Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Rae Company purchased 8,000 of the 40,000 shares outstanding of common stock (par $1) of Sundem Corporation for $80,000 cash. Assume

On January 1, 2020, Rae Company purchased 8,000 of the 40,000 shares outstanding of common stock (par $1) of Sundem Corporation for $80,000 cash. Assume that the fair value and book value of all net assets of Sundem were the same at that time. This is the only long-term equity investment held and the ownership of Sundem shares represents a significant interest. The accounting periods for both Rae and Sundem end on December 31.

| Sundem Corporation Year 2020 | |

|---|---|

| Income reported for 2020 | $40,000 |

| Cash dividend per share declared and paid on December 15, 2020 | $1.50 |

| Market price per share of stock, December 31, 2020 | $12.00 |

| Year 2021 | |

|---|---|

| Income reported for 2021 | $50,000 |

| Cash dividend per share declared and paid on December 15, 2021 | $1.50 |

| Market price per share of stock, December 31, 2021 | $11.00 |

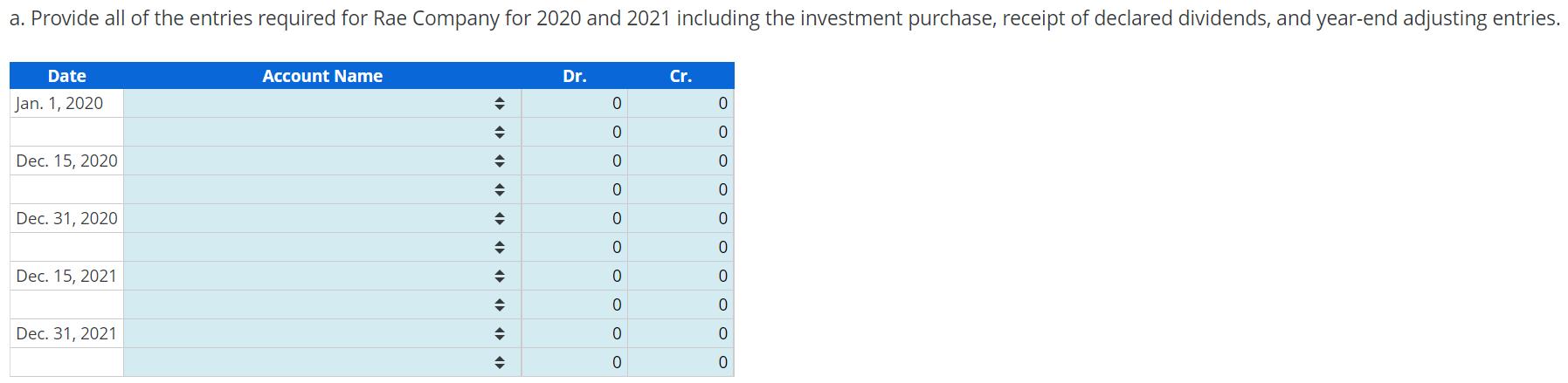

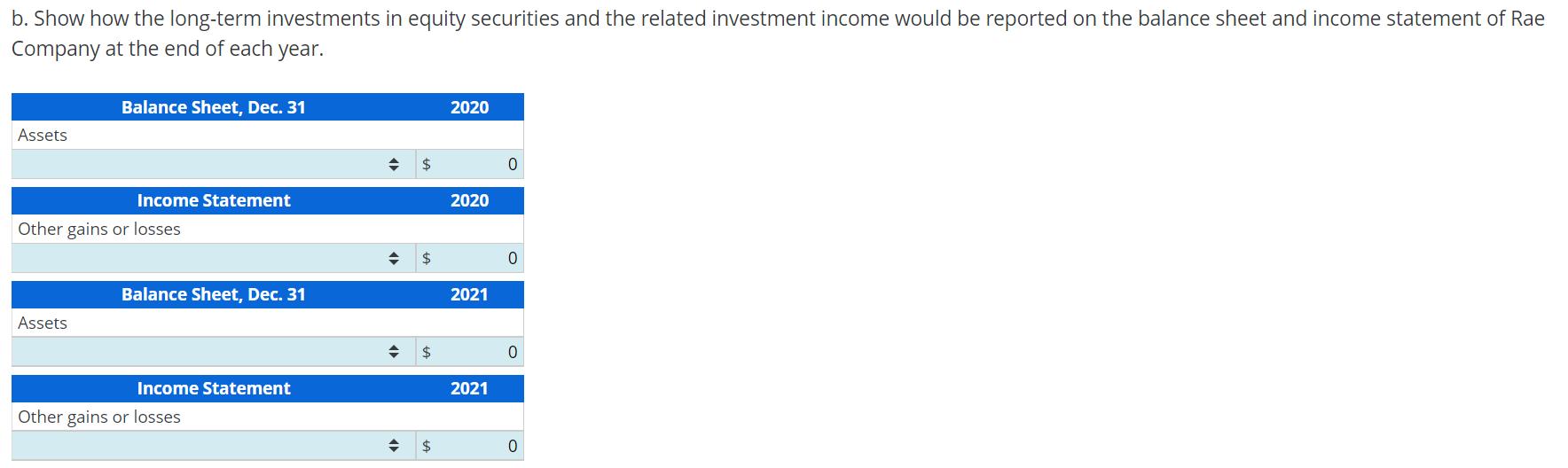

a. Provide all of the entries required for Rae Company for 2020 and 2021 including the investment purchase, receipt of declared dividends, and year-end adjusting entries. Date Account Name Dr. Cr. Jan. 1, 2020 0. Dec. 15, 2020 Dec. 31, 2020 Dec. 15, 2021 Dec. 31, 2021 O o O o o o o o o O

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Date Accounts Debit Credit Jan 1 2020 Investment in Stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started