Answered step by step

Verified Expert Solution

Question

1 Approved Answer

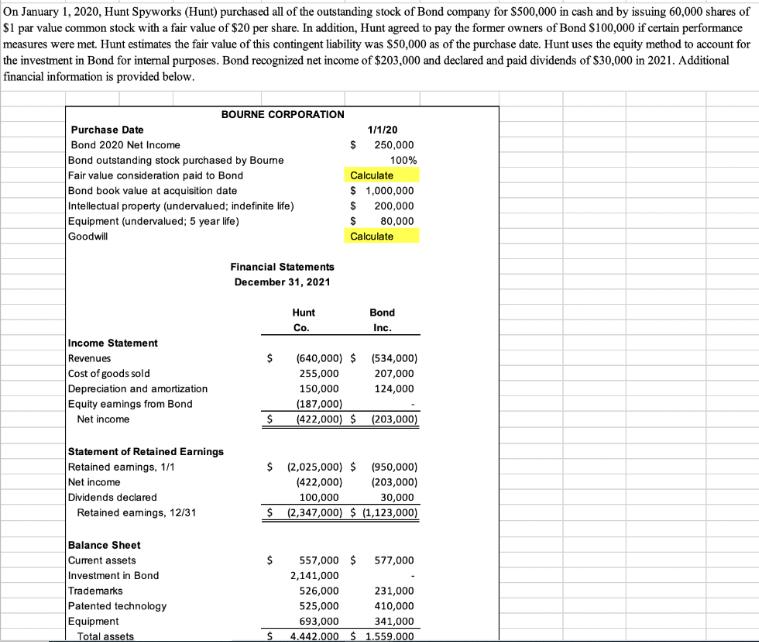

On January 1, 2020, Hunt Spyworks (Hunt) purchased all of the outstanding stock of Bond company for $500,000 in cash and by issuing 60,000

