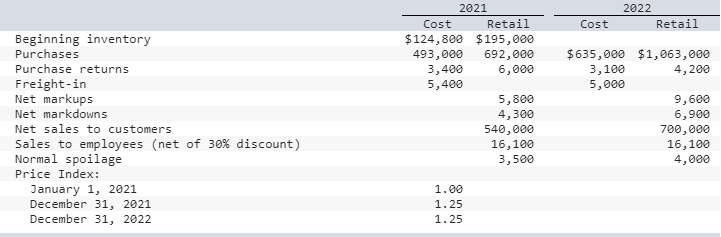

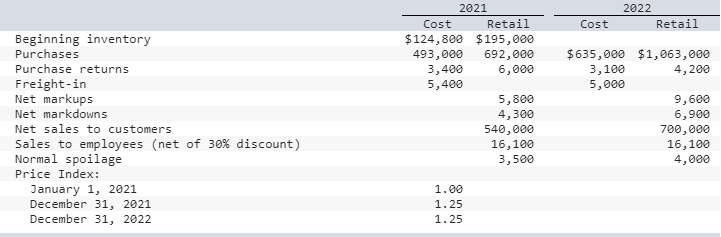

On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2021 and 2022 are as follows:

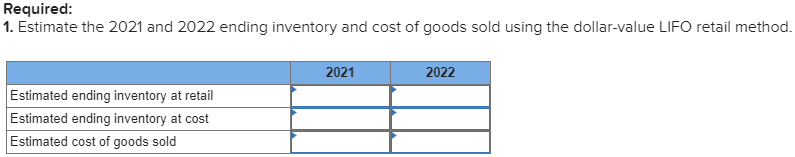

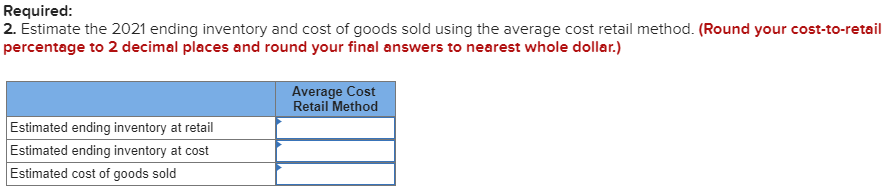

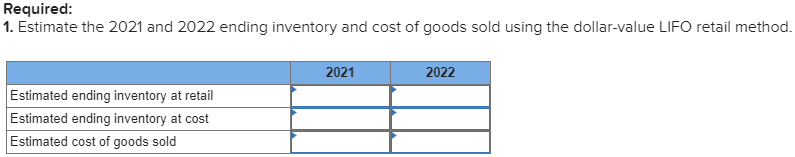

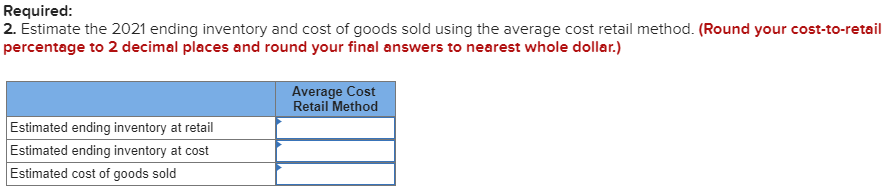

2022 Retail Cost 3,100 Beginning inventory Purchases Purchase returns Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 30% discount) Normal spoilage Price Index: January 1, 2021 December 31, 2021 December 31, 2022 2021 Cost Retail $124,800 $ 195,000 493,000 692,000 3,400 6,000 5,400 5,800 4,300 540,000 16,100 3,500 $635,000 $1,063,000 4,200 5,000 9,600 6,900 700,000 16,100 4,000 1.00 1.25 1.25 Required: 1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method. 2021 2022 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Required: 2. Estimate the 2021 ending inventory and cost of goods sold using the average cost retail method. (Round your cost-to-retail percentage to 2 decimal places and round your final answers to nearest whole dollar.) Average Cost Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Required: 3. Estimate the 2021 ending inventory and cost of goods sold using the conventional retail method. (Round your cost-to-retail percentage to 2 decimal places and round your final answers to nearest whole dollar.) Conventional Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2022 Retail Cost 3,100 Beginning inventory Purchases Purchase returns Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 30% discount) Normal spoilage Price Index: January 1, 2021 December 31, 2021 December 31, 2022 2021 Cost Retail $124,800 $ 195,000 493,000 692,000 3,400 6,000 5,400 5,800 4,300 540,000 16,100 3,500 $635,000 $1,063,000 4,200 5,000 9,600 6,900 700,000 16,100 4,000 1.00 1.25 1.25 Required: 1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method. 2021 2022 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Required: 2. Estimate the 2021 ending inventory and cost of goods sold using the average cost retail method. (Round your cost-to-retail percentage to 2 decimal places and round your final answers to nearest whole dollar.) Average Cost Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Required: 3. Estimate the 2021 ending inventory and cost of goods sold using the conventional retail method. (Round your cost-to-retail percentage to 2 decimal places and round your final answers to nearest whole dollar.) Conventional Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold