Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Flackmon Company entered into a lease for a truck with a payment of $16,000 per year for 4 years. The

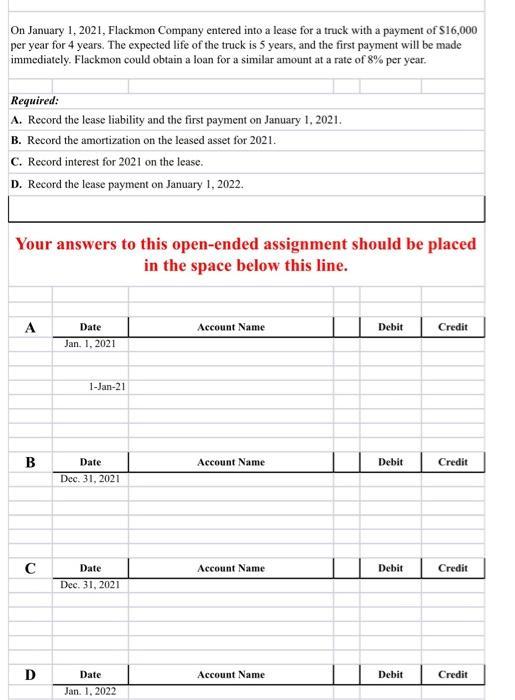

On January 1, 2021, Flackmon Company entered into a lease for a truck with a payment of $16,000 per year for 4 years. The expected life of the truck is 5 years, and the first payment will be made immediately. Flackmon could obtain a loan for a similar amount at a rate of 8% per year. Required: A. Record the lease liability and the first payment on January 1, 2021. B. Record the amortization on the leased asset for 2021. C. Record interest for 2021 on the lease. D. Record the lease payment on January 1, 2022. Your answers to this open-ended assignment should be placed in the space below this line. A B C D Date Jan. 1, 2021 1-Jan-21 Date Dec. 31, 2021 Date Dec. 31, 2021 Date Jan. 1, 2022 Account Name Account Name Account Name Account Name Debit Debit Debit Debit Credit Credit Credit Credit

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Minimum Lease payments Year Installment PVF8 PV 2021 16000 1 16000 2022 16000 0925926 1481481 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started