Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, a company purchased equipment for $66,000. The asset has a 3-year useful life and no residual value. For financial reporting,

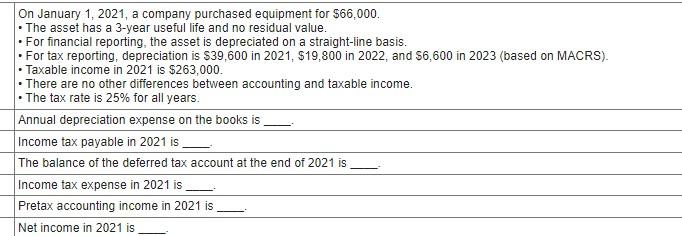

On January 1, 2021, a company purchased equipment for $66,000. The asset has a 3-year useful life and no residual value. For financial reporting, the asset is depreciated on a straight-line basis. For tax reporting, depreciation is $39,600 in 2021, $19,800 in 2022, and $6,600 in 2023 (based on MACRS). Taxable income in 2021 is $263,000. There are no other differences between accounting and taxable income. The tax rate is 25% for all years. Annual depreciation expense on the books is Income tax payable in 2021 is The balance of the deferred tax account at the end of 2021 is Income tax expense in 2021 is Pretax accounting income in 2021 is Net income in 2021 is

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

8 Equipment Cost 66000 Useful Life 3 Annual Depreciation expense on Books is 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started