Answered step by step

Verified Expert Solution

Question

1 Approved Answer

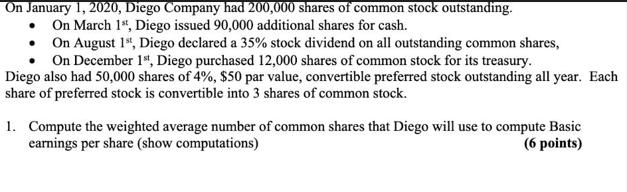

On January 1, 2020, Diego Company had 200,000 shares of common stock outstanding. On March 1st, Diego issued 90,000 additional shares for cash. On

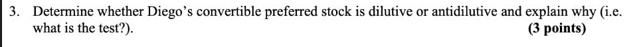

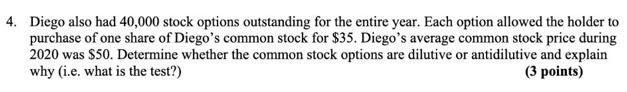

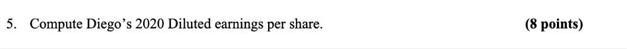

On January 1, 2020, Diego Company had 200,000 shares of common stock outstanding. On March 1st, Diego issued 90,000 additional shares for cash. On August 1st, Diego declared a 35% stock dividend on all outstanding common shares, On December 1st, Diego purchased 12,000 shares of common stock for its treasury. Diego also had 50,000 shares of 4%, $50 par value, convertible preferred stock outstanding all year. Each share of preferred stock is convertible into 3 shares of common stock. 1. Compute the weighted average number of common shares that Diego will use to compute Basic earnings per share (show computations) (6 points) 2. Compute Diego's 2020 Basic earnings per share assuming net income for the year was $400,000. (4 points) 3. Determine whether Diego's convertible preferred stock is dilutive or antidilutive and explain why (i.e. what is the test?). (3 points) 4. Diego also had 40,000 stock options outstanding for the entire year. Each option allowed the holder to purchase of one share of Diego's common stock for $35. Diego's average common stock price during 2020 was $50. Determine whether the common stock options are dilutive or antidilutive and explain why (i.e. what is the test?) (3 points) 5. Compute Diego's 2020 Diluted earnings per share. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started