Answered step by step

Verified Expert Solution

Question

1 Approved Answer

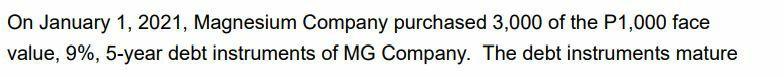

On January 1, 2021, Magnesium Company purchased 3,000 of the P1,000 face value, 9%, 5-year debt instruments of MG Company. The debt instruments mature

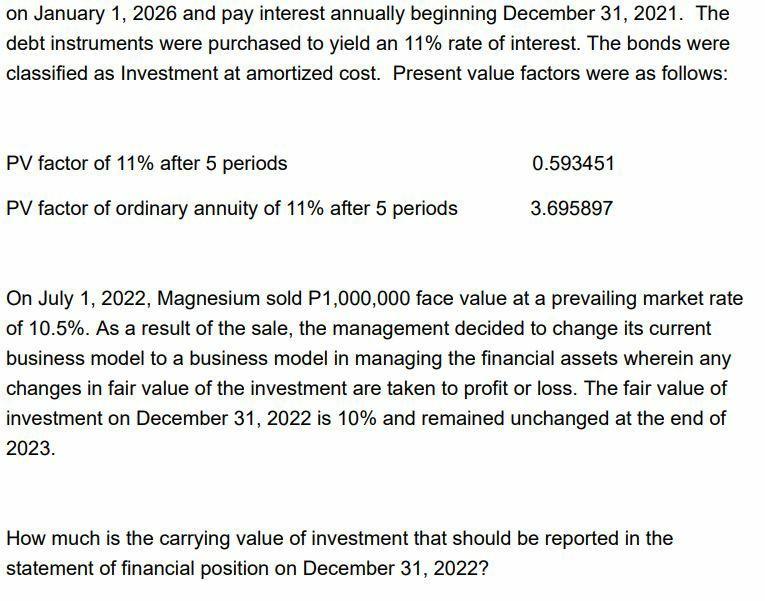

On January 1, 2021, Magnesium Company purchased 3,000 of the P1,000 face value, 9%, 5-year debt instruments of MG Company. The debt instruments mature on January 1, 2026 and pay interest annually beginning December 31, 2021. The debt instruments were purchased to yield an 11% rate of interest. The bonds were classified as Investment at amortized cost. Present value factors were as follows: PV factor of 11% after 5 periods PV factor of ordinary annuity of 11% after 5 periods 0.593451 3.695897 On July 1, 2022, Magnesium sold P1,000,000 face value at a prevailing market rate of 10.5%. As a result of the sale, the management decided to change its current business model to a business model in managing the financial assets wherein any changes in fair value of the investment are taken to profit or loss. The fair value of investment on December 31, 2022 is 10% and remained unchanged at the end of 2023. How much is the carrying value of investment that should be reported in the statement of financial position on December 31, 2022?

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

IFRS 9 allows reclassification of investments only when the entity changes its business model for ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started