Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Sampson Co. purchased 100,000, representing 10% of Fraser's outstanding shares. P10 par ordinary shares of Fraser Co. at P18 per

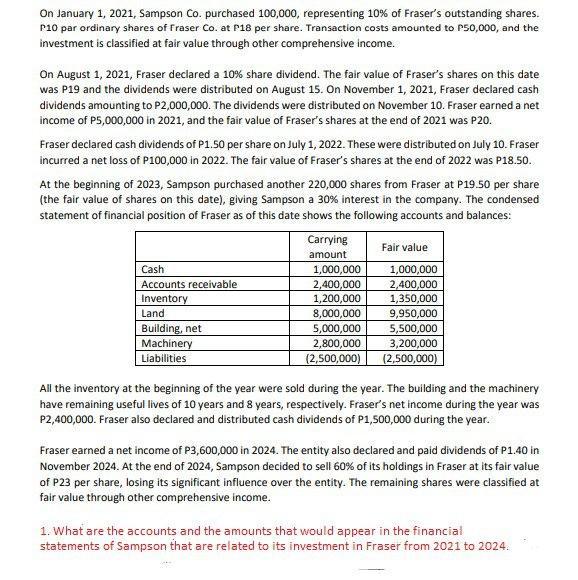

On January 1, 2021, Sampson Co. purchased 100,000, representing 10% of Fraser's outstanding shares. P10 par ordinary shares of Fraser Co. at P18 per share. Transaction costs amounted to P50,000, and the investment is classified at fair value through other comprehensive income. On August 1, 2021, Fraser declared a 10% share dividend. The fair value of Fraser's shares on this date was P19 and the dividends were distributed on August 15. On November 1, 2021, Fraser declared cash dividends amounting to P2,000,000. The dividends were distributed on November 10. Fraser earned a net income of P5,000,000 in 2021, and the fair value of Fraser's shares at the end of 2021 was P20. Fraser declared cash dividends of P1.50 per share on July 1, 2022. These were distributed on July 10. Fraser incurred a net loss of P100,000 in 2022. The fair value of Fraser's shares at the end of 2022 was P18.50. At the beginning of 2023, Sampson purchased another 220,000 shares from Fraser at P19.50 per share (the fair value of shares on this date), giving Sampson a 30% interest in the company. The condensed statement of financial position of Fraser as of this date shows the following accounts and balances: Cash Accounts receivable Inventory Land Building, net Machinery Liabilities Carrying amount 1,000,000 2,400,000 1,200,000 8,000,000 5,000,000 2,800,000 (2,500,000) Fair value 1,000,000 2,400,000 1,350,000 9,950,000 5,500,000 3,200,000 (2,500,000) All the inventory at the beginning of the year were sold during the year. The building and the machinery have remaining useful lives of 10 years and 8 years, respectively. Fraser's net income during the year was P2,400,000. Fraser also declared and distributed cash dividends of P1,500,000 during the year. Fraser earned a net income of P3,600,000 in 2024. The entity also declared and paid dividends of P1.40 in November 2024. At the end of 2024, Sampson decided to sell 60% of its holdings in Fraser at its fair value of P23 per share, losing its significant influence over the entity. The remaining shares were classified at fair value through other comprehensive income. 1. What are the accounts and the amounts that would appear in the financial statements of Sampson that are related to its investment in Fraser from 2021 to 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

An investment is recorded under the fair value method when an inventory is not controlling the affai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started