Question

On January 1, 2020, Leno Ltd. issues bonds for $770,000. The bonds have a maturity value of $800,000 and mature on December 31, 2022. The

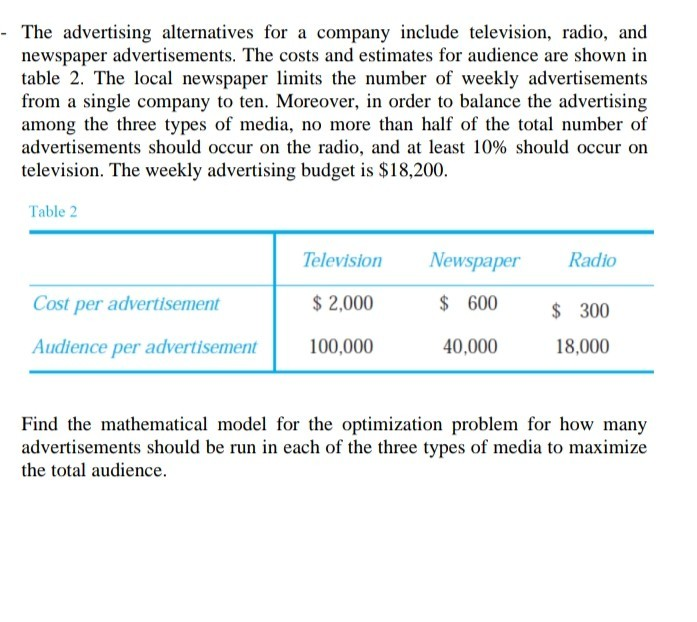

On January 1, 2020, Leno Ltd. issues bonds for $770,000. The bonds have a maturity value of $800,000 and mature on December 31, 2022. The coupon rate on the bonds is 3 percent, with the interest paid annually on December of each year. The maturity amount is paid on December 31, 2022. What are the tax consequences related to this bond issue for Leno Ltd. in each of the years 2020 through 2022? How would these tax consequences differ from the information included in Leno's GAAP based financial statements? Leno Ltd. uses the straight-line method to amortize the discount on the bonds for accounting purposes.

Ms. Marilyn Lox invests in a newly issued debt instrument on April 1, 2020. It has a maturity value of $50,000, matures on March 31, 2024, and pays interest at an annual rate of 5 percent. The terms of the instrument call for payment of interest for the first two and one-half years on September 30, 2022. The remaining interest is paid at the maturity date of the instrument. What amount of interest will Ms. Lox have to include in her tax returns for each of the years 2020 through 2024?

Mr. Martin Pabst owns publicly traded shares which, during 2020, paid eligible dividends of $10,200. His Taxable Income for this year exceeds $300,000 and he lives in a province where the maximum individual tax rate is 16 percent. The provincial tax credit on eligible dividends is equal to 29 percent of the gross up. Determine the total federal and provincial tax that will be payable on these dividends and his after tax retention.

Ms. Linda Udall owns 800 shares of Fordam Inc. that she acquired several years ago at $10 per share. On April 30, 2020, she acquires an additional 200 shares at $12 per share. On July 15, 2020, after Fordam releases unexpectedly bad second quarter results, Ms. Udall sells all 1,000 of her shares at $5 per share. On August 1, 2020, she purchases 200 shares at $1 per share as she believes the market has overreacted to the bad news. Ms. Udall is still holding the shares at the end of the year. What are the tax consequences of these transactions?

For the last two years, Margaret Lane has been interested in the shares of Garod Inc. During the period, her transactions in these securities were as follows:

Shares

Purchased (Sold) Per Share Value

January 2019 Purchase 300 $4.75

July 2019 Purchase 200 5.25

November 2019 Sale (250) 5.40

July 2020 Purchase 400 5.50

December 2020 Sale (150) 4.80

Determine Ms. Lane's taxable capital gains (losses) for 2019 and 2020.

6.During the current year, Robert Langois disposes of several items. The proceeds of disposition

and the adjusted cost base of the various items are as follows:

Adjusted Proceeds Of

Cost Base Disposition

Collector Car $45,000 $61,000

Marble Sculpture 800 13,000

Antique Furniture 21,000 12,000

Stamp Collection 50,500 26,000

What is the net tax consequence of these disposition?

7.For a number of years, Ms. Danine Post has owned a rural cottage property that has been used for her personal enjoyment. The cottage cost $142,000 in 2016 and, on July 1, 2020, it has a fair market value of $242,000. She estimates that the fair market value of the land on which the cottage is located is $22,000 on both of these dates. It will not be designated as her principal residence for any of the years owned. On July 1, 2020, she rents the property to an arm's length party for an amount of $1,000 per month for a period of three years. Net rental income for the year ending December 31, 2020, before the deduction of any CCA, is $4,800. What is the maximum amount of CCA that she can deduct for 2020?

8.On January 1 of the current year, Ms. Lorraine Brock uses $10,000 of her savings to acquire a fixed term annuity. The term of the annuity is three years, the annual payments are $4,020, the payments are received on December 31 of each year, and the rate inherent in the annuity is 10 percent. What is the effect of the $4,020 annual payment on Ms. Brock's Net Income For Tax Purposes.

9.Mr. Norman Low owns a depreciable asset that he has used in his unincorporated business. It has a cost of $145,000 and a fair market value of $132,000. It is the only asset in its CCA class and the balance in the class is $63,500. Mr. Low sells the asset to his father for $132,000. During the year, prior to taking any CCA on the asset, Mr. Low's father sells the asset for $135,000. Determine the amount of income to be recorded by Mr. Low and his father as a result of these transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started