Question

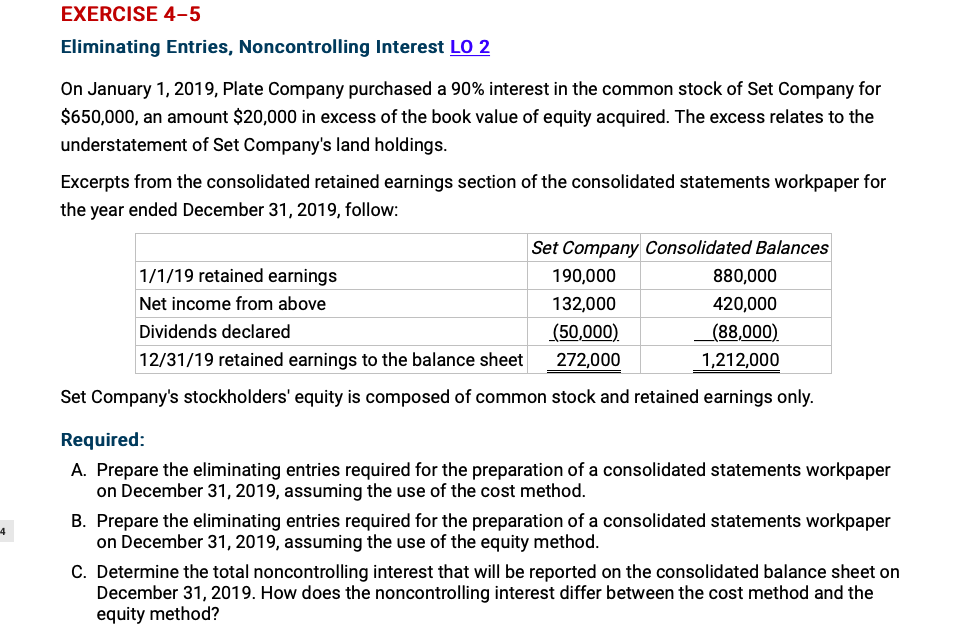

On January 1, 2019, Plate Company purchased a 90% interest in the common stock of Set Company for $650,000, an amount $20,000 in excess of

On January 1, 2019, Plate Company purchased a 90% interest in the common stock of Set Company for $650,000, an amount $20,000 in excess of the book value of equity acquired. The excess relates to the understatement of Set Company's land holdings. Excerpts from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2019, follow: Set Company Consolidated Balances 1/1/19 retained earnings 190,000 880,000 Net income from above 132,000 420,000 Dividends declared (50,000) (88,000) 12/31/19 retained earnings to the balance sheet 272,000 1,212,000 Set Company's stockholders' equity is composed of common stock and retained earnings only. Required: Prepare the eliminating entries required for the preparation of a consolidated statements workpaper on December 31, 2019, assuming the use of the cost method. Prepare the eliminating entries required for the preparation of a consolidated statements workpaper on December 31, 2019, assuming the use of the equity method. Determine the total noncontrolling interest that will be reported on the consolidated balance sheet on December 31, 2019. How does the noncontrolling interest differ between the cost method and the equity method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started