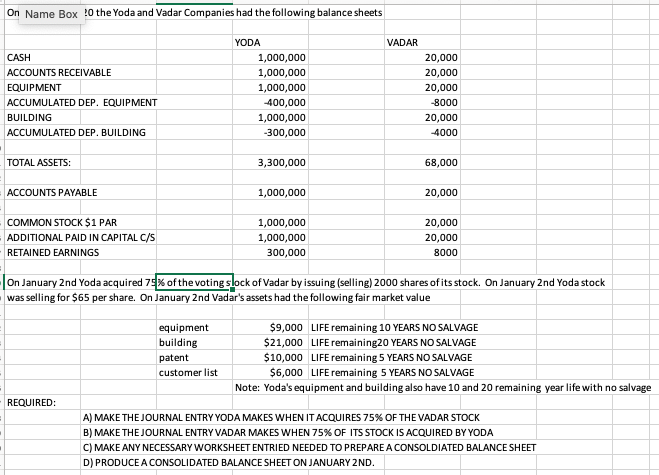

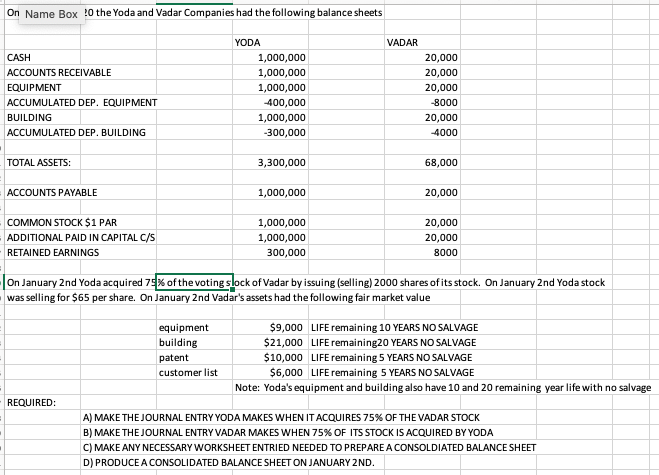

| On January 1, 2020, the Yoda and Vadar Companies had the following balance sheets | | | | |

| | | | | | | | | | |

| | | | YODA | | VADAR | | | | |

| CASH | | | 1,000,000 | | 20,000 | | | | |

| ACCOUNTS RECEIVABLE | | 1,000,000 | | 20,000 | | | | |

| EQUIPMENT | | | 1,000,000 | | 20,000 | | | | |

| ACCUMULATED DEP. EQUIPMENT | -400,000 | | -8000 | | | | |

| BUILDING | | | 1,000,000 | | 20,000 | | | | |

| ACCUMULATED DEP. BUILDING | | -300,000 | | -4000 | | | | |

| | | | | | | | | | |

| TOTAL ASSETS: | | | 3,300,000 | | 68,000 | | | | |

| | | | | | | | | | |

| ACCOUNTS PAYABLE | | 1,000,000 | | 20,000 | | | | |

| | | | | | | | | | |

| COMMON STOCK $1 PAR | | 1,000,000 | | 20,000 | | | | |

| ADDITIONAL PAID IN CAPITAL C/S | 1,000,000 | | 20,000 | | | | |

| RETAINED EARNINGS | | 300,000 | | 8000 | | | | |

| | | | | | | | | | |

| On January 2nd Yoda acquired 75% of the voting stock of Vadar by issuing (selling) 2000 shares of its stock. On January 2nd Yoda stock | |

| was selling for $65 per share. On January 2nd Vadar's assets had the following fair market value | | | | |

| | | | | | | | | | |

| | | equipment | $9,000 | LIFE remaining 10 YEARS NO SALVAGE | | | |

| | | building | $21,000 | LIFE remaining20 YEARS NO SALVAGE | | | |

| | | patent | $10,000 | LIFE remaining 5 YEARS NO SALVAGE | | | |

| | | customer list | $6,000 | LIFE remaining 5 YEARS NO SALVAGE | | | |

| | | | Note: Yoda's equipment and the building also have 10 and 20 remaining year life with no salvage |

