Answered step by step

Verified Expert Solution

Question

1 Approved Answer

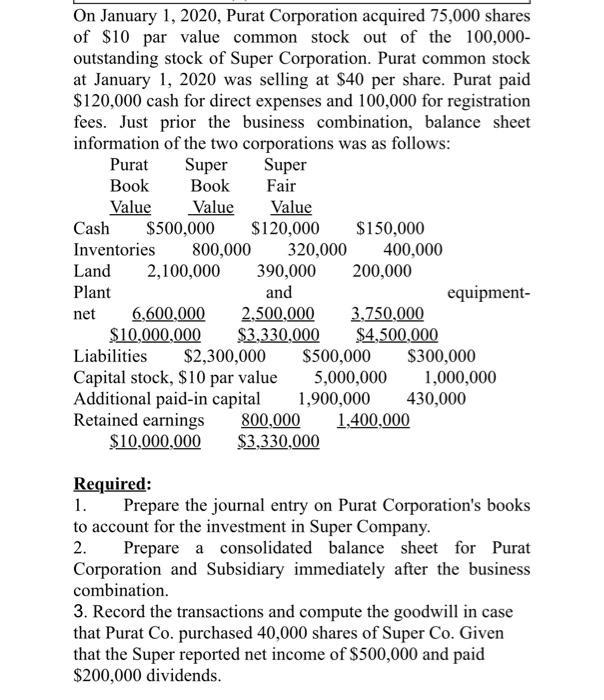

On January 1, 2020, Purat Corporation acquired 75,000 shares of $10 par value common stock out of the 100,000- outstanding stock of Super Corporation.

On January 1, 2020, Purat Corporation acquired 75,000 shares of $10 par value common stock out of the 100,000- outstanding stock of Super Corporation. Purat common stock at January 1, 2020 was selling at $40 per share. Purat paid $120,000 cash for direct expenses and 100,000 for registration fees. Just prior the business combination, balance sheet information of the two corporations was as follows: Super Fair Purat Super ook ook Value Value $500,000 800,000 2,100,000 Value S120,000 320,000 390,000 Cash S150,000 400,000 200,000 Inventories Land Plant and equipment- 3,750,000 $4,500.000 $300,000 1,000,000 430,000 6,600,000 $10,000,000 2.500,000 $3,330,000 net Liabilities $2,300,000 Capital stock, $10 par value Additional paid-in capital Retained earnings $10.000,000 $500,000 5,000,000 1,900,000 1.400,000 800,000 $3.330.000 Required: 1. Prepare the journal entry on Purat Corporation's books to account for the investment in Super Company. 2. Prepare a consolidated balance sheet for Purat Corporation and Subsidiary immediately after the business combination. 3. Record the transactions and compute the goodwill in case that Purat Co. purchased 40,000 shares of Super Co. Given that the Super reported net income of $500,000 and paid $200,000 dividends.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started