Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Pharoah Ltd. had 702,000 common shares outstanding. During 2020, it had the following transactions that affected the common share account:

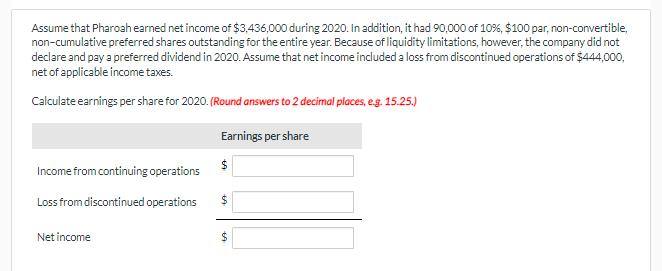

On January 1, 2020, Pharoah Ltd. had 702,000 common shares outstanding. During 2020, it had the following transactions that affected the common share account: Feb. 1 Issued 167,000 shares. Mar. 1 Issued a 14% stock dividend. May 1 Acquired 180,000 common shares and retired them. June 1 Issued a 3-for-1 stock split. Oct. 1 Issued 78,000 shares. The company's year end is December 31. Determine the weighted average number of shares outstanding as at December 31, 2020. (Round answer to 0 decimal places, eg. 5,275.) shares Weighted average number of shares outstanding e Textbook and Media Assume that Pharoahearned net income of $3436,000 during 2020. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Calculate earnings per share for 2020, using the weighted average number of shares determined above (Round answer to 2 decimal places, eg. 15.25.) Earnings per share eTextbook and Media Assume that Pharoahearned net income of $3,436,000 during 2020. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Assume that net income included a loss from discontinued operations of $444,000, net of applicable income taxes. Calculate earnings per share for 2020. (Round answers to 2 decimal places, eg. 15.25.) Earnings per share Income from continuing operations Loss from discontinued operations 24 Net income

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Weighted average number of shares outstanding Date Explanation Shares Outstanding S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started