On January 1, 2020, Cadbury Corporation sells equipment to Denim Finance Corp. for $380,000 and immediately leases the equipment back. Both Cadbury and Denim

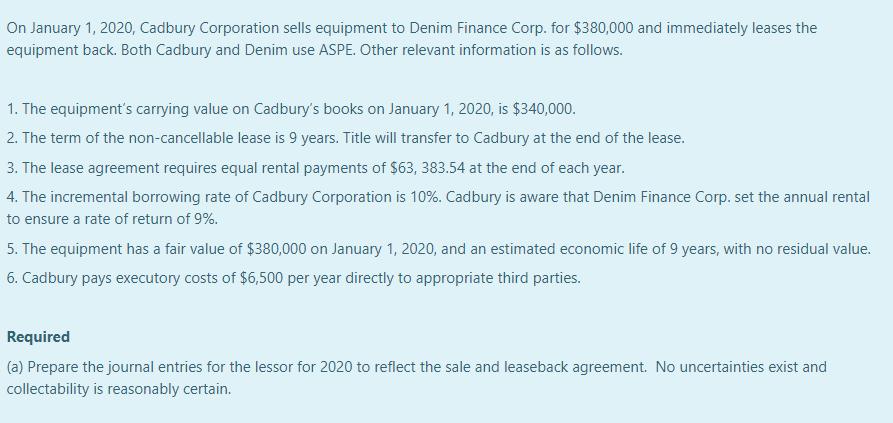

On January 1, 2020, Cadbury Corporation sells equipment to Denim Finance Corp. for $380,000 and immediately leases the equipment back. Both Cadbury and Denim use ASPE. Other relevant information is as follows. 1. The equipment's carrying value on Cadbury's books on January 1, 2020, is $340,000. 2. The term of the non-cancellable lease is 9 years. Title will transfer to Cadbury at the end of the lease. 3. The lease agreement requires equal rental payments of $63, 383.54 at the end of each year. 4. The incremental borrowing rate of Cadbury Corporation is 10%. Cadbury is aware that Denim Finance Corp. set the annual rental to ensure a rate of return of 9%. 5. The equipment has a fair value of $380,000 on January 1, 2020, and an estimated economic life of 9 years, with no residual value. 6. Cadbury pays executory costs of $6,500 per year directly to appropriate third parties. Required (a) Prepare the journal entries for the lessor for 2020 to reflect the sale and leaseback agreement. No uncertainties exist and collectability is reasonably certain.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Given below are the journal entries which needs to be passed ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started