| REQUIRED: | | | | | | | | | |

| | A) MAKE THE JOURNAL ENTRY YODA MAKES WHEN IT ACQUIRES 75% OF THE VADAR STOCK | | | |

| | B) MAKE THE JOURNAL ENTRY VADAR MAKES WHEN 75% OF ITS STOCK IS ACQUIRED BY YODA | | | |

| | C) MAKE ANY NECESSARY WORKSHEET ENTRIES NEEDED TO PREPARE A CONSOLIDATED BALANCE SHEET | | |

| | D) PRODUCE A CONSOLIDATED BALANCE SHEET ON JANUARY 2ND. | | | | |

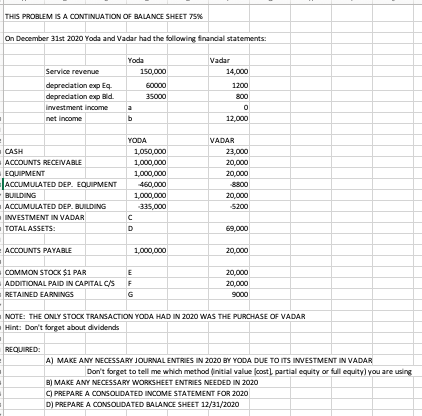

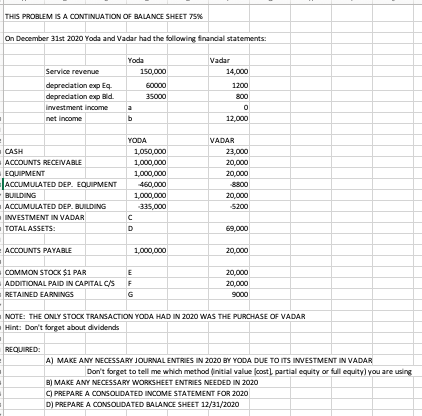

On Name Box !O the Yoda and Vadar Companies had the following balance sheets VADAR CASH ACCOUNTS RECEIVABLE EQUIPMENT ACCUMULATED DEP. EQUIPMENT BUILDING ACCUMULATED DEP. BUILDING YODA 1,000,000 1,000,000 1,000,000 -400,000 1,000,000 -300,000 20,000 20,000 20,000 -8000 20,000 -4000 TOTAL ASSETS: 3,300,000 68,000 ACCOUNTS PAYABLE 1,000,000 20,000 COMMON STOCK $1 PAR ADDITIONAL PAID IN CAPITAL C/S RETAINED EARNINGS 1,000,000 1,000,000 300,000 20,000 20,000 8000 JOn January 2nd Yoda acquired 79% of the voting slock of Vadarby issuing (selling) 2000 shares of its stock. On January 2nd Yoda stock was selling for $65 per share. On January 2nd Vadar's assets had the following fair market value equipment building patent customer list $9,000 LIFE remaining 10 YEARS NO SALVAGE $21,000 LIFE remaining20 YEARS NO SALVAGE $10,000 LIFE remaining 5 YEARS NO SALVAGE $6,000 LIFE remaining 5 YEARS NO SALVAGE Note: Yoda's equipment and building also have 10 and 20 remaining year life with no salvage - REQUIRED: A) MAKE THE JOURNAL ENTRY YODA MAKES WHEN IT ACQUIRES 75% OF THE VADAR STOCK B) MAKE THE JOURNAL ENTRY VADAR MAKES WHEN 75% OF ITS STOCK IS ACQUIRED BY YODA C) MAKE ANY NECESSARY WORKSHEET ENTRIED NEEDED TO PREPARE A CONSOLDIATED BALANCE SHEET D) PRODUCE A CONSOLIDATED BALANCE SHEET ON JANUARY 2ND. THIS PROBLEM IS A CONTINUATION OF BALANCE SHEET 75% On December 31st 2020 Yoda and Vadar had the following financial statements: Vadar Service revenue depreciation exp Eq. depreciation exp Bild Investment income net income Yoda 150,000 60000 35000 14.000 1200 800 12.000 YODA 1,050,000 1,000,000 1,000,000 450,000 1,000,000 335,000 VADAR 23.000 20,000 20.000 CASH ACCOUNTS RECEIVABLE EQUIPMENT JACCUMULATED DEP. EQUIPMENT BUILDING ACCUMULATED DEP. BUILDING INVESTMENT IN VADAR TOTAL ASSETS: 20.000 5200 69,000 E ACCOUNTS PAYABLE 1,000,000 20,000 COMMON STOCK $1 PAR ADDITIONAL PAID IN CAPITAL CASF RETAINED EARNINGS 20,000 20.000 9000 NOTE: THE ONLY STOCK TRANSACTION YODA HAD IN 2020 WAS THE PURCHASE OF VADAR Hint: Don't forget about dividends REQUIRED: A) MAKE ANY NECESSARY JOURNAL ENTRIES IN 2020 BY YODA DUE TO ITS INVESTMENT IN VADAR Don't forget to tell me