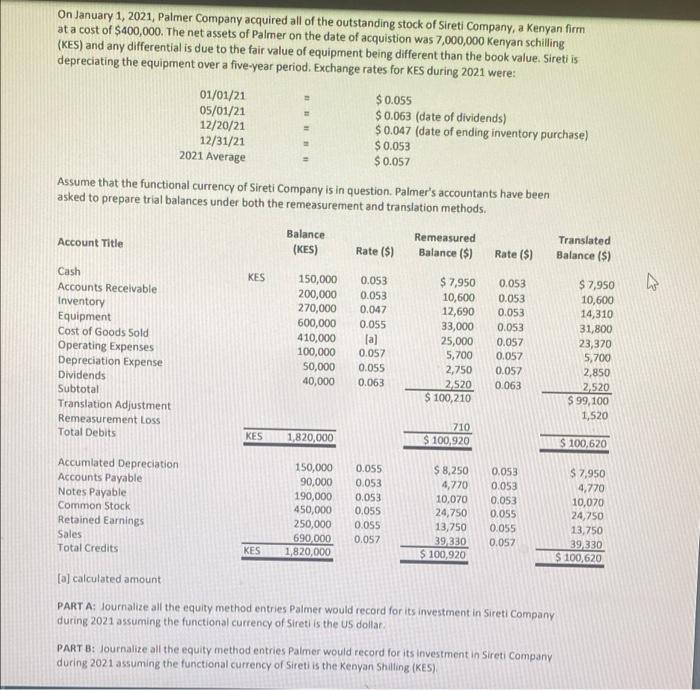

On January 1, 2021, Palmer Company acquired all of the outstanding stock of Sireti Company, a Kenyan firm at a cost of $400,000. The net assets of Palmer on the date of acquistion was 7,000,000 Kenyan schilling (KES) and any differential is due to the fair value of equipment being different than the book value. Sireti is depreciating the equipment over a five-year period. Exchange rates for KES during 2021 were: 01/01/21 $ 0.055 05/01/21 $ 0.063 (date of dividends) 12/20/21 $ 0.047 (date of ending inventory purchase) 12/31/21 $ 0.053 2021 Average $ 0.057 Assume that the functional currency of Sireti Company is in question. Palmer's accountants have been asked to prepare trial balances under both the remeasurement and translation methods. Balance Remeasured Translated Account Title (KES) Rate ($) Balance ($) Rate ($) Balance (S) KES Cash Accounts Receivable Inventory Equipment Cost of Goods Sold Operating Expenses Depreciation Expense Dividends Subtotal Translation Adjustment Remeasurement loss Total Debits 150,000 200,000 270,000 600,000 410,000 100,000 50,000 40,000 0.053 0.053 0.047 0.055 (a) 0.057 0.055 0.063 $ 7,950 10,600 12,690 33,000 25,000 5,700 2,750 2.520 $ 100,210 0.053 0.053 0.053 0.053 0.057 0.057 0.057 0.063 $ 7,950 10,600 14,310 31,800 23,370 5,700 2,850 2.520 $ 99, 100 1,520 KES 1,820,000 710 $ 100,920 $ 100,620 Accumlated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Sales Total Credits 150,000 90.000 190,000 450,000 250,000 690,000 KES 1,820,000 0.055 0.053 0.053 0.055 0.055 0.057 $ 8,250 4,770 10,070 24,750 13,750 394330 $ 100,920 0.053 0.053 0.053 0.055 0.055 0.057 $ 7,950 4,770 10,070 24,750 13,750 39,330 $ 100,620 [a] calculated amount PART A: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the US dollar PART 3: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the Kenyan Shilling (KES) On January 1, 2021, Palmer Company acquired all of the outstanding stock of Sireti Company, a Kenyan firm at a cost of $400,000. The net assets of Palmer on the date of acquistion was 7,000,000 Kenyan schilling (KES) and any differential is due to the fair value of equipment being different than the book value. Sireti is depreciating the equipment over a five-year period. Exchange rates for KES during 2021 were: 01/01/21 $ 0.055 05/01/21 $ 0.063 (date of dividends) 12/20/21 $ 0.047 (date of ending inventory purchase) 12/31/21 $ 0.053 2021 Average $ 0.057 Assume that the functional currency of Sireti Company is in question. Palmer's accountants have been asked to prepare trial balances under both the remeasurement and translation methods. Balance Remeasured Translated Account Title (KES) Rate ($) Balance ($) Rate ($) Balance (S) KES Cash Accounts Receivable Inventory Equipment Cost of Goods Sold Operating Expenses Depreciation Expense Dividends Subtotal Translation Adjustment Remeasurement loss Total Debits 150,000 200,000 270,000 600,000 410,000 100,000 50,000 40,000 0.053 0.053 0.047 0.055 (a) 0.057 0.055 0.063 $ 7,950 10,600 12,690 33,000 25,000 5,700 2,750 2.520 $ 100,210 0.053 0.053 0.053 0.053 0.057 0.057 0.057 0.063 $ 7,950 10,600 14,310 31,800 23,370 5,700 2,850 2.520 $ 99, 100 1,520 KES 1,820,000 710 $ 100,920 $ 100,620 Accumlated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Sales Total Credits 150,000 90.000 190,000 450,000 250,000 690,000 KES 1,820,000 0.055 0.053 0.053 0.055 0.055 0.057 $ 8,250 4,770 10,070 24,750 13,750 394330 $ 100,920 0.053 0.053 0.053 0.055 0.055 0.057 $ 7,950 4,770 10,070 24,750 13,750 39,330 $ 100,620 [a] calculated amount PART A: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the US dollar PART 3: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the Kenyan Shilling (KES)