Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Red Hawk Company pays $70,000 for a 10 percent interest in Wolf Company's common stock. Because market quotes for Wolf's

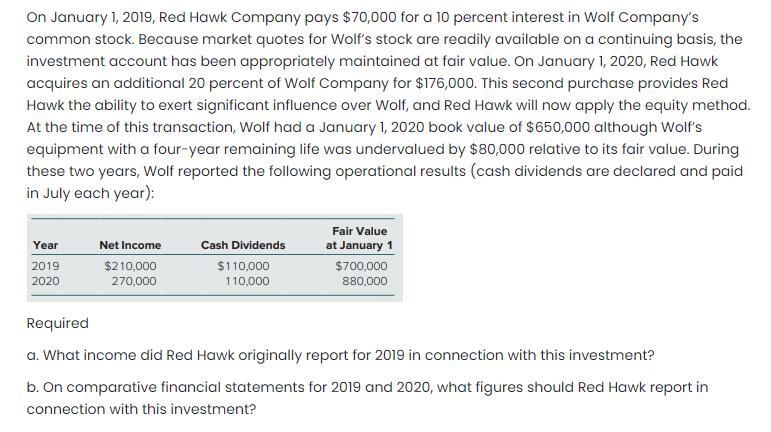

On January 1, 2019, Red Hawk Company pays $70,000 for a 10 percent interest in Wolf Company's common stock. Because market quotes for Wolf's stock are readily available on a continuing basis, the investment account has been appropriately maintained at fair value. On January 1, 2020, Red Hawk acquires an additional 20 percent of Wolf Company for $176,000. This second purchase provides Red Hawk the ability to exert significant influence over Wolf, and Red Hawk will now apply the equity method. At the time of this transaction, Wolf had a January 1, 2020 book value of $650,000 although Wolf's equipment with a four-year remaining life was undervalued by $80,000 relative to its fair value. During these two years, Wolf reported the following operational results (cash dividends are declared and paid in July each year): Year 2019 2020 Net Income $210,000 270,000 Cash Dividends $110,000 110,000 Fair Value at January 1 $700,000 880,000 Required a. What income did Red Hawk originally report for 2019 in connection with this investment? b. On comparative financial statements for 2019 and 2020, what figures should Red Hawk report in connection with this investment?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

On Jan 1 2019 Red Hawle Pays 70000 for 100 lnterst it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started