Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020 ABC Ltd., a publicly-traded oil extraction company, completed construction of a new drilling rig. The total cost to construct the

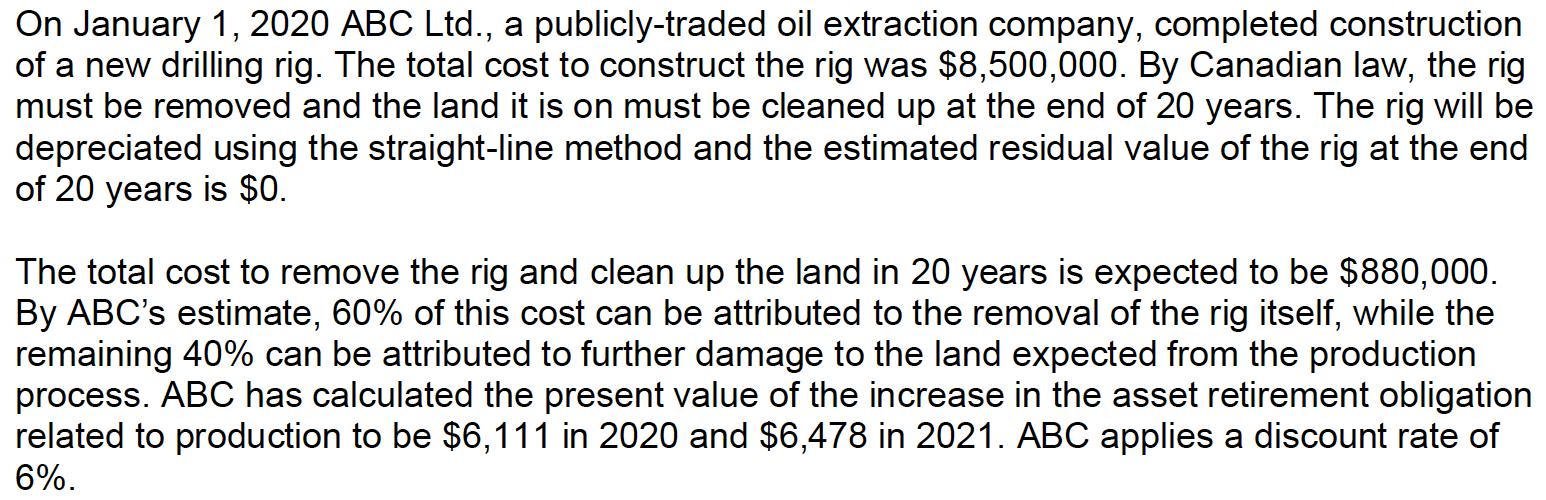

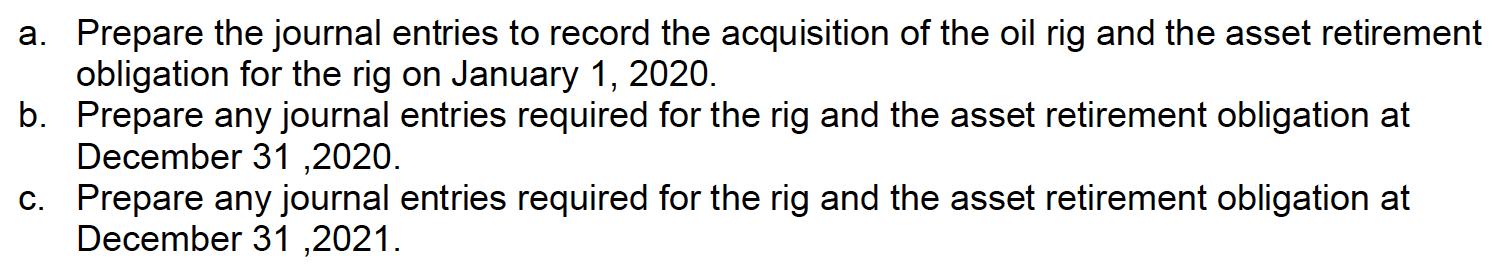

On January 1, 2020 ABC Ltd., a publicly-traded oil extraction company, completed construction of a new drilling rig. The total cost to construct the rig was $8,500,000. By Canadian law, the rig must be removed and the land it is on must be cleaned up at the end of 20 years. The rig will be depreciated using the straight-line method and the estimated residual value of the rig at the end of 20 years is $0. The total cost to remove the rig and clean up the land in 20 years is expected to be $880,000. By ABC's estimate, 60% of this cost can be attributed to the removal of the rig itself, while the remaining 40% can be attributed to further damage to the land expected from the production process. ABC has calculated the present value of the increase in the asset retirement obligation related to production to be $6,111 in 2020 and $6,478 in 2021. ABC applies a discount rate of 6%. a. Prepare the journal entries to record the acquisition of the oil rig and the asset retirement obligation for the rig on January 1, 2020. b. Prepare any journal entries required for the rig and the asset retirement obligation at December 31 ,2020. c. Prepare any journal entries required for the rig and the asset retirement obligation at December 31 ,2021.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

aJournal entry to record the acquisition of the oil ring and the asset retirement obligation for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started