Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, A&A Company bought a property on which a warehouse was constructed. A&A Company plans to use the warehouse to expand its

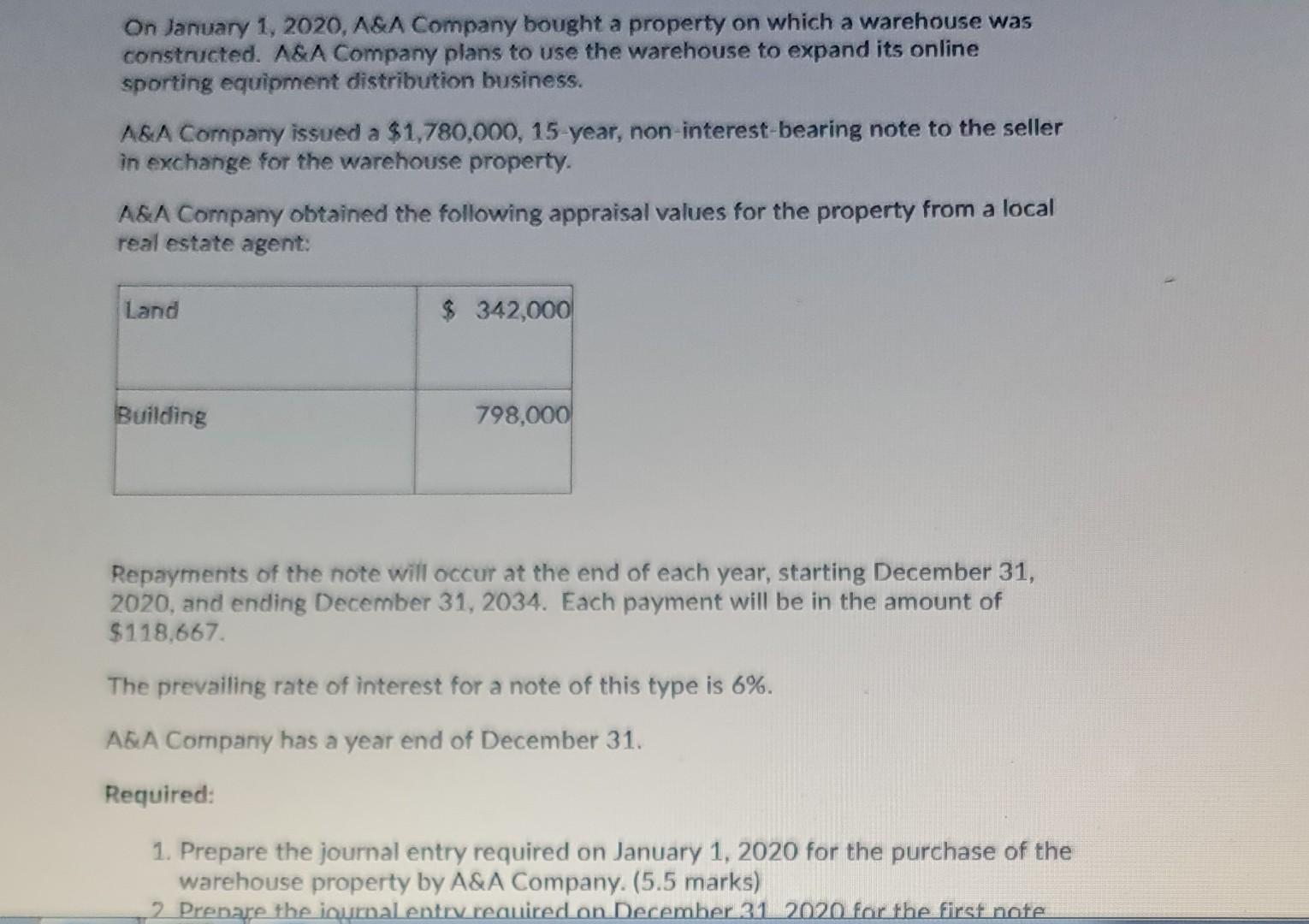

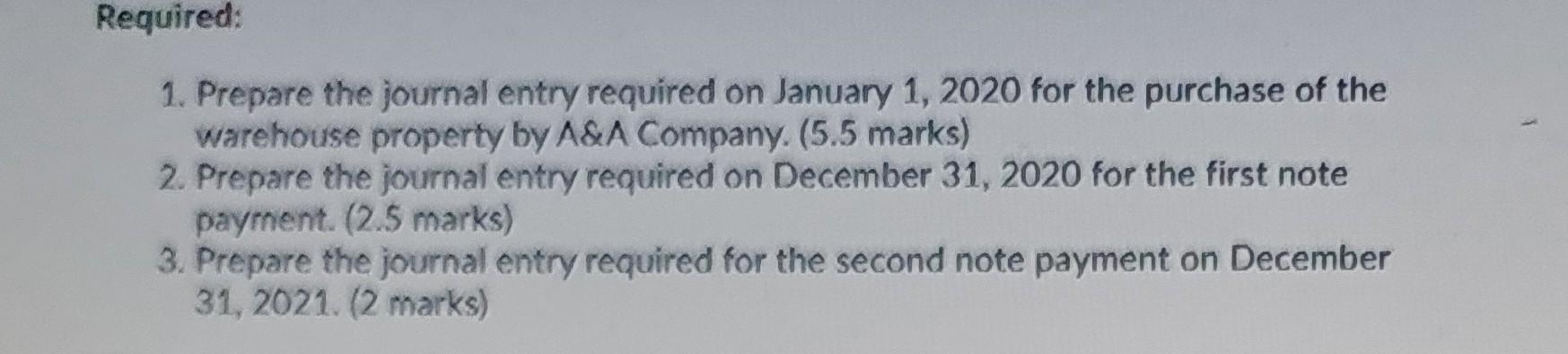

On January 1, 2020, A&A Company bought a property on which a warehouse was constructed. A&A Company plans to use the warehouse to expand its online sporting equipment distribution business. A&A Company issued a $1,780,000, 15-year, non-interest-bearing note to the seller in exchange for the warehouse property. A&A Company obtained the following appraisal values for the property from a local real estate agent: Land $ 342,000 Building 798,000 Repayments of the note will occur at the end of each year, starting December 31, 2020, and ending December 31, 2034. Each payment will be in the amount of $118,667 The prevailing rate of interest for a note of this type is 6%. A&A Company has a year end of December 31. Required: 1. Prepare the journal entry required on January 1, 2020 for the purchase of the warehouse property by A&A Company. (5.5 marks) Prepare the journal entry required on December 31, 2020 for the first note Required: 1. Prepare the journal entry required on January 1, 2020 for the purchase of the warehouse property by A&A Company. (5.5 marks) 2. Prepare the journal entry required on December 31, 2020 for the first note payment. (2.5 marks) 3. Prepare the journal entry required for the second note payment on December 31, 2021. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started