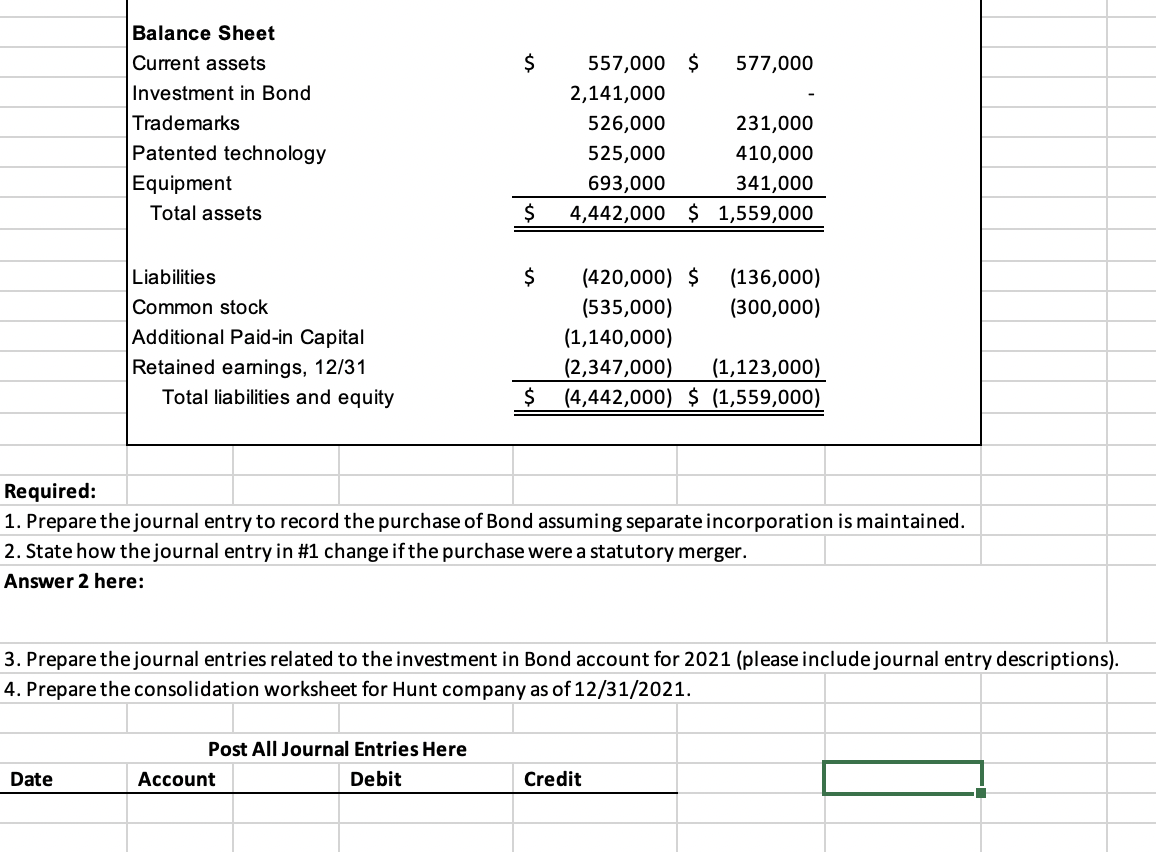

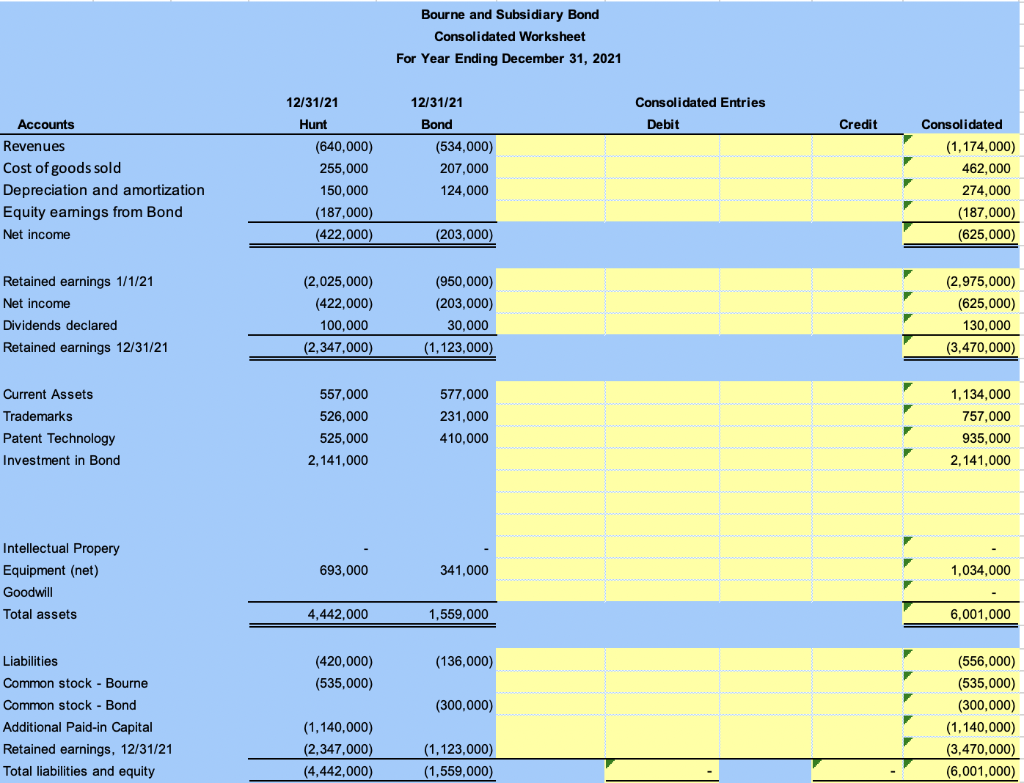

On January 1, 2020, Hunt Spyworks (Hunt) purchased all of the outstanding stock of Bond company for $500,000 in cash and by issuing 60,000 shares of $1 par value common stock with a fair value of $20 per share. In addition, Hunt agreed to pay the former owners of Bond $100,000 if certain performance measures were met. Hunt estimates the fair value of this contingent liability was $50,000 as of the purchase date. Hunt uses the equity method to account for the investment in Bond for internal purposes. Bond recognized net income of $203,000 and declared and paid dividends of $30,000 in 2021. Additional financial information is provided below. Purchase Date Bond 2020 Net Income Bond outstanding stock purchased by Boume Fair value consideration paid to Bond Bond book value at acquisition date Intellectual property (undervalued; indefinite life) Equipment (undervalued; 5 year life) Goodwill Income Statement Revenues Cost of goods sold Depreciation and amortization Equity eamings from Bond Net income BOURNE CORPORATION Statement of Retained Earnings Retained eamings. 1/1 Net income Dividends declared Retained eamings, 12/31 Balance Sheet Current assets Investment in Bond Trademarks Patented technology Equipment Total assets Financial Statements December 31, 2021 $ Hunt Co. S 1/1/20 250,000 100% $ Calculate $ 1,000,000 $ 200,000 S 80,000 Calculate Bond Inc. (640,000) $ (534,000) 255,000 207,000 124,000 150,000 (187,000) $ (422,000) $ (203,000) $ (2,025,000) $ (950,000) (203,000) (422,000) 100,000 30,000 $ (2,347,000) $ (1,123,000) 557,000 $ 577,000 2,141,000 526,000 231,000 525,000 410,000 693,000 341,000 S 4.442.000 $ 1.559.000 Balance Sheet Current assets Investment in Bond Trademarks Patented technology Equipment Date Total assets Liabilities Common stock Additional Paid-in Capital Retained earnings, 12/31 Total liabilities and equity $ Post All Journal Entries Here Debit $ Account $ 557,000 $ 2,141,000 526,000 231,000 525,000 410,000 693,000 341,000 4,442,000 $ 1,559,000 (420,000) $ (535,000) 577,000 Required: 1. Prepare the journal entry to record the purchase of Bond assuming separate incorporation is maintained. 