Answered step by step

Verified Expert Solution

Question

1 Approved Answer

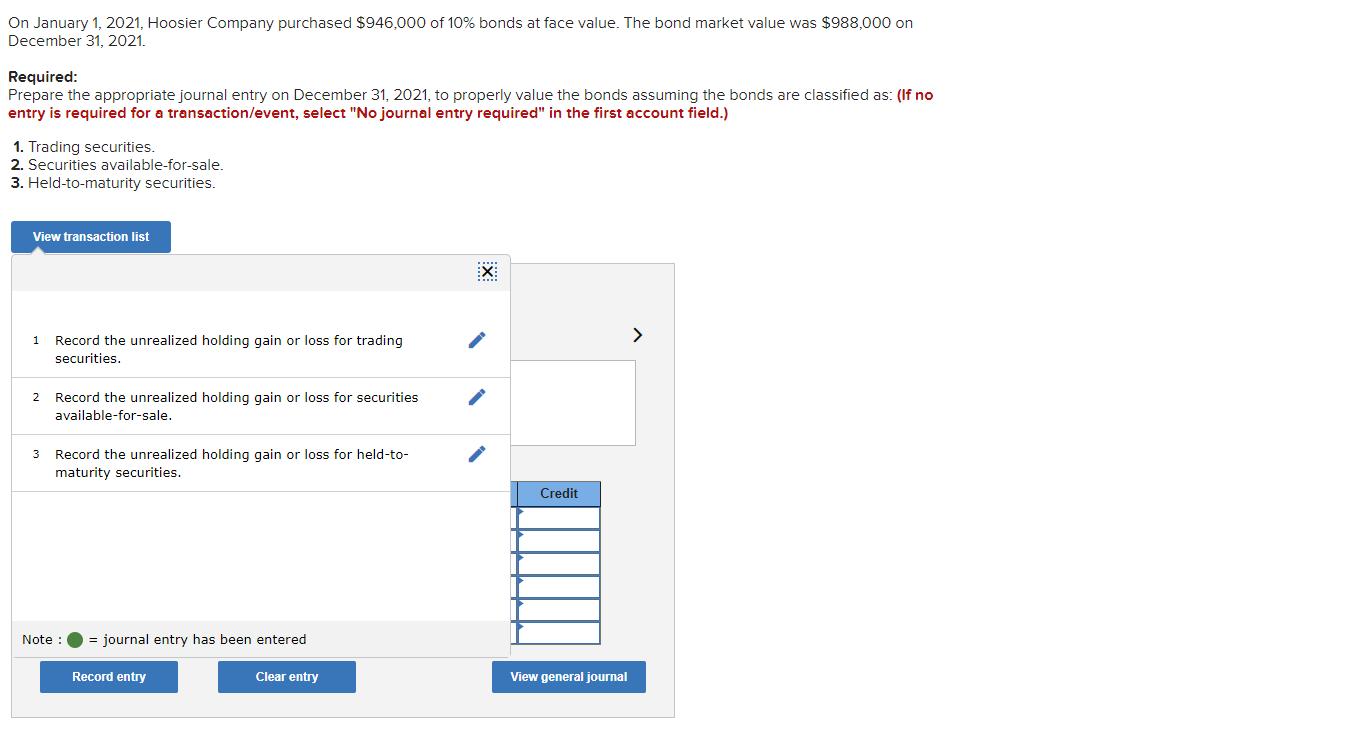

On January 1, 2021, Hoosier Company purchased $946,000 of 10% bonds at face value. The bond market value was $988,000 on December 31, 2021.

On January 1, 2021, Hoosier Company purchased $946,000 of 10% bonds at face value. The bond market value was $988,000 on December 31, 2021. Required: Prepare the appropriate journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Trading securities. 2. Securities available-for-sale. 3. Held-to-maturity securities. View transaction list 1 Record the unrealized holding gain or loss for trading securities. 2 Record the unrealized holding gain or loss for securities available-for-sale. 3 Record the unrealized holding gain or loss for held-to- maturity securities. Note : = journal entry has been entered Record entry Clear entry X Credit View general journal >

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Fair value adjustment 946000988000 Unre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started