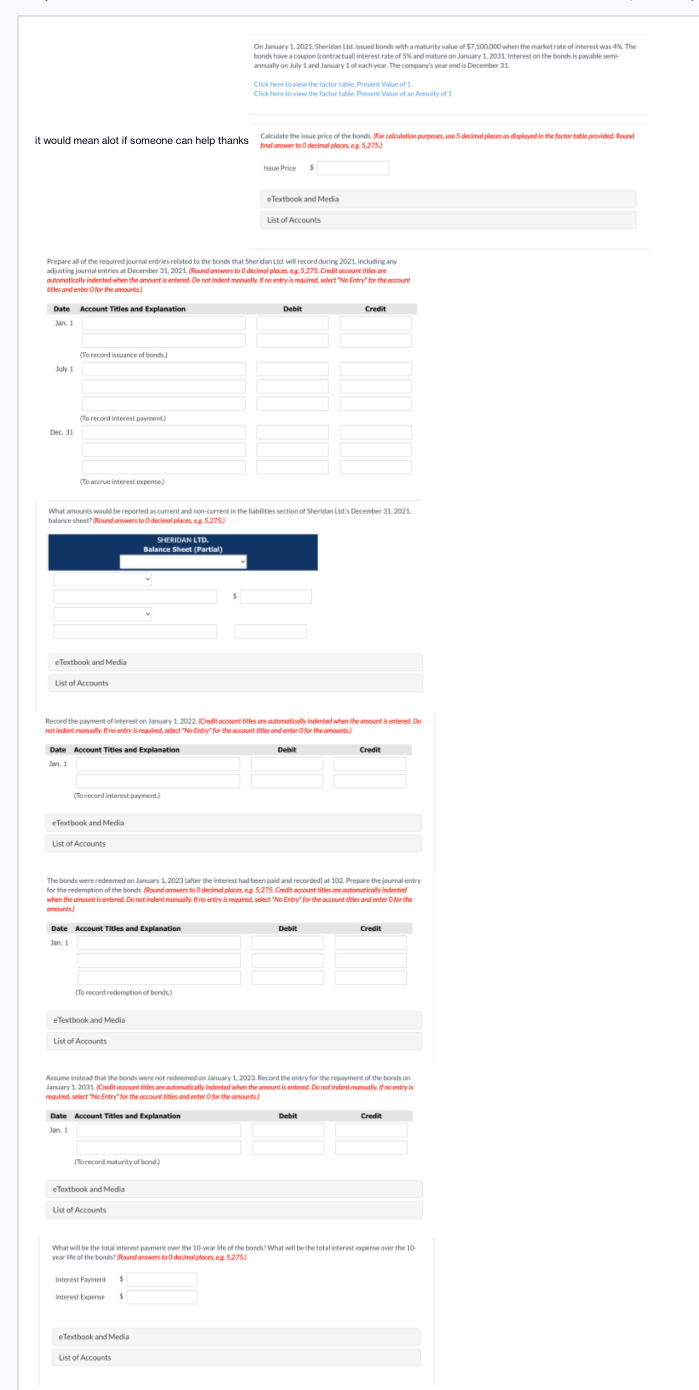

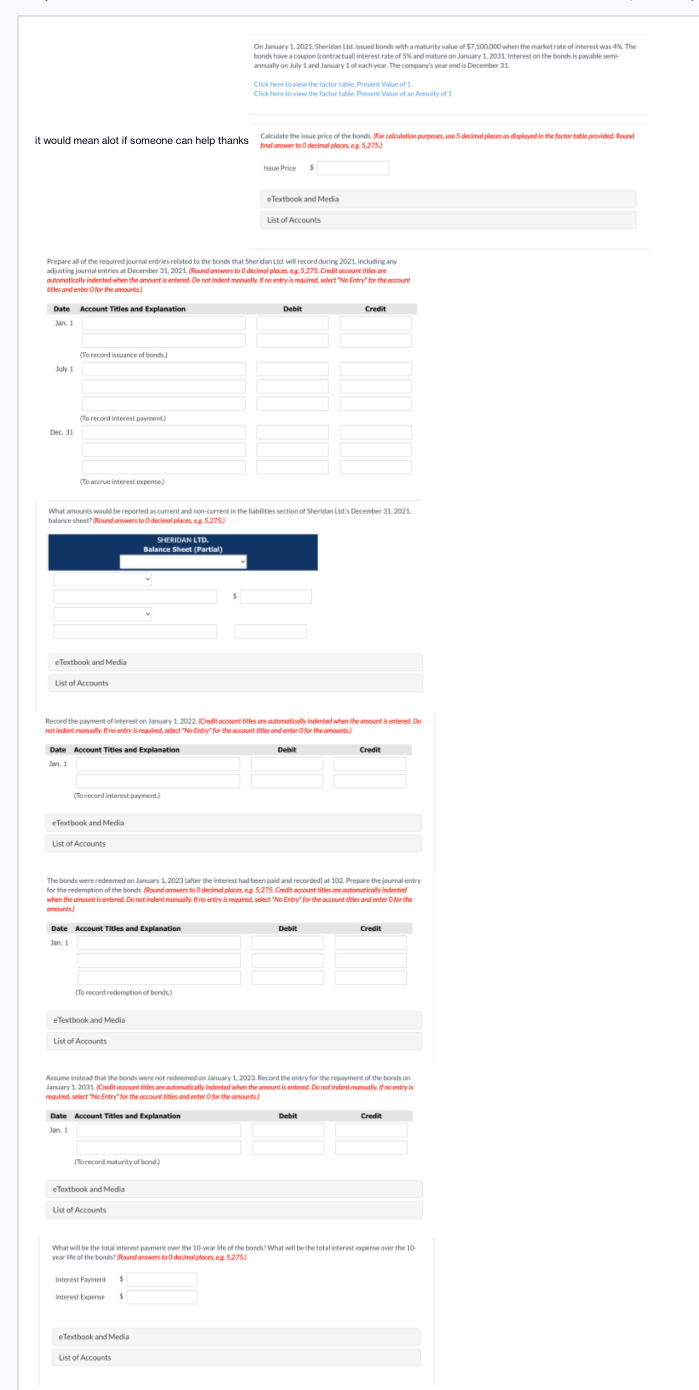

On January 1, 2021. Sheridan Ltd. bonds with a maturity value of $7,100,000 when the market rate of interest was The bonds have a coupon contractual interest rate of 5% and mature on January 1, 2001. Interest on the bonds is payable semi- annually on July 1 and January 1 of each year. The company's year end is December 31 Click here to view the factoren Click here to view the factor table Present Value of an Annuity of 1 it would mean alot if someone can help thanks Calculate the price of the bonds. For calculation purpose decimal places and in the factorile provided. Round final answer to decimal places. e. 5.275) Issue Prices eTextbook and Media List of Accounts Prepare all of the required journal entries related to the bonds that Sheridan Lid will record during 2021. including any adjusting journal entries at December 31, 2021. Round answers to decimal 5.275. Credit account is re automatically indented when the amount is entered. Do not indent mort no entry is required, select "No Entry for the account sites and enter for the amounts Debit Credit Date Account Titles and Explanation an ( To record issuance of bonds) July 1 (To record interest payment Dec. 31 (Tower interest expense What amounts would be reported as current and non-current in the abilities section of Sheridan Ltd December 31, 2021. balance sheet? Round answers to decimal places 5.275.) SHERIDAN LTD. Balance Sheet (Partial) eTextbook and Media List of Accounts Record the payment of interest on January 1, 2022. Credit account titles are automatically indented when the amount is entered Do noindent on the entry "etry for the accounts and enter for the amounts Date Account Titles and Explanation Debit Credit (To record interest payment Textbook and Media List of Accounts The bonds were redeemed on January 1, 2023 after the interest had been paid and recorded at 102. Prepare the journal entry for the redemption of the bonds Round answers to decimal places 5.275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the accounties and enter for the Debit Credit Date Account Titles and Explanation Jan 1 To record redemption of bonds) eTextbook and Media List of Accounts Assume instead that the bonds were not redeemed on January 1, 2023. Record the entry for the repayment of the bondson January 1, 2001. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required select "No Entry for the accountitles and enter for the amounts) Debit Credit Date Account Tities and Explanation Jan. 1 To record maturity of hond.) eTextbook and Media List of Accounts What will be the total interest payment over the 10-year life of the bonds? What will be the total interest expense over the 10- year ite of the bonds? Round answers to decimal places.es 5.275) Interest Payments $ eTextbook and Media List of Accounts On January 1, 2021. Sheridan Ltd. bonds with a maturity value of $7,100,000 when the market rate of interest was The bonds have a coupon contractual interest rate of 5% and mature on January 1, 2001. Interest on the bonds is payable semi- annually on July 1 and January 1 of each year. The company's year end is December 31 Click here to view the factoren Click here to view the factor table Present Value of an Annuity of 1 it would mean alot if someone can help thanks Calculate the price of the bonds. For calculation purpose decimal places and in the factorile provided. Round final answer to decimal places. e. 5.275) Issue Prices eTextbook and Media List of Accounts Prepare all of the required journal entries related to the bonds that Sheridan Lid will record during 2021. including any adjusting journal entries at December 31, 2021. Round answers to decimal 5.275. Credit account is re automatically indented when the amount is entered. Do not indent mort no entry is required, select "No Entry for the account sites and enter for the amounts Debit Credit Date Account Titles and Explanation an ( To record issuance of bonds) July 1 (To record interest payment Dec. 31 (Tower interest expense What amounts would be reported as current and non-current in the abilities section of Sheridan Ltd December 31, 2021. balance sheet? Round answers to decimal places 5.275.) SHERIDAN LTD. Balance Sheet (Partial) eTextbook and Media List of Accounts Record the payment of interest on January 1, 2022. Credit account titles are automatically indented when the amount is entered Do noindent on the entry "etry for the accounts and enter for the amounts Date Account Titles and Explanation Debit Credit (To record interest payment Textbook and Media List of Accounts The bonds were redeemed on January 1, 2023 after the interest had been paid and recorded at 102. Prepare the journal entry for the redemption of the bonds Round answers to decimal places 5.275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the accounties and enter for the Debit Credit Date Account Titles and Explanation Jan 1 To record redemption of bonds) eTextbook and Media List of Accounts Assume instead that the bonds were not redeemed on January 1, 2023. Record the entry for the repayment of the bondson January 1, 2001. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required select "No Entry for the accountitles and enter for the amounts) Debit Credit Date Account Tities and Explanation Jan. 1 To record maturity of hond.) eTextbook and Media List of Accounts What will be the total interest payment over the 10-year life of the bonds? What will be the total interest expense over the 10- year ite of the bonds? Round answers to decimal places.es 5.275) Interest Payments $ eTextbook and Media List of Accounts