Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, ABC Company issued a $500,000, 8%, 10-year bond at the yield of 6%. Interest is to be paid semi-annually on

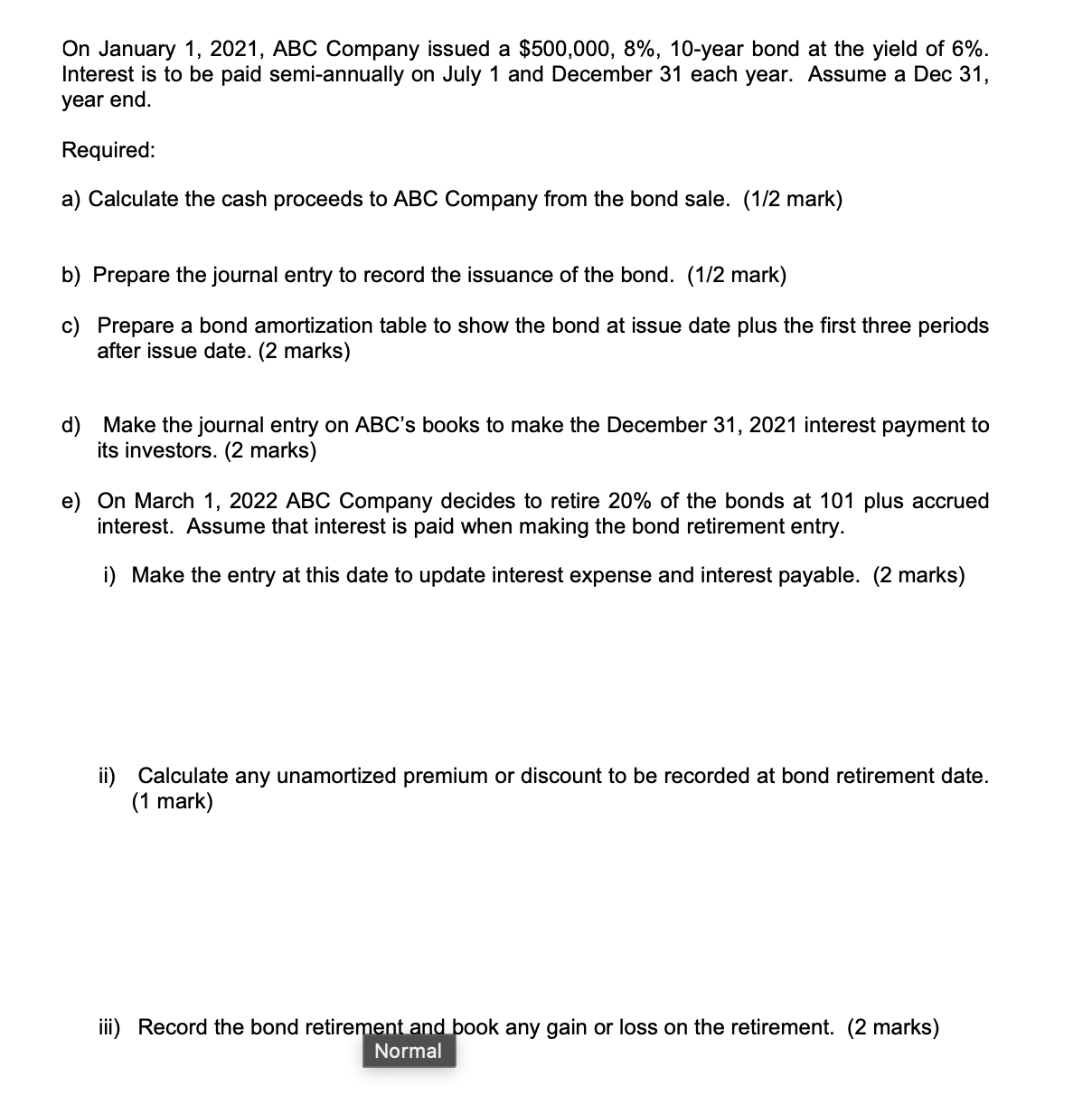

On January 1, 2021, ABC Company issued a $500,000, 8%, 10-year bond at the yield of 6%. Interest is to be paid semi-annually on July 1 and December 31 each year. Assume a Dec 31, year end. Required: a) Calculate the cash proceeds to ABC Company from the bond sale. (1/2 mark) b) Prepare the journal entry to record the issuance of the bond. (1/2 mark) c) Prepare a bond amortization table to show the bond at issue date plus the first three periods after issue date. (2 marks) d) Make the journal entry on ABC's books to make the December 31, 2021 interest payment to its investors. (2 marks) e) On March 1, 2022 ABC Company decides to retire 20% of the bonds at 101 plus accrued interest. Assume that interest is paid when making the bond retirement entry. i) Make the entry at this date to update interest expense and interest payable. (2 marks) ii) Calculate any unamortized premium or discount to be recorded at bond retirement date. (1 mark) iii) Record the bond retirement and book any gain or loss on the retirement. (2 marks) Normal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The cash proceeds to ABC Company from the bond sale can be calculated using the formula Cash Proceeds Bond Principal Bond Discount The bond principa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started