Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, tacular Inc. acquired Biotech Corp and recorded $1,083 of intangible assets. To promote investment in healthcare, the tax code allowed

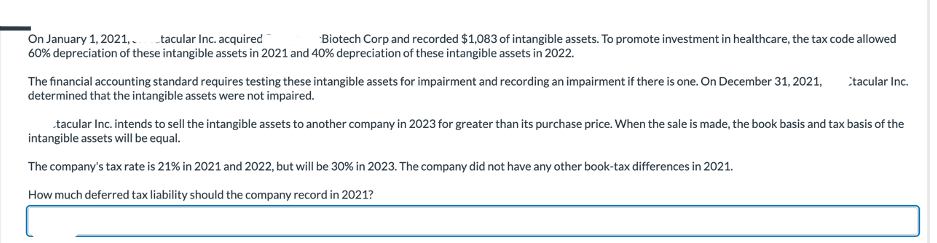

On January 1, 2021, tacular Inc. acquired Biotech Corp and recorded $1,083 of intangible assets. To promote investment in healthcare, the tax code allowed 60% depreciation of these intangible assets in 2021 and 40% depreciation of these intangible assets in 2022. Ctacular Inc. The financial accounting standard requires testing these intangible assets for impairment and recording an impairment if there is one. On December 31, 2021, determined that the intangible assets were not impaired. tacular Inc. intends to sell the intangible assets to another company in 2023 for greater than its purchase price. When the sale is made, the book basis and tax basis of the intangible assets will be equal. The company's tax rate is 21% in 2021 and 2022, but will be 30% in 2023. The company did not have any other book-tax differences in 2021. How much deferred tax liability should the company record in 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started