Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Sanchez Corp. Issues $50 million face value bonds with an 8% coupon rate. The interest is paid semi-annually for a

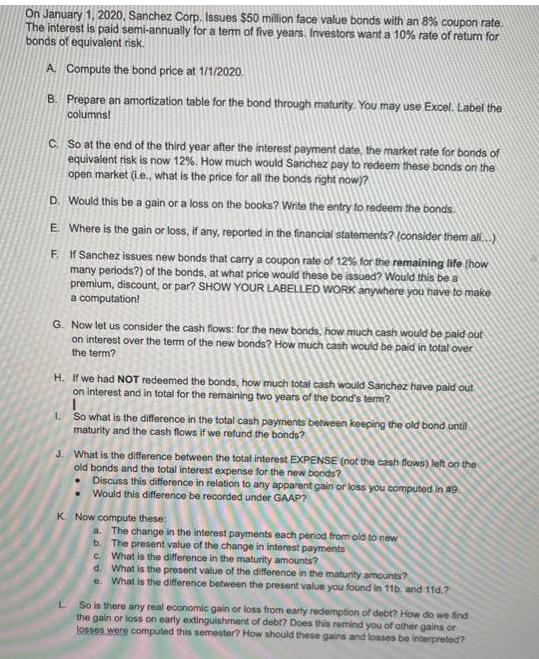

On January 1, 2020, Sanchez Corp. Issues $50 million face value bonds with an 8% coupon rate. The interest is paid semi-annually for a term of five years. Investors want a 10% rate of return for bonds of equivalent risk. A. Compute the bond price at 1/1/2020. B. Prepare an amortization table for the bond through maturity. You may use Excel. Label the columns! C. So at the end of the third year after the interest payment date, the market rate for bonds of equivalent risk is now 12%. How much would Sanchez pay to redeem these bonds on the open market (i.e., what is the price for all the bonds right now)? D. Would this be a gain or a loss on the books? Write the entry to redeem the bonds E. Where is the gain or loss, if any, reported in the financial statements? (consider them all...) F. If Sanchez issues new bonds that carry a coupon rate of 12% for the remaining life (how many periods?) of the bonds, at what price would these be issued? Would this be a premium, discount, or par? SHOW YOUR LABELLED WORK anywhere you have to make a computation! G. Now let us consider the cash flows: for the new bonds, how much cash would be paid out on interest over the term of the new bonds? How much cash would be paid in total over the term? H. If we had NOT redeemed the bonds, how much total cash would Sanchez have paid out on interest and in total for the remaining two years of the bond's term? 1. So what is the difference in the total cash payments between keeping the old bond until maturity and the cash flows if we refund the bonds? J. What is the difference between the total interest EXPENSE (not the cash flows) left on the old bonds and the total interest expense for the new bonds? Discuss this difference in relation to any apparent gain or loss you computed in #9 . Would this difference be recorded under GAAP? K. Now compute these: a. The change in the interest payments each period from old to new b. The present value of the change in interest payments c. What is the difference in the maturity amounts? d. What is the present value of the difference in the maturity amounts? e. What is the difference between the present value you found in 11b. and 11d.? L So is there any real economic gain or loss from early redemption of debt? How do we find the gain or loss on early extinguishment of debt? Does this remind you of other gains or losses were computed this semester? How should these gains and losses be interpreted?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Compute the bond price at 112020 The bond price at 112020 is calculated using the present value formula PV FV 1 rt PV 50000000 1 0105 PV 3748896645 B Prepare an amortization table for the bond throu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started