Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, a machine was purchased for $860,000 by Metlock Co. The machine is expected to have an 8-year life with no

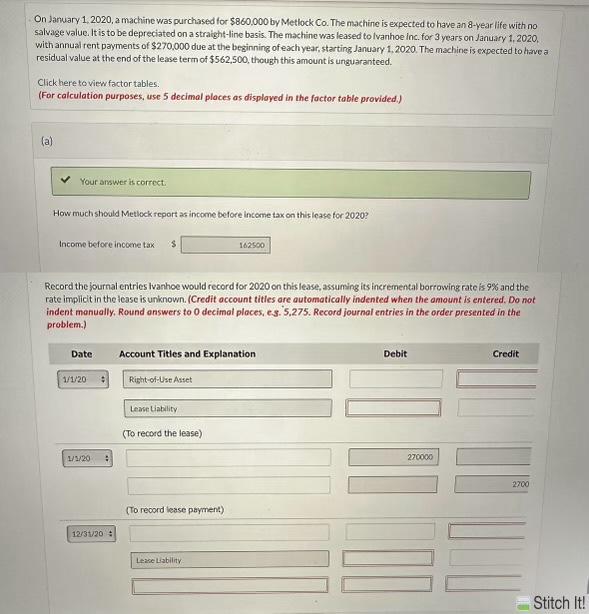

On January 1, 2020, a machine was purchased for $860,000 by Metlock Co. The machine is expected to have an 8-year life with no salvage value. It is to be depreciated on a straight-line basis. The machine was leased to Ivanhoe Inc. for 3 years on January 1, 2020, with annual rent payments of $270,000 due at the beginning of each year, starting January 1, 2020. The machine is expected to have a residual value at the end of the lease term of $562,500, though this amount is unguaranteed. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Your answer is correct. How much should Metlock report as income before income tax on this lease for 2020? Income before income tax 162500 Record the journal entries Ivanhoe would record for 2020 on this lease, assuming its incremental borrowing rate is 9% and the rate implicit in the lease is unknown. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, es. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation 1/1/20 Right-of-Use Asset 1/1/20 : 12/31/20 Lease Liability (To record the lease) (To record lease payment) Lease Liability Debit 270000 Credit 2700 Stitch It!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started