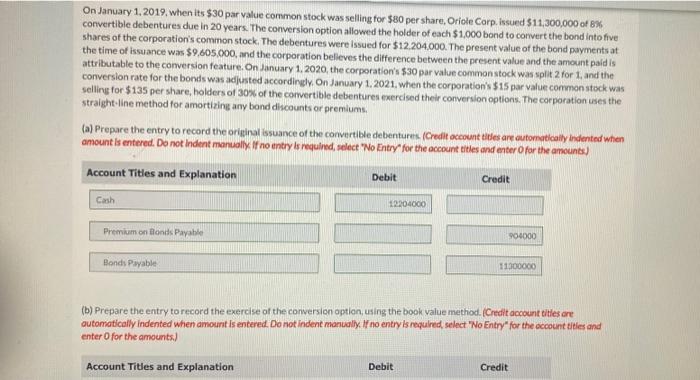

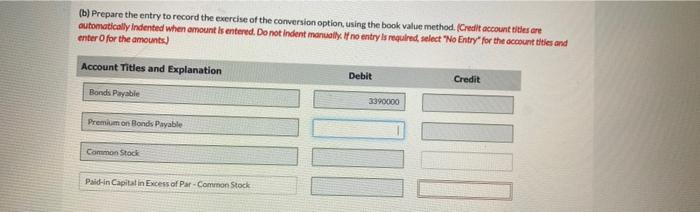

On January 1, 2019, when its $30 par value common stock was selling for $80 per share, Oriole Corp. issued 511,300,000 of 8% convertible debentures due in 20 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into five shares of the corporation's common stock. The debentures were issued for $12,204,000. The present value of the bond payments at the time of issuance was $9.605.000, and the corporation believes the difference between the present value and the amount paid is attributable to the conversion feature. On January 1, 2020, the corporation's $30 par value common stock was split 2 for 1, and the conversion rate for the bonds was adjusted accordingly. On January 1, 2021. when the corporation's $15 par value common stock was selling for $135 per shareholders of 30% of the convertible debentures exercised their conversion options. The corporation uses the straight line method for amortizing any bond discounts or premiums, (a) Prepare the entry to record the original issuance of the convertible debentures. (Credit occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit Cash 12204000 Premium on Blonds Payable 904000 Bonds Payable 11000000 (b) Prepare the entry to record the exercise of the conversion option, using the book value method. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit (b) Prepare the entry to record the exercise of the conversion option, using the book value method. (Credit account elles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit Bonds Payable 3390000 Premium on Bonds Payable Common Stock Paid-in Capitalin Excess of Par-Common Stock