Answered step by step

Verified Expert Solution

Question

1 Approved Answer

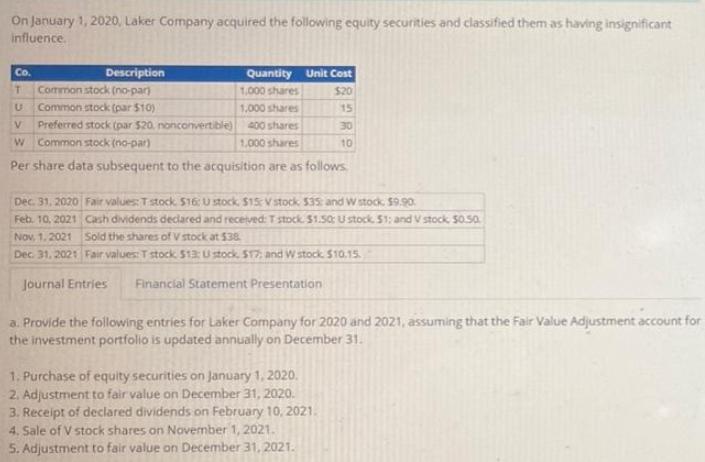

On January 1, 2020, Laker Company acquired the following equity securities and classified them as having insignificant influence. CO. Description Common stock (no-par) Quantity

On January 1, 2020, Laker Company acquired the following equity securities and classified them as having insignificant influence. CO. Description Common stock (no-par) Quantity Unit Cost T. 1,000 shares $20 Common stock (par $10) 1,000 shares 15 V. Preferred stock (par $20. nonconvertible) 400 shares 30 w Common stock (no-par) 1,000 shares 10 Per share data subsequent to the acquisition are as follows Dec. 31, 2020 Fair values: Tstock. S16: U stock S15 V stock 535 and w stock $9.90o. Feb. 10, 2021 Cash dividends declared and recetved: T stock $1.50 Ustock. S1: and V stock 50.50 Nov, 1. 2021 Sold the shares of V stock at $38 Dec. 31, 2021 Fair values: T stock S12 U stock. S17; and W stock S10.15. Journal Entries Financial Statement Presentation a. Provide the following entries for Laker Company for 2020 and 2021, assuming that the Fair Value Adjustment account for the investment portfolio is updated annually on December 31. 1. Purchase of equity securities on January 1, 2020. 2. Adjustment to fair value on December 31, 2020. 3. Receipt of declared dividends on February 10, 2021. 4. Sale of V stock shares on November 1, 2021. 5. Adjustment to fair value on December 31, 2021.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Date Account Name Debit Credit 1 Jan 2020 Investments Company T stock 20000 InvestmentsCompany U stock 15000 Investments Company V stock 12000 Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started