Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Borrowing Company Inc. has a $100,000 loan that charges a 20% interest rate each year. The company has agreed to

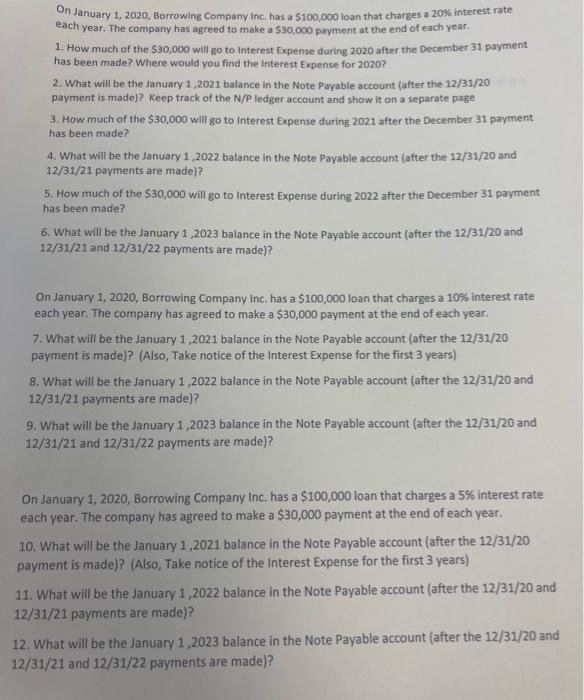

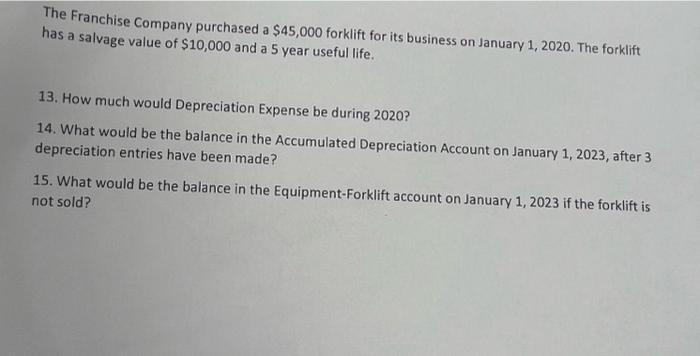

On January 1, 2020, Borrowing Company Inc. has a $100,000 loan that charges a 20% interest rate each year. The company has agreed to make a $30,000 payment at the end of each year. 1. How much of the $30,000 will go to Interest Expense during 2020 after the December 31 payment has been made? Where would you find the Interest Expense for 2020? 2. What will be the January 1,2021 balance in the Note Payable account (after the 12/31/20 payment is made)? Keep track of the N/P ledger account and show it on a separate page 3. How much of the $30,000 will go to Interest Expense during 2021 after the December 31 payment has been made? 4. What will be the January 1,2022 balance in the Note Payable account (after the 12/31/20 and 12/31/21 payments are made)? 5. How much of the $30,000 will go to Interest Expense during 2022 after the December 31 payment has been made? 6. What will be the January 1,2023 balance in the Note Payable account (after the 12/31/20 and 12/31/21 and 12/31/22 payments are made)? On January 1, 2020, Borrowing Company Inc. has a $100,000 loan that charges a 10% interest rate each year. The company has agreed to make a $30,000 payment at the end of each year. 7. What will be the January 1,2021 balance in the Note Payable account (after the 12/31/20 payment is made)? (Also, Take notice of the Interest Expense for the first 3 years) 8. What will be the January 1,2022 balance in the Note Payable account (after the 12/31/20 and 12/31/21 payments are made)? 9. What will be the January 1,2023 balance in the Note Payable account (after the 12/31/20 and 12/31/21 and 12/31/22 payments are made)? On January 1, 2020, Borrowing Company Inc. has a $100,000 loan that charges a 5% interest rate each year. The company has agreed to make a $30,000 payment at the end of each year. 10. What will be the January 1,2021 balance in the Note Payable account (after the 12/31/20 payment is made)? (Also, Take notice of the Interest Expense for the first 3 years) 11. What will be the January 1,2022 balance in the Note Payable account (after the 12/31/20 and 12/31/21 payments are made)? 12. What will be the January 1,2023 balance in the Note Payable account (after the 12/31/20 and 12/31/21 and 12/31/22 payments are made)? The Franchise Company purchased a $45,000 forklift for its business on January 1, 2020. The forklift has a salvage value of $10,000 and a 5 year useful life. 13. How much would Depreciation Expense be during 2020? 14. What would be the balance in the Accumulated Depreciation Account on January 1, 2023, after 3 depreciation entries have been made? 15. What would be the balance in the Equipment-Forklift account on January 1, 2023 if the forklift is not sold?

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each scenario Scenario 1 20 interest rate and 30000 payment each year 1 In this scenario the Interest Expense for 2020 will be calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started