Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, the HHI Company purchased 10% coupon-rate bonds with a face value of $250,000. The maturity date is December 31, 2030.

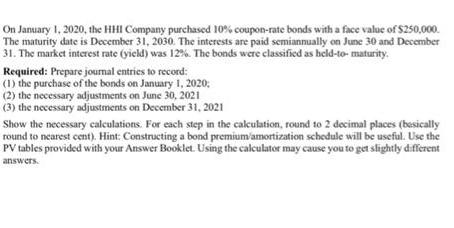

On January 1, 2020, the HHI Company purchased 10% coupon-rate bonds with a face value of $250,000. The maturity date is December 31, 2030. The interests are paid semiannually on June 30 and December 31. The market interest rate (yield) was 12%. The bonds were classified as held-to-maturity. Required: Prepare journal entries to record: (1) the purchase of the bonds on January 1, 2020; (2) the necessary adjustments on June 30, 2021 (3) the necessary adjustments on December 31, 2021 Show the necessary calculations. For each step in the calculation, round to 2 decimal places (besically round to nearest cent). Hint: Constructing a bond premium/amortization schedule will be useful. Use the PV tables provided with your Answer Booklet. Using the calculator may cause you to get slightly different answers.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal entry to record the purchase of the bonds on January 1 2020 Debit HeldtoMaturity Investments 22316227 Credit Cash 22316227 Calculation The purchase price of the bonds is calculated using the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started