Question

On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a three-year period ending December 31, 2024, at which time possession of

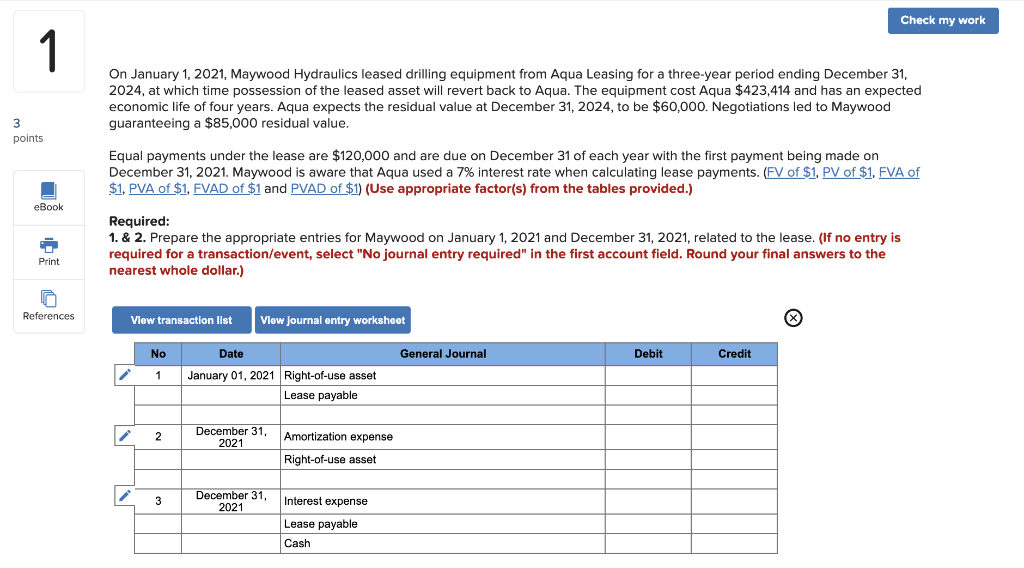

On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a three-year period ending December 31, 2024, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua $423,414 and has an expected economic life of four years. Aqua expects the residual value at December 31, 2024, to be $60,000. Negotiations led to Maywood guaranteeing a $85,000 residual value.

Equal payments under the lease are $120,000 and are due on December 31 of each year with the first payment being made on December 31, 2021. Maywood is aware that Aqua used a 7% interest rate when calculating lease payments. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. & 2. Prepare the appropriate entries for Maywood on January 1, 2021 and December 31, 2021, related to the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started