Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020 Beta issues 10-year, 12% bonds payablewith a par value of $400,000. The bonds are issued at a premiumof $23,900 to

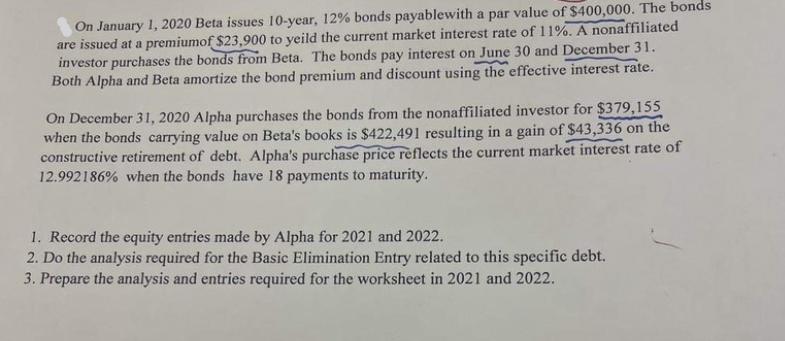

On January 1, 2020 Beta issues 10-year, 12% bonds payablewith a par value of $400,000. The bonds are issued at a premiumof $23,900 to yeild the current market interest rate of 11%. A nonaffiliated investor purchases the bonds from Beta. The bonds pay interest on June 30 and December 31. Both Alpha and Beta amortize the bond premium and discount using the effective interest rate. On December 31, 2020 Alpha purchases the bonds from the nonaffiliated investor for $379,155 when the bonds carrying value on Beta's books is $422,491 resulting in a gain of $43,336 on the constructive retirement of debt. Alpha's purchase price reflects the current market interest rate of 12.992186% when the bonds have 18 payments to maturity. 1. Record the equity entries made by Alpha for 2021 and 2022. 2. Do the analysis required for the Basic Elimination Entry related to this specific debt. 3. Prepare the analysis and entries required for the worksheet in 2021 and 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Record the equity entries made by Alpha for 2021 and 2022 The following equity entries would be ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started