Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Palmer Company acquired all of the outstanding stock of Sireti Company, a Kenyan firm at a cost of $400,000. The net

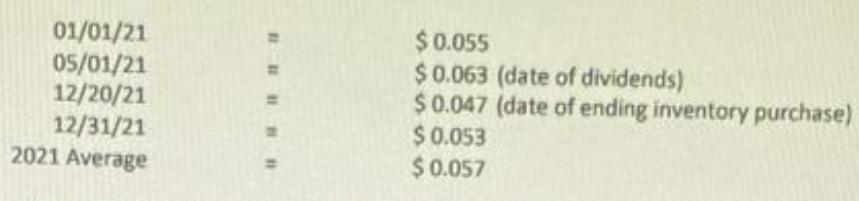

On January 1, 2021, Palmer Company acquired all of the outstanding stock of Sireti Company, a Kenyan firm at a cost of $400,000. The net assets of Palmer on the date of acquistion was 7,000,000 Kenyan schilling (KES) and any differential is due to the fair value of equipment being different than the book value. Sireti is depreciating the equipment over a five-year period. Exchange rates for KES during 2021 were:

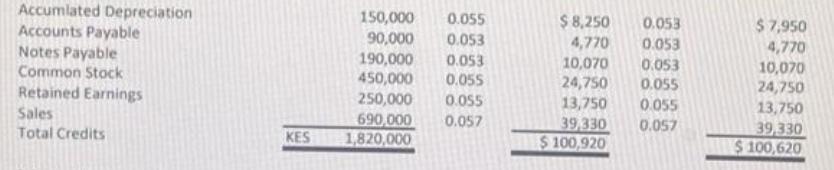

calculated amount

PART A: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the US dollar PART B: Journalize all the equity method entries Palmer would record for its investment in Sireti Company during 2021 assuming the functional currency of Sireti is the Kenyan Shilling

01/01/21 05/01/21 12/20/21 12/31/21 2021 Average $ 0.055 $0.063 (date of dividends) $ 0.047 (date of ending inventory purchase) $ 0.053 $0.057

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

112021 Palmer Company acquires all of the outstanding stock of Siret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started