Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Harley Company bought 15% of Buttercup Company. Harley paid $200,000 for these shares, an amount that exactly equaled the proportionate book

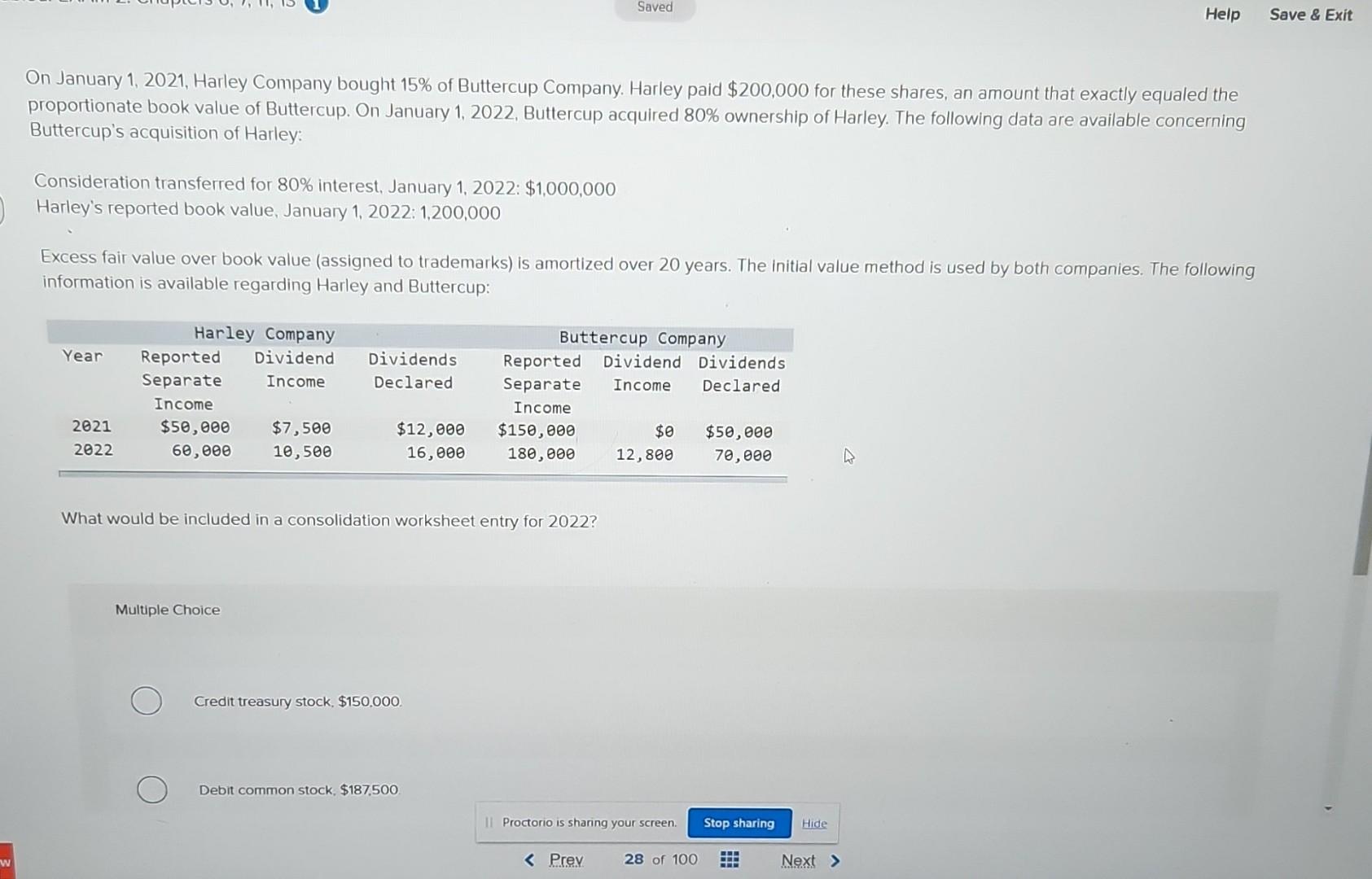

On January 1, 2021, Harley Company bought 15% of Buttercup Company. Harley paid $200,000 for these shares, an amount that exactly equaled the proportionate book value of Buttercup. On January 1, 2022, Buttercup acquired 80% ownership of Harley. The following data are available concerning Buttercup's acquisition of Harley: Consideration transferred for 80% interest, January 1,2022:$1,000,000 Harley's reported book value, January 1, 2022:1,200,000 Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Harley and Buttercup: What would be included in a consolidation worksheet entry for 2022 ? Multiple Choice Credit treasury stock, $150.000. Debit common stock, $187,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started