Answered step by step

Verified Expert Solution

Question

1 Approved Answer

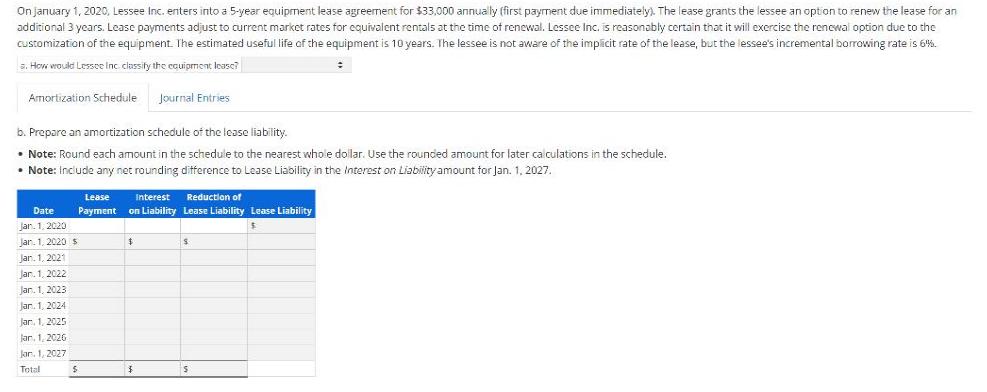

On january 1, 2020, Lessee Inc. enters into a 5-year equipment lease agreement for $33,000 annually (first payrment due immediately). The lease grants the

On january 1, 2020, Lessee Inc. enters into a 5-year equipment lease agreement for $33,000 annually (first payrment due immediately). The lease grants the lessee an option to renew the lease for an additional 3 years. Lease payments adjust to current market rates for cquivalent rentals at the time of renewal. Lessec Inc. is reasonably certain that it will exercise the rencwal option due to the Customization of the equipment. The estimated useful life of the equipment is 10 years. The lessee is not aware of the implicit rate of the lease, but the lessee's incremental borrowing rate is 6%. 5. How would Lesse Inc classify the equipment leasc? Amortization Schedule Journal Entries b. Prepare an amortization schedule of the lease liability. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Note: Include any net rounding difference to Lease Liability in the Interest on Liability amount for Jan. 1, 2027. Lease Interest Reduction of Date Payment on Liability Lease Liability Lease Liability lan, 1. 2020 Jan. 1, 2020 S Jan. 1, 2021 Jar. 1, 2022 Jar. 1, 2023 Jar. 1, 2024 Jar. 1, 2025 tar. 1. 2026 Jar Jar. 1,2027 Total

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Since the lessee is certain about renewing the lease we include this portion for computation of PV o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started