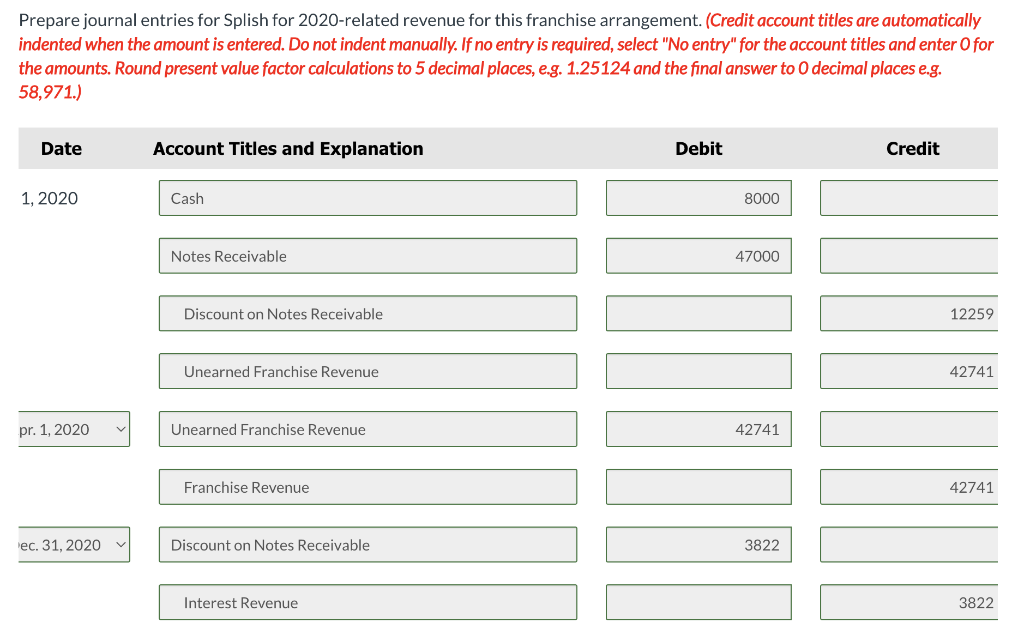

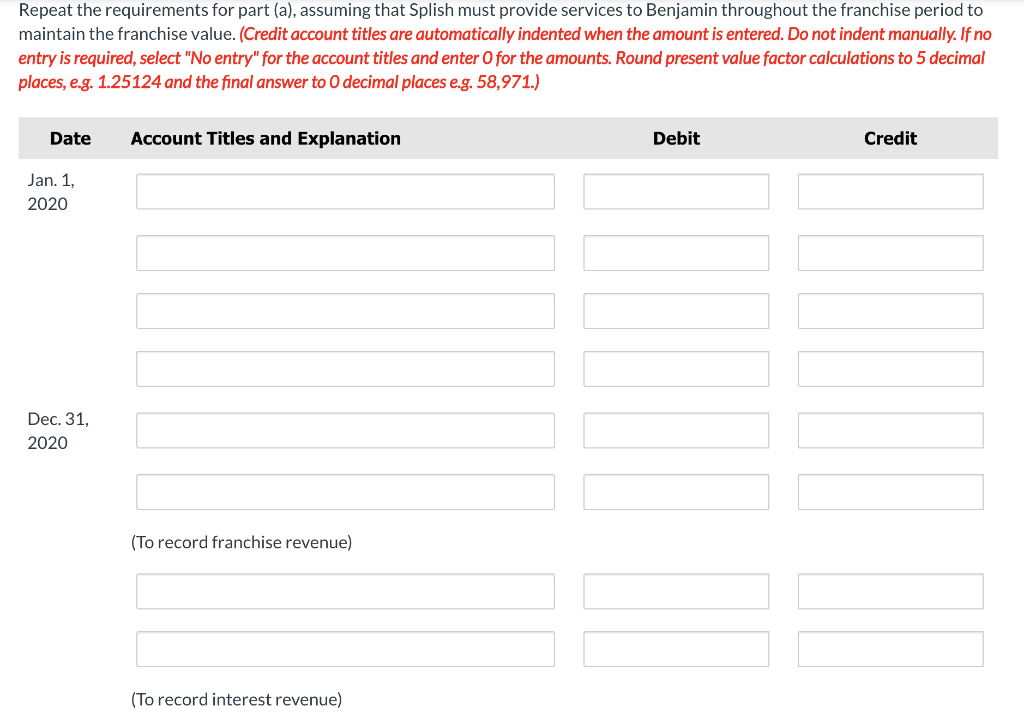

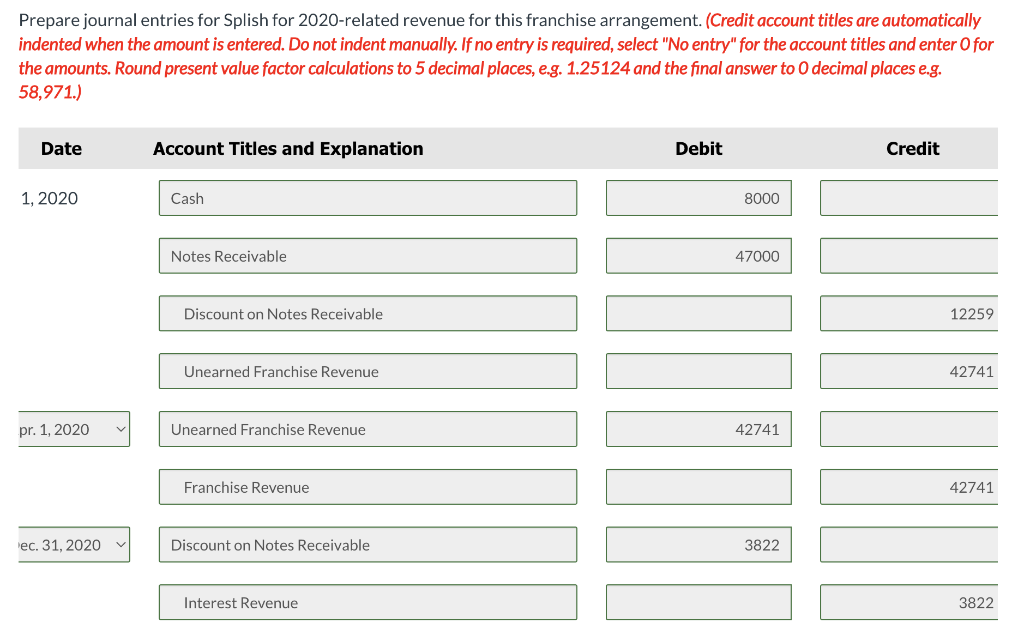

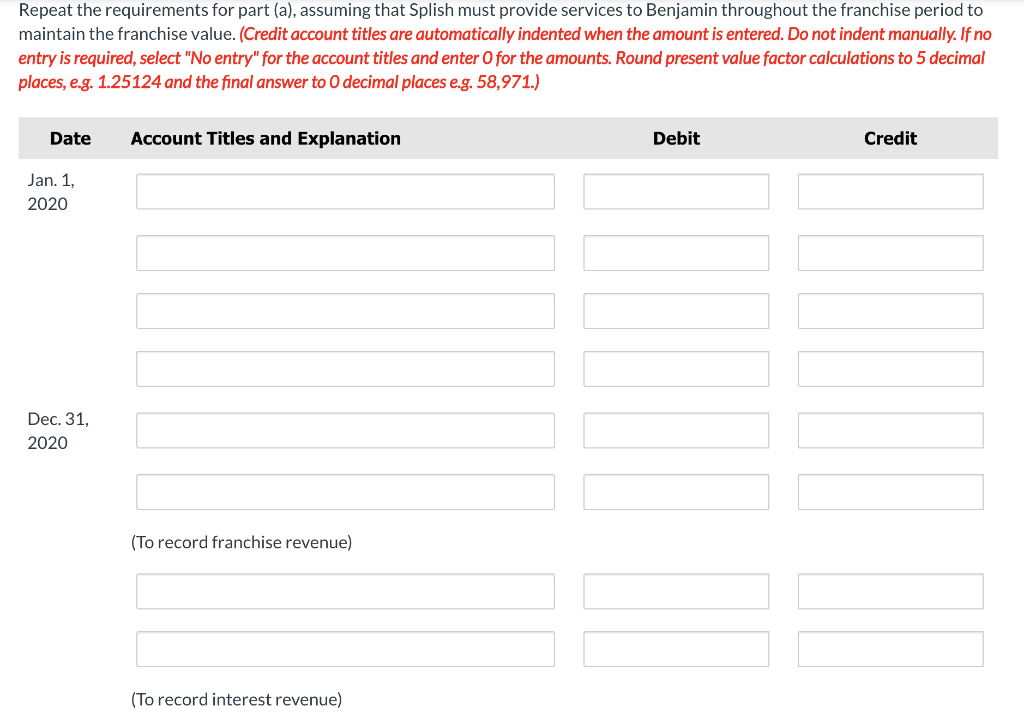

On January 1, 2020, Lesley Benjamin signed an agreement, covering 5 years, to operate as a franchisee of Splish Inc. for an initial payments of $9,400 each, beginning January 1, 2021. The agreement provides that the down payment is nonrefundable and that no future services are required of the franchisor once the franchise commences operations on April 1, 2020. Lesley Benjamin's credit rating indicates that she can borrow money at 11% for a loan of this type. Click here to view factor table. Prepare journal entries for Splish for 2020-related revenue for this franchise arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Repeat the requirements for part (a), assuming that Splish must provide services to Benjamin throughout the franchise period to maintain the franchise value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Jsi D On January 1, 2020, Lesley Benjamin signed an agreement, covering 5 years, to operate as a franchisee of Splish Inc. for an initial payments of $9,400 each, beginning January 1, 2021. The agreement provides that the down payment is nonrefundable and that no future services are required of the franchisor once the franchise commences operations on April 1, 2020. Lesley Benjamin's credit rating indicates that she can borrow money at 11% for a loan of this type. Click here to view factor table. Prepare journal entries for Splish for 2020-related revenue for this franchise arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Repeat the requirements for part (a), assuming that Splish must provide services to Benjamin throughout the franchise period to maintain the franchise value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Jsi D