which method initial value costl partial equity or full equity) you are using B) MAKE ANY NECESSARY WORKSHEET ENTRIES NEEDED IN 2020 C) PREPARE A CONSOLIDATED INCOME STATEMENT FOR 2020 D) PREPARE A CONSOLIDATED BALANCE SHEET 12/31/2020 On Name Box !O the Yoda and Vadar Companies had the following balance sheets VADAR CASH ACCOUNTS RECEIVABLE EQUIPMENT ACCUMULATED DEP. EQUIPMENT BUILDING ACCUMULATED DEP. BUILDING YODA 1,000,000 1,000,000 1,000,000 -400,000 1,000,000 -300,000 20,000 20,000 20,000 -8000 20,000 -4000 TOTAL ASSETS: 3,300,000 68,000 ACCOUNTS PAYABLE 1,000,000 20,000 COMMON STOCK $1 PAR ADDITIONAL PAID IN CAPITAL C/S RETAINED EARNINGS 1,000,000 1,000,000 300,000 20,000 20,000 8000 JOn January 2nd Yoda acquired 79% of the voting slock of Vadarby issuing (selling) 2000 shares of its stock. On January 2nd Yoda stock was selling for $65 per share. On January 2nd Vadar's assets had the following fair market value equipment building patent customer list $9,000 LIFE remaining 10 YEARS NO SALVAGE $21,000 LIFE remaining20 YEARS NO SALVAGE $10,000 LIFE remaining 5 YEARS NO SALVAGE $6,000 LIFE remaining 5 YEARS NO SALVAGE Note: Yoda's equipment and building also have 10 and 20 remaining year life with no salvage - REQUIRED: A) MAKE THE JOURNAL ENTRY YODA MAKES WHEN IT ACQUIRES 75% OF THE VADAR STOCK B) MAKE THE JOURNAL ENTRY VADAR MAKES WHEN 75% OF ITS STOCK IS ACQUIRED BY YODA C) MAKE ANY NECESSARY WORKSHEET ENTRIED NEEDED TO PREPARE A CONSOLDIATED BALANCE SHEET D) PRODUCE A CONSOLIDATED BALANCE SHEET ON JANUARY 2ND. THIS PROBLEM IS A CONTINUATION OF BALANCE SHEET 75% On December 31st 2020 Yoda and Vadar had the following financial statements: Vadar Service revenue depreciation exp Eq. depreciation exp Bild Investment income net income Yoda 150,000 60000 35000 14.000 1200 800 12.000 YODA 1,050,000 1,000,000 1,000,000 450,000 1,000,000 335,000 VADAR 23.000 20,000 20.000 CASH ACCOUNTS RECEIVABLE EQUIPMENT JACCUMULATED DEP. EQUIPMENT BUILDING ACCUMULATED DEP. BUILDING INVESTMENT IN VADAR TOTAL ASSETS: 20.000 5200 69,000 E ACCOUNTS PAYABLE 1,000,000 20,000 COMMON STOCK $1 PAR ADDITIONAL PAID IN CAPITAL CASF RETAINED EARNINGS 20,000 20.000 9000 NOTE: THE ONLY STOCK TRANSACTION YODA HAD IN 2020 WAS THE PURCHASE OF VADAR Hint: Don't forget about dividends REQUIRED: A) MAKE ANY NECESSARY JOURNAL ENTRIES IN 2020 BY YODA DUE TO ITS INVESTMENT IN VADAR Don't forget to tell me which method initial value costl partial equity or full equity) you are using B) MAKE ANY NECESSARY WORKSHEET ENTRIES NEEDED IN 2020 C) PREPARE A CONSOLIDATED INCOME STATEMENT FOR 2020 D) PREPARE A CONSOLIDATED BALANCE SHEET 12/31/2020