Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, PAR Inc. purchased 6000 shares (60%) of SUB Co for $300,000 cash. PAR also is required to pay $60,000 total

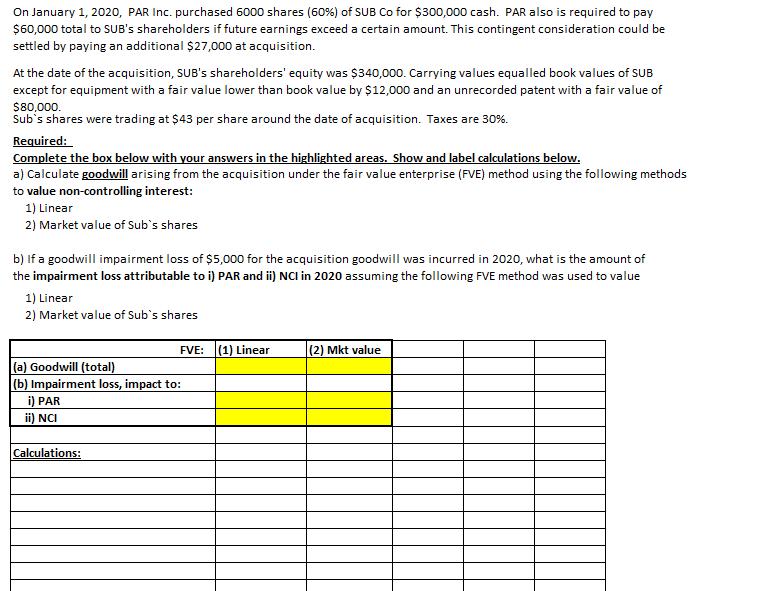

On January 1, 2020, PAR Inc. purchased 6000 shares (60%) of SUB Co for $300,000 cash. PAR also is required to pay $60,000 total to SUB's shareholders if future earnings exceed a certain amount. This contingent consideration could be settled by paying an additional $27,000 at acquisition. At the date of the acquisition, SUB's shareholders' equity was $340,000. Carrying values equalled book values of SUB except for equipment with a fair value lower than book value by $12,000 and an unrecorded patent with a fair value of $80,000. Sub's shares were trading at $43 per share around the date of acquisition. Taxes are 30%. Required: Complete the box below with your answers in the highlighted areas. Show and label calculations below. a) Calculate goodwill arising from the acquisition under the fair value enterprise (FVE) method using the following methods to value non-controlling interest: 1) Linear 2) Market value of Sub's shares b) If a goodwill impairment loss of $5,000 for the acquisition goodwill was incurred in 2020, what is the amount of the impairment loss attributable to i) PAR and ii) NCI in 2020 assuming the following FVE method was used to value 1) Linear 2) Market value of Sub's shares (a) Goodwill (total) (b) Impairment loss, impact to: i) PAR ii) NCI FVE: (1) Linear Calculations: (2) Mkt value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Purchase Consideration Contingent Consideration Total Consideration Fair ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started