Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Countryside Resorts, Inc. purchased a luxury tour bus to be used to transport guests to and from the airport and

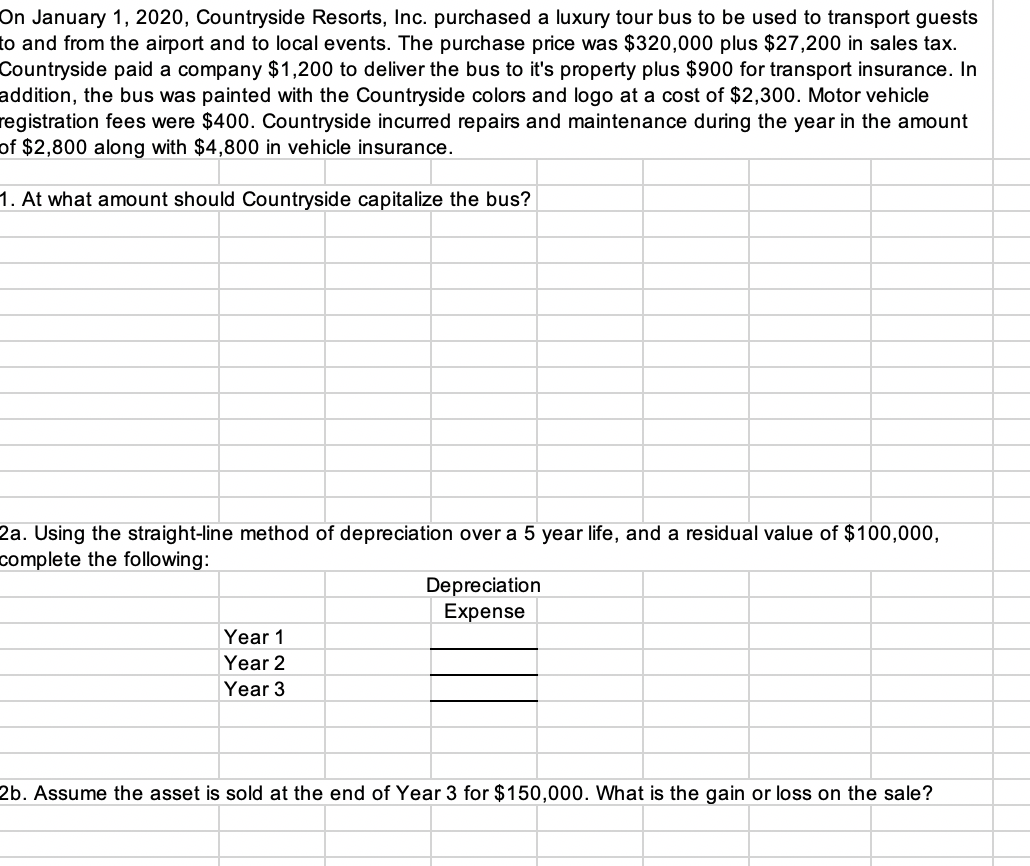

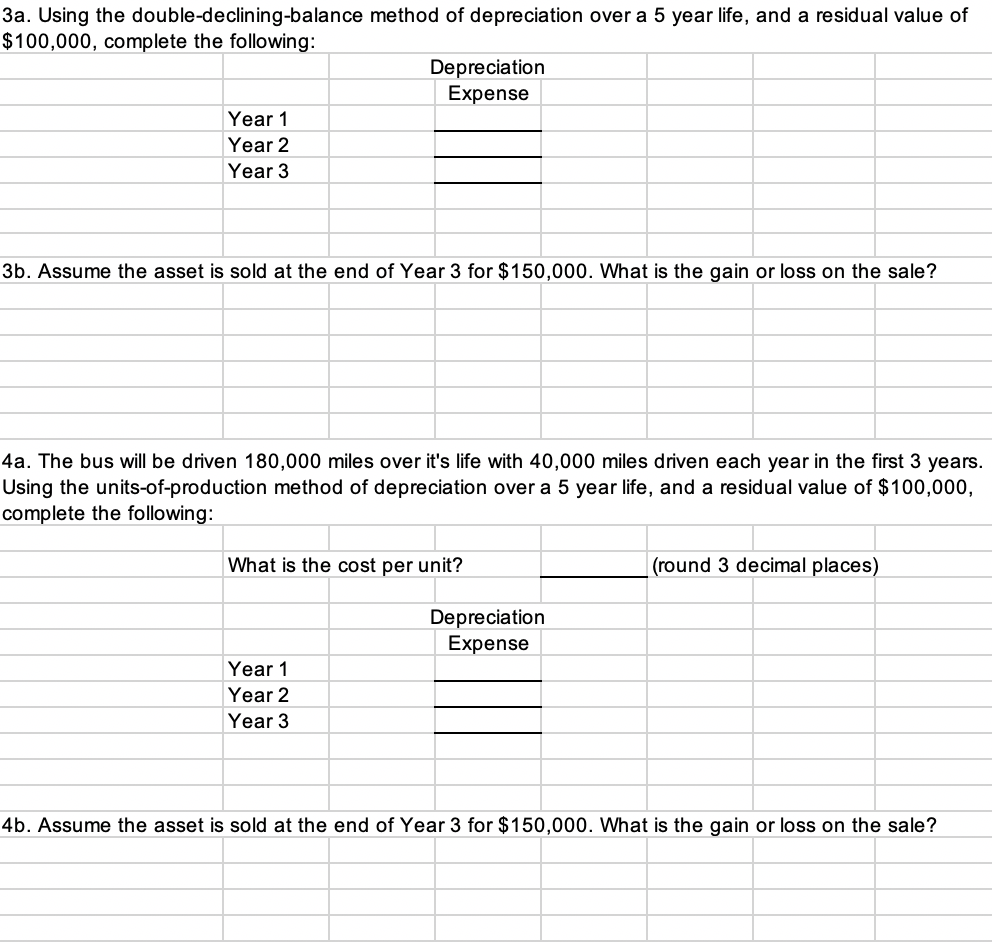

On January 1, 2020, Countryside Resorts, Inc. purchased a luxury tour bus to be used to transport guests to and from the airport and to local events. The purchase price was $320,000 plus $27,200 in sales tax. Countryside paid a company $1,200 to deliver the bus to it's property plus $900 for transport insurance. In addition, the bus was painted with the Countryside colors and logo at a cost of $2,300. Motor vehicle registration fees were $400. Countryside incurred repairs and maintenance during the year in the amount of $2,800 along with $4,800 in vehicle insurance. 1. At what amount should Countryside capitalize the bus? 2a. Using the straight-line method of depreciation over a 5 year life, and a residual value of $100,000, complete the following: Depreciation Expense Year 1 Year 2 Year 3 2b. Assume the asset is sold at the end of Year 3 for $150,000. What is the gain or loss on the sale? 3a. Using the double-declining-balance method of depreciation over a 5 year life, and a residual value of $100,000, complete the following: Depreciation Expense Year 1 Year 2 Year 3 3b. Assume the asset is sold at the end of Year 3 for $150,000. What is the gain or loss on the sale? miles driven each year in the first 3 years. 4a. The bus will be driven 180,000 miles over it's life with 40, Using the units-of-production method of depreciation over a 5 year life, and a residual value of $100,000, complete the following: What is the cost per unit? |(round 3 decimal places) Depreciation Expense Year 1 Year 2 Year 3 4b. Assume the asset is sold at the end of Year 3 for $150,000. What is the gain or loss on the sale?

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 At what amount should Countryside capitalize the bus ANSWER 355700 DETAILED WORKING Purchase Price 320000 Sales Tax 27200 Delivery Cost 1200 Transpo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started