2. State how the journal entry in #1 change if the purchase were a statutory merger. Answer 2 here: 3. Prepare the journal entries related to the investment in Bond account for 2021 (please include journal entry descriptions). 4. Prepare the consolidation worksheet for Hunt company as of 12/31/2021. (136,000) (300,000) (1,140,000) (2,347,000) (1,123,000) $ (4,442,000) $ (1,559,000) Credit Accounts Revenues Cost of goods sold Depreciation and amortization Equity earings from Bond Net income Retained earnings 1/1/21 Net income Dividends declared Retained earnings 12/31/21 Current Assets Trademarks Patent Technology Investment in Bond Intellectual Propery Equipment (net) Goodwill Total assets Liabilities Common stock - Bourne Common stock - Bond Additional Paid-in Capital Retained earnings, 12/31/21 Total liabilities and equity 12/31/21 Hunt (640,000) 255,000 150,000 (187,000) (422,000) (2,025,000) (422,000) 100,000 (2,347,000) 557,000 526,000 525,000 2,141,000 693,000 4,442,000 (420,000) (535,000) (1,140,000) (2,347,000) (4,442,000) Bourne and Subsidiary Bond Consolidated Worksheet For Year Ending December 31, 2021 12/31/21 Bond (534,000) 207,000 124,000 (203,000) (950,000) (203,000) 30,000 (1,123,000) 577,000 231,000 410,000 341,000 1,559,000 (136,000) (300,000) (1,123,000) (1,559,000) Consolidated Entries Debit Credit Y Consolidated (1,174,000) 462,000 274,000 (187,000) (625,000) (2,975,000) (625,000) 130,000 (3,470,000) 1,134,000 757,000 935,000 2,141,000 1,034,000 6,001,000 (556,000) (535,000) (300,000) (1,140,000) (3,470,000) (6,001,000)

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1 Journal entry to record the purchase of Bond assuming separate incorporation is maintained Date Account Debit Credit Jan 1 2020 Investment i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started