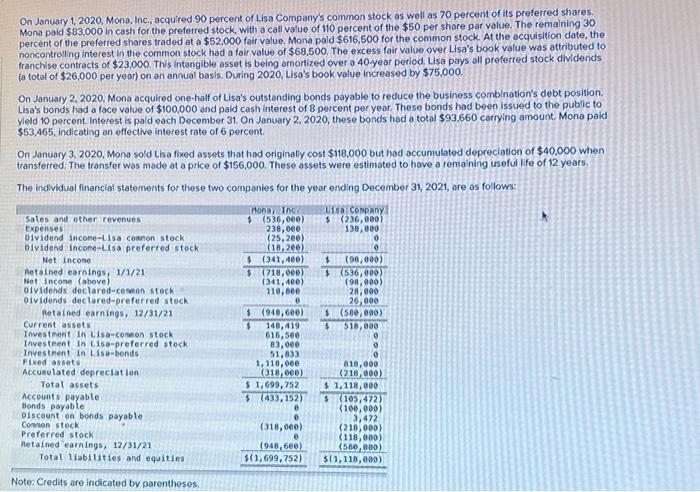

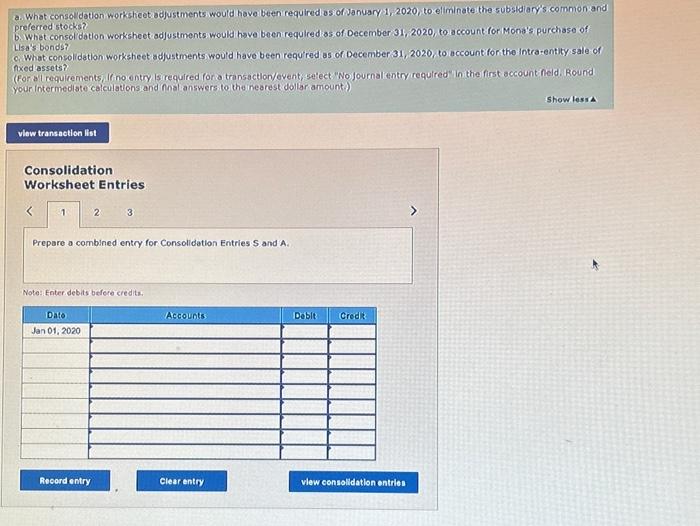

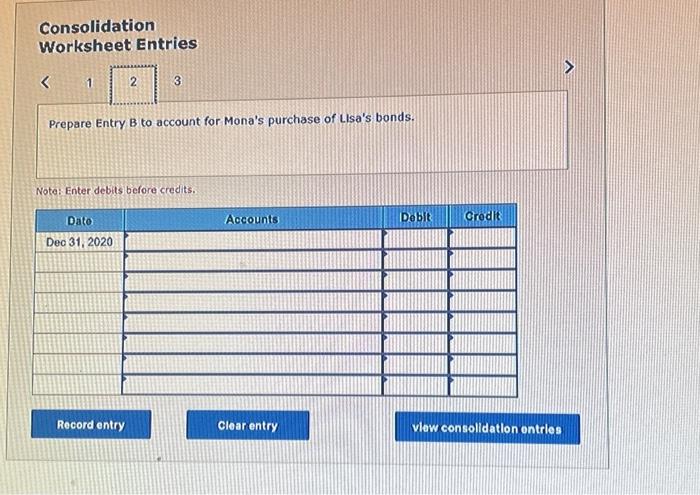

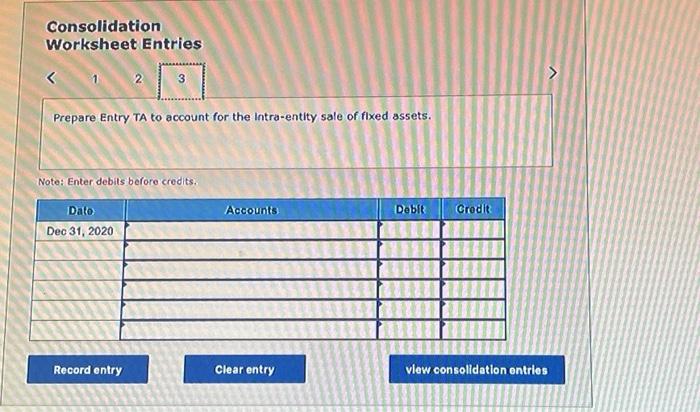

On January 1, 2020, Mona, Inc, acquired 90 percent of Lisa Company's common stock as welf as 70 percent of its preferred shares. Mona paid $83,000 in cash for the preferred stock, with a call value of 110 percent of the $50 per share par value. The remalning 30 percent of the preferred shares traded at a $52,000 fair value. Mona pald $616,500 for the common stock. At the acquisition date, the noncontrolling interest in the cornmon stock had a fair value of $68,500. The excess fair value over Lisa's book value was attributed to franchise contracts of $23,000. This intanglble asset is being omortized over a 40 -year period, Lisa pays all preferted stack dividends pa total of $26,000 per year) on an annual basis. During 2020, Lisa's book value increased by $75,000. On January 2,2020, Mona acquired one-half of Lisa's outstanding bonds payable to reduce the business comblnation's debt position. Lisa's bonds had a face value of $100,000 ond paid cash interest of 8 percent per year. These bonds had been issued to the public to yeld 10 percent. Interest is pald each December 31 . On January 2,2020 , these bonds had a total $93,660 carrying amount. Mona paid $53,465, indicating an effective interest rate of 6 percent. On January 3, 2020, Mona sold Lisa fixed assets that had originally cost $118,000 but had accunulated depreciation of $40,000 when transforred. The transfer was made at a price of $156,000. These assets were estimated to have a remaining useful ife of 12 years. The individual financial statements for these two companies for the year ending December 31, 2021, are as follows: Note: Credits are indicated by parentheses. a. What consoldation worksheetiadjustments would hove been required as of January 1,2020 , to eliminate the subsidiary's comnion and preferred stocks? b. Whet consol dation worksheet adjustments would have been requiced as of December 31,2020 , to account for Mond's purchase of Lisas bonds? c. What consolidation worksheet adjustments would have been requ' red as of December 31,2020 , to accountiforithe intra-entity sale of nxedassets? your intermediste calculationsiand mal answers to thainearest dollar amount) Show lessa Consolidation Worksheet Entries Prepare a comblned entry for Consolldation Entries S and A. Note: Enter debits befere credits. Consolidation Worksheet Entries Prepare Entry B to account for Mona's purchase of Lisa's bonds. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare Entry TA to account for the intra-entity sale of flxed assets. Note: Enter debils before credits