, 2020 December 31, 2021 $0.71 0.74 0.60 0.58 Required: 1.) Determine the depreciation expense stated in U.S. dollars on the excess allocated to equipment for each of the three years ended December 31, 2019, 2020 and 2021, respectively. 2.) Determine the unamortized excess allocated to equipment on December 31, 2019, 2020 and 2021, respectively, in U.S. dollars. 3.) If Star's functional currency was the U.S. dollar, what would be the depreciation expense on the excess allocated to the equipment for each of the three years ended December 31, 2019, 2020 and 2021, respectively.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Depreciation Expense allocated on the excess allocated to Equipment in US Particulars Dec19 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started