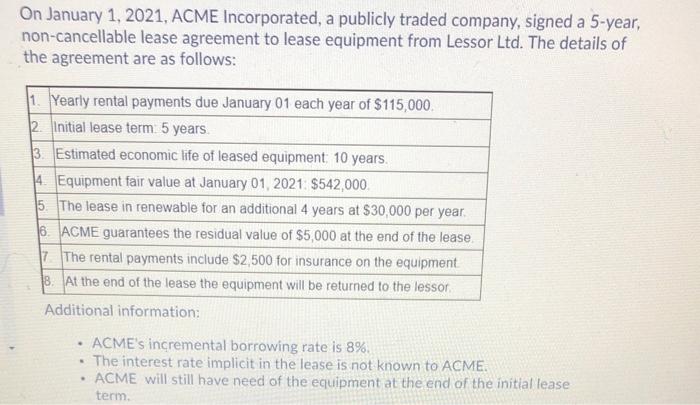

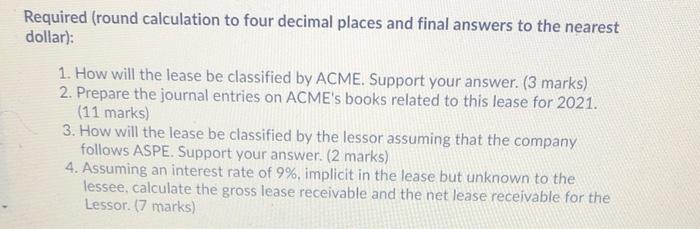

On January 1, 2021, ACME Incorporated, a publicly traded company, signed a 5-year, non-cancellable lease agreement to lease equipment from Lessor Ltd. The details of the agreement are as follows: 1 Yearly rental payments due January 01 each year of $115,000 2. Initial lease term. 5 years 3. Estimated economic life of leased equipment 10 years. 4. Equipment fair value at January 01, 2021 $542,000 5. The lease in renewable for an additional 4 years at $30,000 per year. 8 ACME guarantees the residual value of $5,000 at the end of the lease 17 The rental payments include $2,500 for insurance on the equipment 8. At the end of the lease the equipment will be returned to the lesson Additional information: ACME's incremental borrowing rate is 8% The interest rate implicit in the lease is not known to ACME. ACME will still have need of the equipment at the end of the initial lease - term Required (round calculation to four decimal places and final answers to the nearest dollar): 1. How will the lease be classified by ACME. Support your answer. (3 marks) 2. Prepare the journal entries on ACME's books related to this lease for 2021. (11 marks) 3. How will the lease be classified by the lessor assuming that the company follows ASPE. Support your answer. (2 marks) 4. Assuming an interest rate of 9%, implicit in the lease but unknown to the lessee, calculate the gross lease receivable and the net lease receivable for the Lessor. (7 marks) On January 1, 2021, ACME Incorporated, a publicly traded company, signed a 5-year, non-cancellable lease agreement to lease equipment from Lessor Ltd. The details of the agreement are as follows: 1 Yearly rental payments due January 01 each year of $115,000 2. Initial lease term. 5 years 3. Estimated economic life of leased equipment 10 years. 4. Equipment fair value at January 01, 2021 $542,000 5. The lease in renewable for an additional 4 years at $30,000 per year. 8 ACME guarantees the residual value of $5,000 at the end of the lease 17 The rental payments include $2,500 for insurance on the equipment 8. At the end of the lease the equipment will be returned to the lesson Additional information: ACME's incremental borrowing rate is 8% The interest rate implicit in the lease is not known to ACME. ACME will still have need of the equipment at the end of the initial lease - term Required (round calculation to four decimal places and final answers to the nearest dollar): 1. How will the lease be classified by ACME. Support your answer. (3 marks) 2. Prepare the journal entries on ACME's books related to this lease for 2021. (11 marks) 3. How will the lease be classified by the lessor assuming that the company follows ASPE. Support your answer. (2 marks) 4. Assuming an interest rate of 9%, implicit in the lease but unknown to the lessee, calculate the gross lease receivable and the net lease receivable for the Lessor. (7 marks)