Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Frozen Yogart Inc. signed a 10-year lease for its retail outlet. The lease payments, paid semiannually, are based upon semiannual

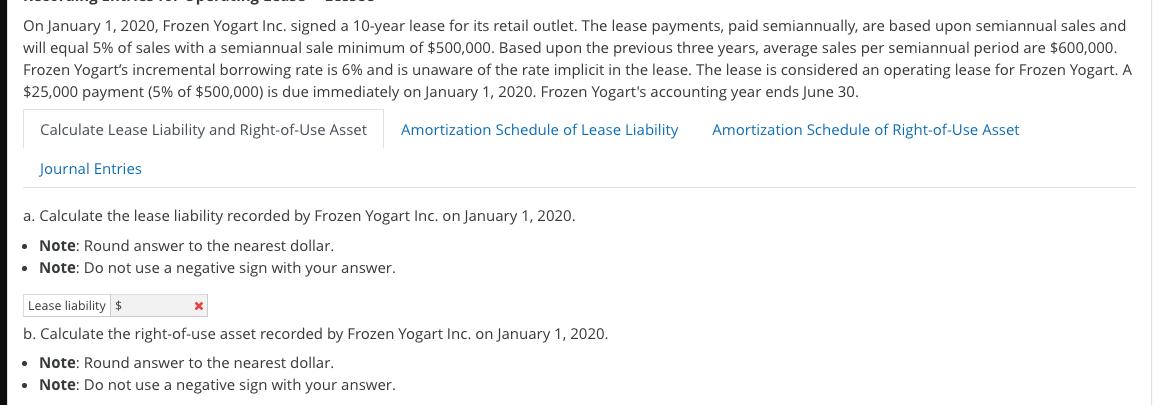

On January 1, 2020, Frozen Yogart Inc. signed a 10-year lease for its retail outlet. The lease payments, paid semiannually, are based upon semiannual sales and will equal 5% of sales with a semiannual sale minimum of $500,000. Based upon the previous three years, average sales per semiannual period are $600,000. Frozen Yogart's incremental borrowing rate is 6% and is unaware of the rate implicit in the lease. The lease is considered an operating lease for Frozen Yogart. A $25,000 payment (5% of $500,000) is due immediately on January 1, 2020. Frozen Yogart's accounting year ends June 30. Calculate Lease Liability and Right-of-Use Asset Amortization Schedule of Lease Liability Amortization Schedule of Right-of-Use Asset Journal Entries a. Calculate the lease liability recorded by Frozen Yogart Inc. on January 1, 2020. . Note: Round answer to the nearest dollar. Note: Do not use a negative sign with your answer. Lease liability $ b. Calculate the right-of-use asset recorded by Frozen Yogart Inc. on January 1, 2020. Note: Round answer to the nearest dollar. Note: Do not use a negative sign with your answer.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Insubstance Fixed lease paymets for Insubstance Fixed lease payments payments which are virtually ce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started